Debt Consolidation for Business Debt Separating Personal and Business Finances

Strategies for business owners to consolidate business debt while maintaining clear separation from personal finances.

Hey there, fellow entrepreneurs! Let's talk about something super important but often overlooked: managing business debt without letting it bleed into your personal life. It's a common trap, especially for small business owners or those just starting out. You pour your heart, soul, and often your personal savings into your venture. But when debt starts piling up, it can feel like a tangled mess, blurring the lines between your business and personal finances. That's where debt consolidation for business debt comes in, and it's crucial to understand how to do it right while keeping your personal finances safe and sound.

Understanding Business Debt vs Personal Debt Why the Separation Matters

First things first, why is this separation so critical? Imagine your business hits a rough patch. If your personal and business finances are intertwined, that rough patch could easily drag your personal assets – like your home, car, or savings – down with it. Keeping them separate protects your personal wealth from business liabilities. It also makes accounting clearer, tax season less of a headache, and gives you a much better picture of your business's true financial health. Plus, when you're looking for investors or trying to sell your business, a clean financial separation makes your company look much more professional and appealing.

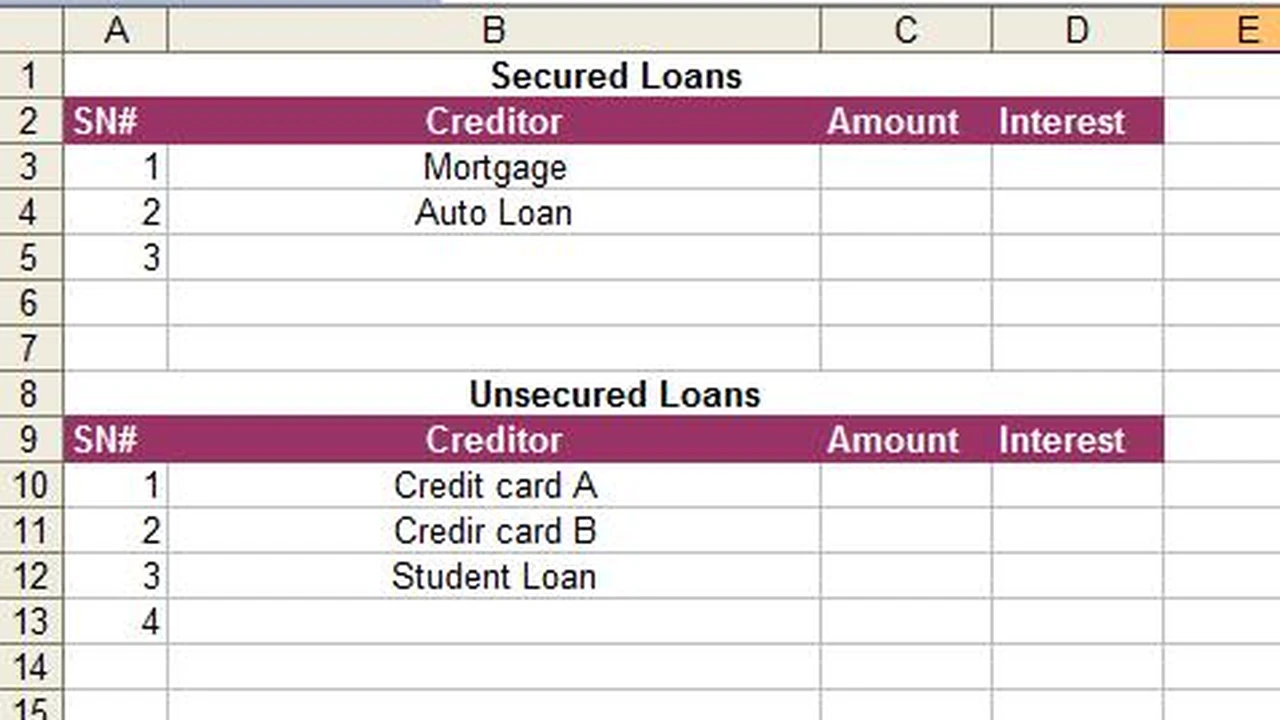

Common Types of Business Debt for Small Businesses

Let's quickly look at the kinds of business debt you might be dealing with:

- Business Credit Cards: Often used for day-to-day expenses, inventory, or short-term cash flow. High interest rates can make these tricky.

- Term Loans: Traditional bank loans for specific purposes like equipment purchase or expansion.

- Lines of Credit: Flexible borrowing options for ongoing operational costs.

- Merchant Cash Advances (MCAs): Quick cash based on future sales, but often come with very high costs.

- Vendor Credit: Debts owed to suppliers for goods or services.

The Dangers of Commingling Funds and Debt

Mixing personal and business funds is a huge no-no. It can:

- Jeopardize Personal Assets: In a lawsuit or bankruptcy, creditors might 'pierce the corporate veil' and go after your personal assets if they see no clear distinction.

- Complicate Taxes: Makes it incredibly difficult to track deductible expenses and can lead to IRS scrutiny.

- Obscure Financial Health: You won't know if your business is truly profitable if you're constantly injecting personal funds or paying business expenses from your personal account.

When to Consider Business Debt Consolidation Signs and Triggers

So, how do you know it's time to think about consolidating your business debt? Here are some red flags:

- Multiple High-Interest Debts: Juggling several business credit cards or loans with varying, often high, interest rates.

- Struggling with Monthly Payments: Finding it hard to keep up with minimum payments across different creditors.

- Cash Flow Issues: Your business is profitable, but debt payments are eating up too much of your working capital.

- Stress and Overwhelm: The mental burden of managing multiple debts is impacting your focus and well-being.

- Desire for Simplicity: You want to streamline payments and have a clearer path to becoming debt-free.

Business Debt Consolidation Options Keeping Personal Finances Separate

Alright, let's dive into the actual strategies for consolidating business debt without touching your personal piggy bank. The key here is to look for financing options that are specifically designed for businesses and don't require a personal guarantee unless absolutely necessary, or at least minimize its impact.

1. Business Term Loans for Consolidation

This is often the most straightforward approach. A business term loan provides a lump sum of money that you use to pay off your existing, higher-interest business debts. You then make regular, fixed payments to the new lender over a set period. The goal is to secure a loan with a lower interest rate and more favorable terms than your current debts.

- How it works: You apply for a new business loan. If approved, the funds are deposited into your business bank account. You then use these funds to pay off your business credit cards, lines of credit, or other business loans.

- Pros: Clear repayment schedule, potentially lower interest rates, simplified payments to one creditor.

- Cons: Requires a decent business credit score and financial history. May still require a personal guarantee, especially for newer or smaller businesses.

Recommended Products and Providers for Business Term Loans

- SBA Loans (Small Business Administration): These are government-backed loans offered through traditional banks. They often have excellent terms, lower interest rates, and longer repayment periods. While they require a personal guarantee, the government backing makes banks more willing to lend, and the terms are usually far better than other options.

- SBA 7(a) Loan: Highly versatile, can be used for working capital, equipment, real estate, and debt consolidation. Loan amounts up to $5 million. Interest rates are capped by the SBA, typically prime rate + 2.25% to 4.75%.

- SBA Express Loan: Faster approval process for smaller amounts, up to $500,000.

- SBA CAPLines: For businesses with short-term or cyclical working capital needs.

- Typical Providers: Major banks like Chase, Bank of America, Wells Fargo, and regional banks. Online lenders like Live Oak Bank specialize in SBA loans.

- Use Case: Ideal for established businesses with good credit seeking favorable long-term consolidation.

- Traditional Bank Loans: Your local bank or credit union might offer business term loans. They often prefer established businesses with strong financials.

- Typical Providers: Local banks, credit unions.

- Use Case: Good for businesses with an existing banking relationship and solid financial history.

- Online Lenders: Companies like Fundbox, OnDeck, or Kabbage (now American Express) offer faster application and approval processes, often with less stringent requirements than traditional banks. However, interest rates can be higher.

- Fundbox: Offers lines of credit and term loans up to $150,000. Focuses on cash flow. Rates vary.

- OnDeck: Offers term loans up to $250,000 and lines of credit up to $100,000. Rates can range from 9% to 99% APR, so compare carefully.

- Lendio: A marketplace that connects businesses with various lenders. You fill out one application and get offers from multiple providers.

- Use Case: Good for businesses needing quick access to funds or those who might not qualify for traditional bank loans.

2. Business Line of Credit for Consolidation

A business line of credit (LOC) is a flexible borrowing option. You're approved for a maximum amount, and you can draw from it as needed, only paying interest on the amount you've used. This can be useful for consolidating smaller, revolving debts like business credit card balances.

- How it works: You get approved for a credit limit. You draw funds to pay off existing business debts. As you repay, the credit becomes available again.

- Pros: Flexibility, only pay interest on what you use, good for ongoing working capital needs.

- Cons: Interest rates can be variable, temptation to overspend, may still require a personal guarantee.

Recommended Products and Providers for Business Lines of Credit

- Traditional Banks: Many banks offer business lines of credit, often with competitive rates for established businesses.

- Typical Providers: Chase, Bank of America, Wells Fargo, local credit unions.

- Use Case: Businesses with predictable cash flow and good credit history.

- Online Lenders: Fundbox, BlueVine, and OnDeck are popular for their quick approval and funding.

- BlueVine: Offers lines of credit up to $250,000. Weekly or monthly payments. Rates start from 4.8% simple interest.

- Use Case: Businesses needing quick access to flexible funds, especially for managing inventory or short-term cash flow gaps.

3. Business Balance Transfer Credit Cards

If your business debt is primarily on high-interest business credit cards, a business balance transfer card can be a great option. These cards often offer an introductory 0% APR period on transferred balances, giving you time to pay down debt without accruing interest.

- How it works: You apply for a new business credit card with a balance transfer offer. Once approved, you transfer balances from your existing high-interest business credit cards to the new card.

- Pros: 0% APR period can save a lot on interest, simplifies payments to one card.

- Cons: Requires excellent business and personal credit. If you don't pay off the balance before the intro period ends, the interest rate can jump significantly. Balance transfer fees (typically 3-5%) apply.

Recommended Products and Providers for Business Balance Transfer Cards

- Chase Ink Business Unlimited Credit Card: Offers an introductory 0% APR for 12 months on purchases. While not explicitly a balance transfer card, you can use it to pay off other business expenses, freeing up cash to pay down existing high-interest cards.

- American Express Blue Business Cash Card: Similar to Chase Ink, offers 0% APR on purchases for 12 months.

- Bank of America Business Advantage Customized Cash Rewards Mastercard: Offers 0% APR for 9 billing cycles on purchases.

- Use Case: Businesses with excellent credit looking to consolidate high-interest credit card debt and pay it off quickly within the introductory period.

4. Invoice Factoring or Financing

If your business has outstanding invoices from creditworthy customers, you can use these as collateral to get immediate cash. This isn't strictly debt consolidation in the traditional sense, but it can free up cash flow to pay down existing high-interest debts.

- How it works: You sell your invoices (factoring) or use them as collateral for a loan (financing). The factoring company advances you a percentage of the invoice value, then collects from your customer.

- Pros: Quick access to cash, doesn't create new debt, good for businesses with slow-paying clients.

- Cons: Can be expensive (fees typically 1-5% of invoice value), you're essentially selling your receivables at a discount.

Recommended Products and Providers for Invoice Factoring/Financing

- BlueVine: Offers invoice factoring with credit lines up to $5 million. Rates start from 0.25% per week.

- Fundbox: Also offers invoice financing, integrating with accounting software.

- Use Case: Businesses with B2B sales and long payment terms, needing immediate cash flow to manage existing debts.

5. Revenue-Based Financing

This option allows you to borrow against your future revenue. Repayments are typically a percentage of your daily or weekly sales, making it flexible if your revenue fluctuates.

- How it works: A lender provides capital in exchange for a percentage of your future sales until the advance plus a fee is repaid.

- Pros: Flexible repayment based on revenue, often easier to qualify for than traditional loans.

- Cons: Can be more expensive than traditional loans, not suitable for all business types.

Recommended Products and Providers for Revenue-Based Financing

- Clearco: Specializes in e-commerce and SaaS businesses, offering capital based on revenue.

- Lendio: Can connect you with revenue-based financing options.

- Use Case: E-commerce businesses, SaaS companies, or businesses with consistent, predictable revenue streams.

Crucial Steps to Maintain Personal and Business Financial Separation

Even when consolidating business debt, it's vital to reinforce the wall between your personal and business finances. Here's how:

1. Establish a Separate Legal Entity

If you haven't already, form an LLC (Limited Liability Company) or Corporation. This legally separates your business from your personal assets, offering liability protection. A sole proprietorship or partnership offers no such protection.

2. Open Dedicated Business Bank Accounts and Credit Cards

This is non-negotiable. All business income should go into the business account, and all business expenses should be paid from it. Never use your personal credit card for business purchases or vice versa.

3. Keep Meticulous Records

Maintain clear, organized records for all business transactions. Use accounting software (like QuickBooks, Xero, or FreshBooks) to track income, expenses, and debt payments. This makes tax time easier and provides a clear audit trail.

4. Pay Yourself a Salary

Instead of dipping into the business account whenever you need personal funds, pay yourself a regular salary or owner's draw. This reinforces the separation and helps you budget both personally and professionally.

5. Understand Personal Guarantees

Many small business loans, especially for newer businesses, require a personal guarantee. This means you are personally liable for the debt if your business defaults. While it blurs the line, it's often unavoidable. If you must sign one:

- Negotiate: See if you can limit the guarantee to a specific amount or asset.

- Understand the Risks: Be fully aware of what you're putting on the line.

- Mitigate: Ensure your business has strong cash flow and a solid repayment plan to minimize the chance of default.

6. Consult with Professionals

Don't go it alone! A good accountant can help you set up your financial systems correctly and advise on tax implications. A business financial advisor can help you choose the best consolidation strategy and structure your finances for long-term success.

Comparing Products and Scenarios A Practical Look

Let's put some of these options into context with hypothetical scenarios:

Scenario 1: High-Interest Business Credit Card Debt

Business: A small e-commerce store with $30,000 across three business credit cards, average APR 22%. Goal: Reduce interest and simplify payments. Recommended Solution: Business Balance Transfer Credit Card or a small Business Term Loan.

- Balance Transfer Card (e.g., Chase Ink Business Unlimited): If the business has excellent credit, they could transfer the $30,000 to a new card with a 0% intro APR for 12 months. Assuming a 3% transfer fee ($900), they'd need to pay $2,575 per month to clear the debt before the high APR kicks in. This saves significant interest.

- Online Business Term Loan (e.g., OnDeck): If credit isn't perfect or they prefer fixed payments, an OnDeck loan for $30,000 might have an APR of 25% over 12 months. Monthly payments would be around $2,800, but it's a predictable schedule.

Scenario 2: Multiple Business Loans and Vendor Debts

Business: A growing manufacturing business with a $50,000 equipment loan (10% APR), a $20,000 line of credit (15% APR), and $15,000 in overdue vendor invoices. Goal: Consolidate into one manageable payment with a lower overall interest rate. Recommended Solution: SBA 7(a) Loan or a larger Traditional Bank Term Loan.

- SBA 7(a) Loan: For a total of $85,000, an SBA loan could offer an APR of 7-9% over 5-10 years. This significantly reduces the overall interest burden and extends the repayment period, improving cash flow. For example, an $85,000 loan at 8% over 7 years would have monthly payments around $1,330.

- Traditional Bank Term Loan: Similar to SBA, but potentially higher rates (e.g., 10-12%) and shorter terms if not SBA-backed.

Scenario 3: Cash Flow Issues Due to Slow-Paying Clients

Business: A marketing agency with $40,000 in outstanding invoices, but also $25,000 in high-interest business credit card debt. Goal: Improve cash flow to pay down existing debt without taking on new loans. Recommended Solution: Invoice Factoring/Financing.

- Invoice Factoring (e.g., BlueVine): The agency could factor $40,000 worth of invoices. BlueVine might advance 85-90% ($34,000 - $36,000) upfront, charging a fee of 1-3% per month. This immediate cash injection can be used to pay off the $25,000 credit card debt, avoiding further interest charges. Once clients pay, the remaining balance (minus fees) is released to the agency.

The Importance of a Post-Consolidation Financial Plan

Consolidating debt is a fantastic first step, but it's not a magic bullet. What you do *after* consolidation is just as important. You need a solid plan to ensure you don't fall back into the same debt cycle.

1. Create a Detailed Business Budget

Now that your debt payments are streamlined, create a comprehensive budget for your business. Track every dollar in and out. Identify areas where you can cut costs and optimize spending. This budget will be your roadmap to staying on track and ensuring you can comfortably make your new consolidated debt payments.

2. Build a Business Emergency Fund

Just like personal finances, businesses need an emergency fund. Aim to save 3-6 months of operating expenses. This fund acts as a buffer against unexpected downturns, equipment breakdowns, or slow sales periods, preventing you from having to take on new debt when things get tough.

3. Monitor Cash Flow Regularly

Keep a close eye on your business's cash flow. Understand your peak and slow seasons. Proactively manage receivables and payables to ensure you always have enough liquidity to cover your obligations, including your consolidated debt payments.

4. Re-evaluate Spending Habits

Take an honest look at how your business spends money. Are there unnecessary subscriptions? Can you negotiate better terms with suppliers? Every dollar saved is a dollar that can go towards debt repayment or building your emergency fund.

5. Focus on Growth and Profitability

While managing debt, don't lose sight of growing your business. Increased revenue and profitability will make debt repayment easier and strengthen your overall financial position. Look for opportunities to expand your customer base, introduce new products or services, or improve operational efficiency.

6. Regularly Review Your Financials

Set aside time each month or quarter to review your business's financial statements. Are you sticking to your budget? Is your debt decreasing as planned? Are there any new financial challenges on the horizon? Regular reviews help you stay agile and make informed decisions.

Final Thoughts on Business Debt Consolidation

Consolidating business debt is a powerful tool for entrepreneurs looking to simplify their finances, reduce interest costs, and gain better control over their business's financial health. The key is to choose the right consolidation method that aligns with your business's specific needs and financial situation, always prioritizing the separation of your personal and business finances. By doing so, you protect your personal wealth and set your business up for a more stable and prosperous future. It's about smart financial management, not just quick fixes. So, take the time, do your research, and make a plan that works for you and your business.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)