Debt Consolidation for Expats in Southeast Asia A Guide

Specific advice and options for expatriates living in Southeast Asia seeking debt consolidation solutions.

Specific advice and options for expatriates living in Southeast Asia seeking debt consolidation solutions.

Debt Consolidation for Expats in Southeast Asia A Guide

Living as an expatriate in Southeast Asia offers incredible opportunities for adventure, career growth, and a vibrant lifestyle. However, it also comes with its unique set of financial challenges, and debt can quickly become a significant concern. Whether it's credit card debt from international travel, personal loans taken out for relocation, or even business debts from a new venture, managing multiple debts across different currencies and legal systems can be a nightmare. This comprehensive guide is designed specifically for expats in Southeast Asia looking to understand and implement effective debt consolidation strategies. We'll dive deep into the options available, compare specific products, discuss pricing, and offer practical advice to help you regain control of your finances.

Understanding Expat Debt Challenges Navigating Financial Waters Abroad

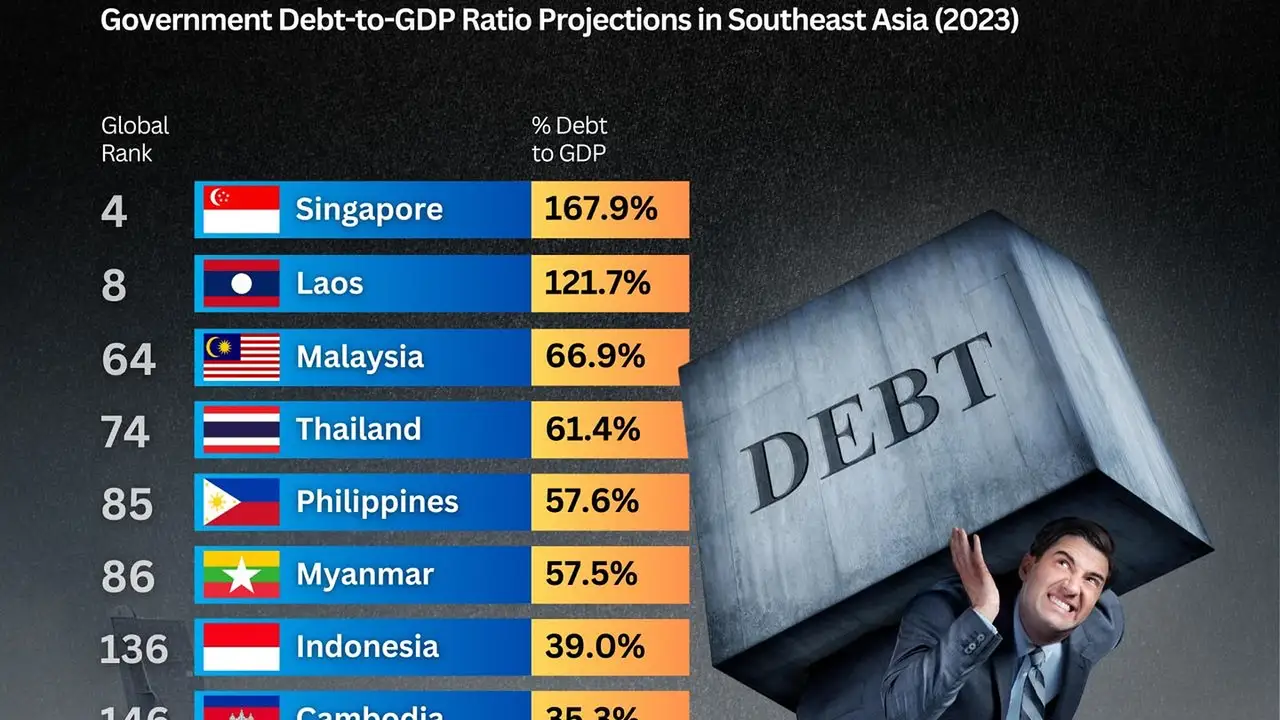

Expats often face a complex financial landscape. You might have income in one currency, expenses in another, and debts denominated in yet a third. This currency fluctuation alone can make debt management unpredictable. Furthermore, accessing traditional financial products can be harder without a long-standing local credit history. You might also be dealing with debts from your home country alongside new ones acquired in your host nation. The legal and regulatory frameworks for debt and lending vary significantly across Southeast Asian countries like Singapore, Malaysia, Thailand, the Philippines, and Indonesia, adding another layer of complexity. Understanding these unique challenges is the first step toward finding a viable debt consolidation solution.

What is Debt Consolidation for Expats Simplifying Your Financial Life

At its core, debt consolidation for expats works much like it does for anyone else: you take out a new loan to pay off several smaller, existing debts. The goal is to simplify your payments into a single, more manageable monthly installment, often at a lower interest rate. For expats, this can be particularly beneficial. Imagine having credit card debts in USD, a personal loan in SGD, and a car loan in THB. Consolidating these into one loan, ideally in a stable currency or one aligned with your primary income, can drastically reduce stress and make budgeting much clearer. It can also potentially lower your overall interest payments, saving you a significant amount of money over time. The key is finding a lender willing to work with expats and understanding the local financial products available.

Types of Debt Consolidation Options for Expats Exploring Your Choices

Expats have several avenues to explore when considering debt consolidation. The best option for you will depend on your credit history, income stability, the amount of debt, and your residency status in your host country.

Personal Loans for Expats A Common Consolidation Tool

Personal loans are often the most straightforward debt consolidation option. Many banks and financial institutions in Southeast Asia offer personal loans, and some even have specific products tailored for expats. These loans are typically unsecured, meaning you don't need to put up collateral. The interest rate you receive will largely depend on your creditworthiness, income, and the lender's assessment of your risk.

Product Spotlight HSBC Personal Loan (Singapore)

HSBC is a global bank with a strong presence in Southeast Asia, making it a familiar choice for many expats. In Singapore, their personal loan products are often accessible to foreign residents with valid employment passes and a minimum income. They offer competitive interest rates and flexible repayment terms. For example, an expat earning S$60,000 annually might qualify for a loan of up to 4-6 times their monthly salary, with interest rates starting from around 3.8% p.a. (Effective Interest Rate, EIR, can be higher, around 7-8% p.a. depending on loan tenure and processing fees). The application process usually requires proof of income, residency, and a good credit history. They often have online application processes, which can be convenient for busy expats.

Product Spotlight Standard Chartered Personal Loan (Malaysia)

Standard Chartered is another international bank with a significant footprint in Malaysia. Their personal loans are available to expats meeting specific income and residency criteria. They often promote fast approval times and competitive rates. An expat in Malaysia with a monthly income of RM8,000 might be eligible for a loan up to 5-7 times their monthly salary, with interest rates ranging from 5% to 10% p.a. (EIR can be higher, up to 15% p.a. with fees). They often require a minimum period of employment in Malaysia. It's worth noting that Malaysian banks might have stricter requirements for expats compared to Singaporean banks.

Balance Transfer Credit Cards for Expats Shifting High-Interest Debt

If your primary debt is high-interest credit card debt, a balance transfer credit card can be an excellent consolidation tool. These cards allow you to transfer balances from multiple credit cards onto a single card, often with an introductory 0% or low-interest rate for a promotional period (e.g., 6-12 months). This gives you a window to pay down a significant portion of your principal without accruing high interest.

Product Spotlight Citibank Balance Transfer (Thailand)

Citibank has a strong presence in Thailand and offers balance transfer options. For expats, eligibility often depends on a stable income, a valid work permit, and a local bank account. They might offer 0% interest for 3-6 months on transferred balances, followed by a standard interest rate of around 16-20% p.a. There's usually a one-time balance transfer fee, typically 1-3% of the transferred amount. This option is best if you're confident you can pay off the transferred balance within the promotional period.

Product Spotlight UOB Balance Transfer (Singapore)

UOB, a major regional bank, also provides balance transfer facilities in Singapore. Expats with good credit and stable employment can often access these. They might offer promotional rates like 0% for 6 months with a 1.5% processing fee, or a low fixed rate for a longer period. The key is to understand the post-promotional interest rate and ensure you have a plan to clear the debt before it kicks in.

Secured Loans for Expats Leveraging Assets

If you own assets in your host country, such as a car or even property (though property loans are more complex), a secured loan might offer lower interest rates. However, this comes with the risk of losing your asset if you default on the loan. This option is less common for expats unless they have significant local assets.

Debt Management Plans (DMPs) for Expats Professional Assistance

While not strictly debt consolidation, a Debt Management Plan (DMP) offered by credit counseling agencies can help expats manage their debts. In a DMP, the agency negotiates with your creditors on your behalf to reduce interest rates and monthly payments. You then make one consolidated payment to the agency, which distributes it to your creditors. This is particularly useful if you're struggling to get approved for a consolidation loan due to poor credit or if you have a very high debt-to-income ratio. However, DMPs can sometimes negatively impact your credit score, and not all countries in Southeast Asia have robust credit counseling infrastructure for expats.

Eligibility Criteria for Expats What Lenders Look For

Lenders in Southeast Asia assess several factors when considering expat applications for debt consolidation. Understanding these can help you prepare and improve your chances of approval.

Income Stability and Employment Status Crucial for Approval

Lenders want to see a stable and verifiable income. This usually means a full-time employment contract with a reputable company, a minimum period of employment (e.g., 6-12 months), and a certain income threshold. Self-employed expats might find it harder to qualify unless they can demonstrate consistent, high income and a well-established business.

Residency and Visa Status Long-Term Commitment Matters

Your visa and residency status play a significant role. Lenders prefer expats with long-term visas (e.g., employment passes, permanent residency) rather than short-term tourist or business visas. The longer your expected stay in the country, the more comfortable lenders will be.

Credit History Local and International Considerations

This is often a tricky area for expats. You might have an excellent credit history in your home country but no local credit history in your host nation. Some international banks might consider your home country credit report, but many local lenders will rely solely on your local credit bureau data. Building local credit by getting a local credit card and paying bills on time is crucial. If you have a poor credit history, your options will be more limited, and interest rates will be higher.

Bank Account and Financial Relationships Building Trust

Having a local bank account, especially with the same institution you're applying to, can be beneficial. A history of managing your finances responsibly with that bank can build trust and improve your application's chances.

The Application Process for Expat Debt Consolidation Step-by-Step

While specific requirements vary by country and lender, the general application process for expats seeking debt consolidation usually involves these steps:

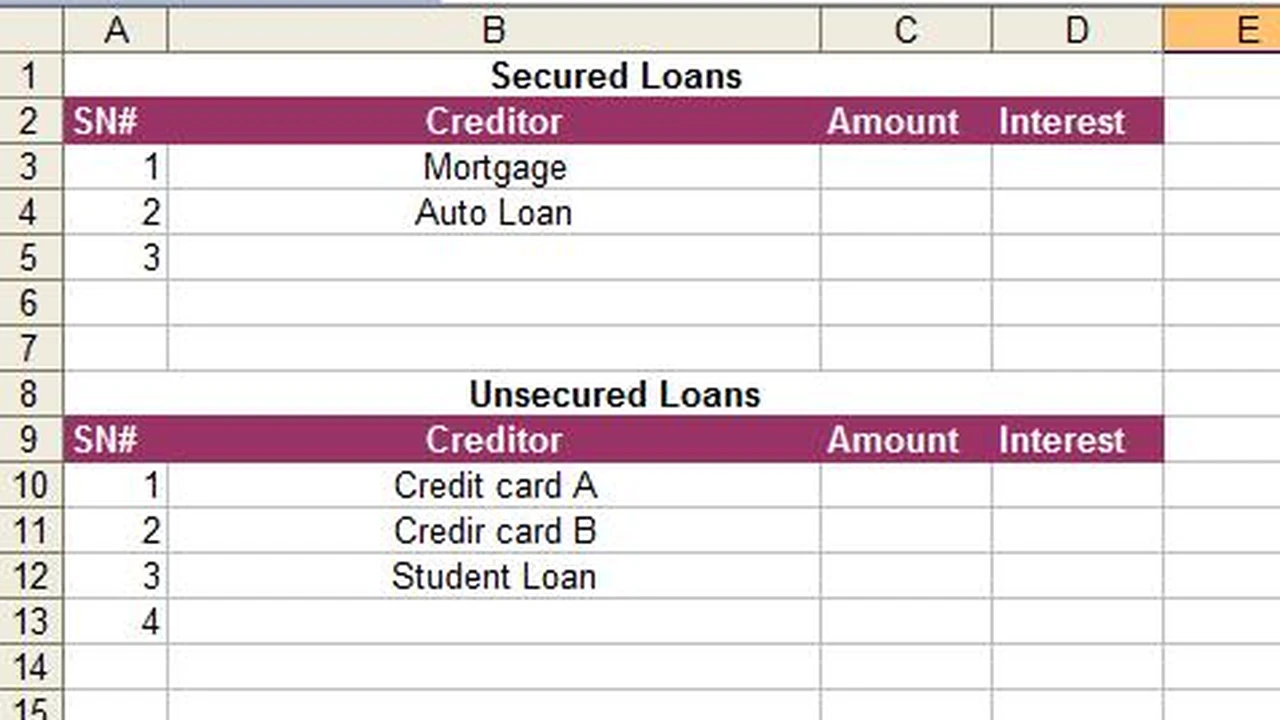

- Research and Compare: Don't just go with the first offer. Research different banks and financial institutions that cater to expats in your country of residence. Look at interest rates, fees, eligibility criteria, and customer reviews.

- Gather Documents: Prepare all necessary documentation. This typically includes your passport, valid visa/work permit, proof of address (utility bills, tenancy agreement), employment contract, recent pay slips, bank statements (local and potentially from your home country), and statements for all debts you wish to consolidate.

- Check Your Credit Score: If available, obtain your local credit report to understand your standing. If you have a credit report from your home country, have it ready, though its utility might vary.

- Apply: Submit your application, either online or in person. Be honest and thorough with all information.

- Interview/Assessment: Some lenders might require an interview or further assessment of your financial situation.

- Approval and Disbursement: If approved, the loan funds will be disbursed. Often, the lender will directly pay off your existing debts, simplifying the process for you.

- Repayment: Make sure you understand your repayment schedule and stick to it diligently.

Comparing Debt Consolidation Products for Expats A Detailed Look

Let's compare some hypothetical scenarios and product types to illustrate the differences for expats.

Scenario 1 High-Income Expat in Singapore with Good Credit

An expat earning S$120,000 annually, with a stable job for 3 years, excellent credit, and S$30,000 in credit card debt across three cards (average interest 24% p.a.).

- Option A: HSBC Personal Loan (Singapore)

- Loan Amount: S$30,000

- Interest Rate: ~3.8% p.a. (EIR ~7.5% p.a. with fees)

- Tenure: 3 years

- Monthly Payment: Approximately S$930

- Total Interest Paid: ~S$3,480

- Pros: Significantly lower interest than credit cards, fixed payments, clear repayment schedule.

- Cons: Requires good credit, potential processing fees.

- Option B: UOB Balance Transfer (Singapore)

- Loan Amount: S$30,000

- Interest Rate: 0% for 6 months, then 20% p.a.

- Transfer Fee: 1.5% (S$450)

- Monthly Payment (during 0%): S$5,000 (to clear within 6 months)

- Total Interest Paid: S$450 (if paid within 6 months)

- Pros: Potentially zero interest, quick debt reduction.

- Cons: Requires aggressive repayment, high interest after promotional period, one-time fee.

Recommendation: For this expat, the HSBC Personal Loan offers a more manageable and predictable repayment plan with substantial interest savings. The UOB Balance Transfer is viable only if they can realistically pay off the entire S$30,000 within 6 months, which is a high monthly commitment.

Scenario 2 Mid-Income Expat in Thailand with Fair Credit

An expat earning THB 80,000 monthly, 1 year into their contract, with THB 200,000 in personal loan and credit card debt (average interest 20% p.a.). Fair local credit history.

- Option A: Citibank Personal Loan (Thailand)

- Loan Amount: THB 200,000

- Interest Rate: ~12% p.a. (EIR ~15% p.a. with fees)

- Tenure: 4 years

- Monthly Payment: Approximately THB 5,800

- Total Interest Paid: ~THB 78,400

- Pros: Lower interest than current debts, fixed payments.

- Cons: Higher interest rate due to fair credit, potential processing fees.

- Option B: Debt Management Plan (DMP) via a local credit counseling agency (if available)

- Negotiated Interest Rate: Potentially 8-15% p.a.

- Tenure: 3-5 years

- Monthly Payment: Negotiated, likely lower than current combined payments.

- Total Interest Paid: Varies, but likely lower than current.

- Pros: Professional negotiation, potentially lower payments, less impact on credit than bankruptcy.

- Cons: May impact credit score, not always available for expats, agency fees.

Recommendation: The Citibank Personal Loan is a good starting point. If rejected or if the interest rate is too high, exploring a DMP with a reputable local agency would be the next step. It's crucial to verify the legitimacy and effectiveness of such agencies in Thailand.

Potential Pitfalls and How to Avoid Them for Expats

Debt consolidation, while beneficial, isn't without its risks, especially for expats.

Higher Interest Rates Due to Expat Status

Some lenders might view expats as higher risk due to their transient nature or lack of local credit history, leading to higher interest rates. Avoid: Shop around, build local credit, and be prepared to provide extensive documentation.

Hidden Fees and Charges

Processing fees, early repayment penalties, and other charges can eat into your savings. Avoid: Always read the fine print and ask for a full breakdown of all costs before signing any agreement.

Falling Back into Debt

Consolidating debt frees up cash flow, but if you don't address the underlying spending habits, you can quickly accumulate new debt. Avoid: Create a strict budget, stick to it, and cut up old credit cards if necessary. Focus on building an emergency fund.

Currency Fluctuations

If your consolidated loan is in a different currency than your income, exchange rate fluctuations can increase your effective monthly payment. Avoid: Try to consolidate into the currency you earn in, or a stable major currency like USD or SGD if your income is also in a major currency. Understand the risks.

Scams and Unlicensed Lenders

Be extremely wary of offers that seem too good to be true, especially from unknown entities. Unlicensed lenders can charge exorbitant rates and use aggressive collection tactics. Avoid: Only deal with reputable, licensed banks and financial institutions. Check their credentials with local financial regulators.

Building a Strong Financial Future Post-Consolidation for Expats

Successfully consolidating your debt is a huge step, but it's just the beginning. For expats, maintaining financial health requires ongoing vigilance.

Create a Realistic Expat Budget

Factor in all your income and expenses, including remittances, international travel, and any unique expat costs. Use budgeting apps or spreadsheets to track every dollar, baht, or ringgit.

Build an Emergency Fund

Aim for 3-6 months of living expenses in an easily accessible savings account. This is crucial for expats who might face unexpected relocation costs, medical emergencies, or job changes.

Continue to Build Local Credit

Even after consolidation, continue to use credit responsibly. Pay bills on time, keep credit utilization low, and avoid opening too many new credit lines.

Consider Professional Financial Advice

An expat financial advisor can help you with long-term planning, investments, and navigating the complexities of international taxation and wealth management.

Stay Informed About Local Regulations

Financial laws and regulations can change. Stay updated on any changes in your host country that might affect your debt or financial standing.

Debt consolidation can be a powerful tool for expats in Southeast Asia to simplify their finances, reduce interest payments, and regain control. By understanding the unique challenges, exploring available options, and being diligent in your research and repayment, you can successfully navigate the financial landscape and build a more secure future abroad. Remember, every country and every expat's situation is unique, so always seek personalized advice from financial professionals licensed in your country of residence.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)