Avoiding Pitfalls The 3 Biggest Mistakes in Debt Consolidation

Be aware of common errors when consolidating debt and learn how to avoid them for a successful debt relief journey.

Avoiding Pitfalls The 3 Biggest Mistakes in Debt Consolidation

Be aware of common errors when consolidating debt and learn how to avoid them for a successful debt relief journey.Hey there! So, you're thinking about debt consolidation, huh? That's a smart move for many people looking to get a handle on their finances. It can really simplify things, potentially lower your interest rates, and even help you pay off debt faster. But, like with any big financial decision, there are some traps you can fall into. Nobody wants to consolidate their debt only to find themselves in a worse spot down the road. That's why we're going to talk about the three biggest mistakes people make when consolidating debt and, more importantly, how you can steer clear of them. Think of this as your personal guide to a smoother, more successful debt consolidation journey.

Mistake 1 Not Addressing the Root Cause of Your Debt

This is probably the most common and, frankly, the most damaging mistake people make. You consolidate your debts, get a lower monthly payment, and feel a huge sense of relief. But if you haven't figured out why you got into debt in the first place, you're essentially just putting a band-aid on a bullet wound. The underlying issues – whether it's overspending, an unexpected job loss, medical emergencies, or just not having a budget – will still be there, lurking in the shadows, ready to pounce again.

Why Ignoring the Root Cause Leads to More Debt

Imagine you have a leaky faucet. You can keep mopping up the water, but until you fix the leak itself, the problem will persist. Debt is similar. If your spending habits are the leak, consolidating debt without changing those habits is like buying a bigger mop. You might manage for a while, but eventually, you'll be drowning again. This often leads to what's called the 'debt cycle' – consolidating, accumulating new debt, consolidating again, and so on. It's a frustrating and financially draining loop.

How to Identify and Address Your Debt Triggers

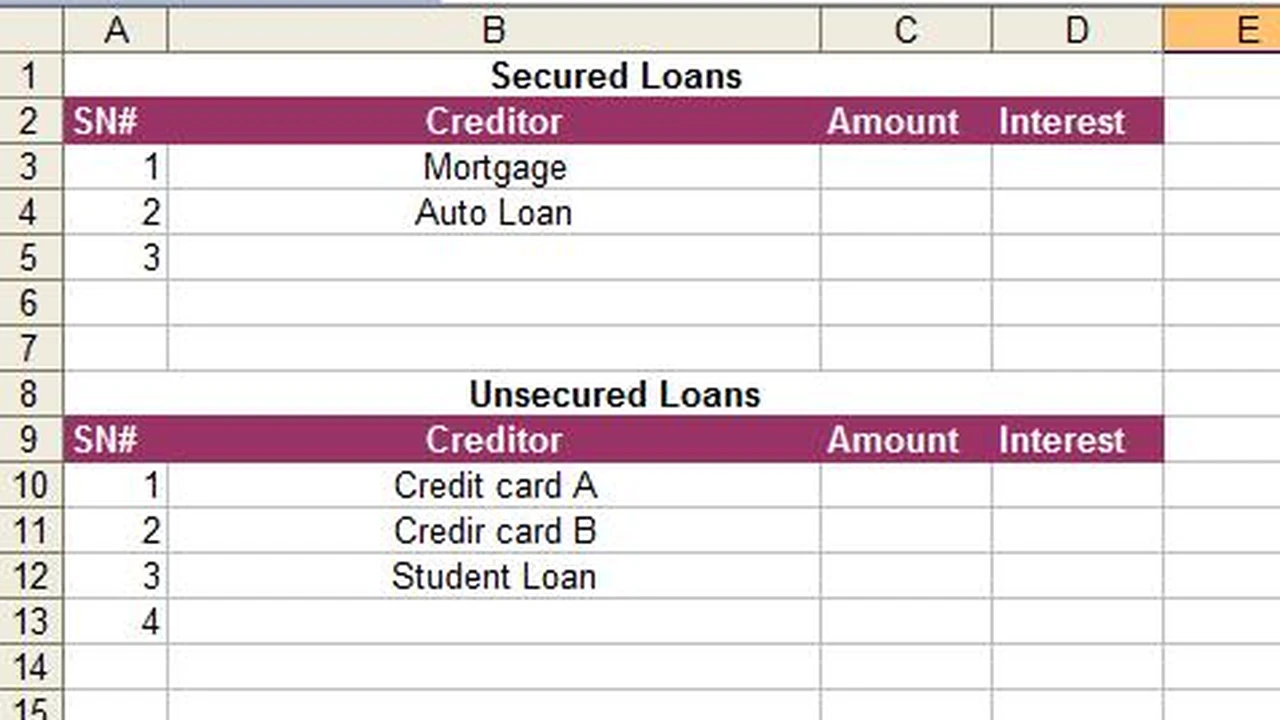

So, how do you break this cycle? It starts with some honest self-reflection. Grab a pen and paper, or open a spreadsheet, and really dig into your past spending. Where did your money go? Were there specific categories where you consistently overspent? Did you rely on credit cards for everyday expenses because your income wasn't enough? Here are some common debt triggers:

- Lifestyle Inflation: As your income grows, so does your spending.

- Impulse Buying: Shopping without a plan, often driven by emotions.

- Lack of a Budget: Not knowing where your money is going.

- Unexpected Expenses: Medical bills, car repairs, home repairs without an emergency fund.

- Job Loss or Income Reduction: Relying on credit to cover living expenses.

- Emotional Spending: Shopping to cope with stress, boredom, or sadness.

Once you identify your triggers, you can start to put strategies in place. For example, if impulse buying is an issue, try the '24-hour rule' – if you want to buy something non-essential, wait 24 hours before purchasing. If a lack of budget is the problem, it's time to create one!

Practical Steps to Prevent Future Debt Accumulation

This is where the real work happens. Debt consolidation gives you a fresh start, but it's up to you to maintain it. Here's how:

- Create a Realistic Budget: This is non-negotiable. Use tools like Mint, YNAB (You Need A Budget), or even a simple spreadsheet. Track every dollar in and every dollar out. Be honest with yourself about your spending habits.

- Build an Emergency Fund: Aim for at least 3-6 months of living expenses. This fund acts as a buffer against unexpected costs, preventing you from relying on credit cards again. Start small, even $500-$1000 can make a huge difference.

- Cut Up or Freeze Credit Cards: If you're prone to overspending, physically removing the temptation can be incredibly effective. Keep one for emergencies if you must, but store it somewhere inconvenient.

- Set Financial Goals: Having clear goals (e.g., saving for a down payment, retirement, a vacation) gives your money a purpose and makes you less likely to spend it frivolously.

- Seek Financial Counseling: If you're struggling to identify or address your spending habits, a non-profit credit counselor can provide invaluable guidance and support. They can help you create a budget and develop a long-term financial plan.

Mistake 2 Choosing the Wrong Debt Consolidation Method or Provider

Debt consolidation isn't a one-size-fits-all solution. There are several different methods, and choosing the wrong one for your specific financial situation can lead to higher costs, longer repayment periods, or even rejection. Plus, not all providers are created equal. Some offer better rates, more flexible terms, or superior customer service. Making an uninformed choice here can seriously undermine your efforts.

Understanding Different Debt Consolidation Options and Their Suitability

Let's break down the main types of debt consolidation and who they're best for:

Debt Consolidation Loans Personal Loans for Debt Relief

These are unsecured loans that you use to pay off multiple smaller debts. You then make one monthly payment to the loan provider. They're great for people with good to excellent credit scores who can qualify for low interest rates. The fixed monthly payment and clear end date can be very motivating.

- Pros: Fixed interest rate, predictable payments, clear repayment timeline, can improve credit utilization.

- Cons: Requires a decent credit score for the best rates, may have origination fees, doesn't address spending habits.

- Best for: Individuals with good credit, manageable debt amounts, and a disciplined approach to spending.

Balance Transfer Credit Cards Consolidating High-Interest Debt

These cards offer a 0% introductory APR for a set period (e.g., 12-21 months) on transferred balances. If you can pay off your debt within this promotional period, you can save a significant amount on interest. However, if you don't, the interest rate can jump significantly.

- Pros: 0% interest for a promotional period, potentially huge interest savings.

- Cons: Requires excellent credit, often has a balance transfer fee (typically 3-5%), high interest rate after the promotional period, risk of accumulating new debt.

- Best for: People with excellent credit who are confident they can pay off the transferred balance before the 0% APR expires.

Home Equity Loans or HELOCs Leveraging Your Home for Debt Consolidation

If you own a home and have equity, you can use a home equity loan (a lump sum) or a Home Equity Line of Credit (HELOC, a revolving line of credit) to consolidate debt. These typically offer lower interest rates because your home serves as collateral.

- Pros: Lower interest rates, potentially tax-deductible interest (consult a tax advisor), longer repayment terms.

- Cons: Your home is collateral, meaning you could lose it if you default. Closing costs and fees.

- Best for: Homeowners with significant equity, stable income, and a clear plan to repay the loan.

Debt Management Plans (DMPs) Through Credit Counseling Agencies

A DMP is facilitated by a non-profit credit counseling agency. They negotiate with your creditors to lower interest rates and waive fees, then consolidate your payments into one monthly sum paid to the agency, which then distributes it to your creditors. This isn't a loan; it's a structured repayment plan.

- Pros: Lower interest rates, waived fees, one monthly payment, no new credit required, addresses spending habits through counseling.

- Cons: Requires closing credit card accounts, may negatively impact credit score initially, typically takes 3-5 years.

- Best for: Individuals with significant unsecured debt who are struggling to make payments and need help with budgeting and financial discipline.

Key Factors to Consider When Choosing a Provider

Once you know which method suits you, it's time to pick a provider. Don't just go with the first one you see. Here's what to look for:

- Interest Rates and APR: This is crucial. A lower APR means less money paid over the life of the loan. Compare offers from multiple lenders.

- Fees: Look out for origination fees, balance transfer fees, annual fees, and late payment fees. These can add up quickly.

- Repayment Terms: How long do you have to repay the loan? Longer terms mean lower monthly payments but more interest paid overall. Shorter terms mean higher payments but less interest.

- Customer Service and Reputation: Read reviews. Check with the Better Business Bureau. A reputable lender will have transparent terms and good customer support.

- Eligibility Requirements: Do you meet the credit score, income, and debt-to-income ratio requirements?

- Pre-qualification Options: Many lenders offer pre-qualification, which allows you to see potential rates without a hard inquiry on your credit report.

Recommended Products and Providers for Debt Consolidation

While I can't give financial advice, I can point you to some popular and reputable options that many people consider. Always do your own research and compare personalized offers.

For Personal Loans (Good to Excellent Credit):

- LightStream: Known for competitive rates for borrowers with excellent credit. They offer a rate beat program.

- SoFi: Offers personal loans with no origination fees and competitive rates. Good for those with strong credit and income.

- Marcus by Goldman Sachs: No fees, competitive rates, and flexible payment options.

- Discover Personal Loans: Fixed rates, no origination fees, and direct payment to creditors option.

For Balance Transfer Credit Cards (Excellent Credit):

- Citi Simplicity Card: Often offers one of the longest 0% intro APR periods for balance transfers (sometimes up to 21 months). No late fees or penalty rates.

- Wells Fargo Reflect Card: Another strong contender for long 0% intro APR periods (up to 21 months).

- BankAmericard Credit Card: Good for balance transfers with a decent 0% intro APR period.

For Debt Management Plans:

- National Foundation for Credit Counseling (NFCC): A non-profit organization that can connect you with accredited credit counseling agencies.

- GreenPath Financial Wellness: A highly-rated non-profit credit counseling agency offering DMPs and financial education.

Important Note on Pricing: Interest rates and fees are highly personalized. They depend on your credit score, income, debt-to-income ratio, and the current market. Always get a personalized quote from multiple lenders to compare. For example, a personal loan interest rate could range from 6% to 36% APR, while balance transfer fees are typically 3-5% of the transferred amount. Home equity loan rates are often in the 5-10% range, but again, this varies.

Mistake 3 Not Having a Solid Repayment Plan and Sticking to It

You've consolidated your debt, you've addressed your spending habits, and you've chosen the right method. Fantastic! But the journey isn't over. The final, crucial step is having a clear, actionable repayment plan and the discipline to stick to it. Many people get excited about the initial consolidation but then lose steam or get sidetracked, leading to missed payments, new debt, and ultimately, failure to achieve financial freedom.

The Importance of a Detailed Repayment Strategy

A repayment plan isn't just about making your monthly payment. It's about understanding your new consolidated debt, knowing exactly when and how much to pay, and having strategies in place to accelerate your repayment if possible. Without a plan, it's easy to get overwhelmed or lose sight of your goal.

Creating Your Post-Consolidation Repayment Roadmap

- Understand Your New Loan Terms: Know your interest rate, monthly payment, and the exact repayment period. Mark your payment due dates on a calendar.

- Automate Payments: Set up automatic payments from your checking account. This ensures you never miss a payment, which can save you from late fees and negative impacts on your credit score.

- Integrate into Your Budget: Your consolidated payment should be a fixed line item in your new budget. Treat it like any other essential bill.

- Consider the Debt Snowball or Avalanche Method: If you have any remaining smaller debts or want to pay off your consolidated loan faster, these methods can be powerful motivators.

- Debt Snowball: Pay the minimum on all debts except the smallest one, which you attack with extra payments. Once the smallest is paid off, roll that payment amount into the next smallest debt. This builds momentum.

- Debt Avalanche: Pay the minimum on all debts except the one with the highest interest rate, which you attack with extra payments. This saves you the most money on interest.

- Look for Opportunities to Pay Extra: Even small extra payments can make a big difference over time. If you get a bonus, a tax refund, or an unexpected windfall, consider putting a portion towards your consolidated debt.

- Track Your Progress: Seeing your debt balance decrease can be incredibly motivating. Use a spreadsheet, an app, or even a visual tracker to celebrate milestones.

Staying Motivated and Disciplined Throughout the Repayment Journey

Repaying debt can be a marathon, not a sprint. There will be days when you feel discouraged. Here's how to stay on track:

- Set Realistic Expectations: Understand that it will take time. Don't expect overnight miracles.

- Celebrate Small Wins: Paid off an old credit card? Made an extra payment? Acknowledge your progress!

- Find an Accountability Partner: Share your goals with a trusted friend or family member who can offer support and encouragement.

- Educate Yourself: Continue learning about personal finance. The more knowledgeable you are, the more confident you'll feel.

- Visualize Your Debt-Free Future: Imagine what life will be like without the burden of debt. This powerful visualization can keep you going when things get tough.

- Review and Adjust: Life happens. Your income might change, or unexpected expenses might arise. Periodically review your budget and repayment plan and make adjustments as needed. Flexibility is key.

Remember, debt consolidation is a tool. A powerful one, but just a tool. Its effectiveness depends entirely on how you use it. By avoiding these three common mistakes – not addressing the root cause of your debt, choosing the wrong method or provider, and failing to stick to a solid repayment plan – you'll significantly increase your chances of achieving true financial freedom. You've got this!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)