Debt Consolidation for Small Businesses in Southeast Asia

Tailored debt consolidation strategies for small and medium-sized enterprises in the Southeast Asian region.

Debt Consolidation for Small Businesses in Southeast Asia

Understanding the Unique Financial Landscape for SMEs in Southeast Asia

Hey there, small business owners in Southeast Asia! Let's talk about something crucial for your financial health: debt consolidation. Running an SME in this vibrant, fast-growing region is exciting, but it also comes with its own set of financial challenges. From managing cash flow to scaling operations, you're constantly juggling multiple balls. And sometimes, those balls include various debts – perhaps a short-term loan for inventory, a line of credit for operational expenses, or even personal loans you took out to kickstart your dream. When these debts start piling up, it can feel overwhelming, impacting your focus on growth and innovation. That's where debt consolidation comes in, offering a lifeline to streamline your finances and get back on track.

The Southeast Asian market is incredibly dynamic, with diverse economies ranging from the established markets of Singapore and Malaysia to the rapidly emerging ones like Vietnam and the Philippines. Each country has its own regulatory environment, banking practices, and cultural nuances that influence how businesses access and manage credit. This means that a one-size-fits-all approach to debt consolidation simply won't work. You need strategies that are tailored to the specific conditions of your market, your business size, and your unique debt profile.

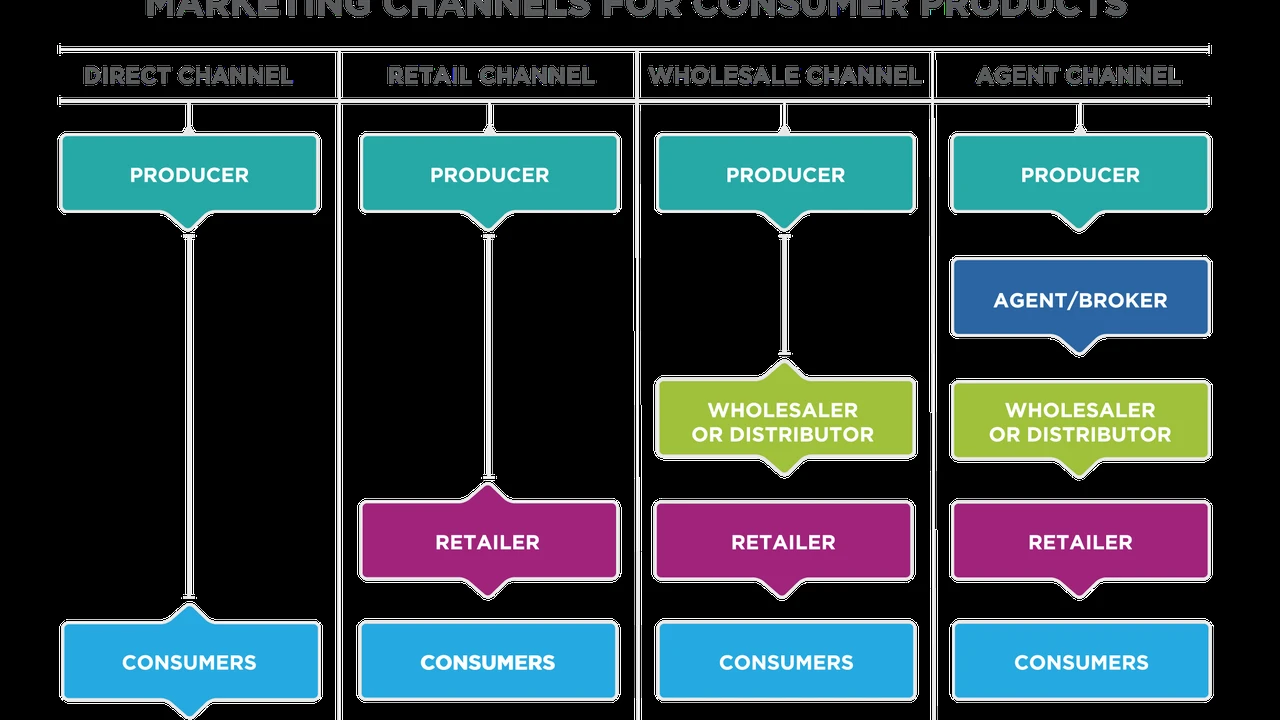

Many SMEs in the region rely on a mix of traditional bank loans, microfinance institutions, and even informal lending channels. This can lead to a complex web of repayment schedules, varying interest rates, and different terms and conditions. Imagine trying to keep track of all that while also running your day-to-day operations! Debt consolidation aims to simplify this complexity, bringing multiple debts under one umbrella, ideally with a lower interest rate and a more manageable single monthly payment. This not only reduces your administrative burden but also frees up valuable cash flow that can be reinvested into your business or used to build a stronger financial buffer.

Why Small Businesses in Southeast Asia Need Debt Consolidation Solutions

So, why is debt consolidation particularly relevant for SMEs in Southeast Asia? Well, several factors contribute to this need. Firstly, many small businesses, especially startups, might not have extensive credit histories, making it harder to secure large, low-interest loans from traditional banks. This often leads them to take on smaller, higher-interest loans from various sources, creating a fragmented debt structure. Secondly, the rapid growth cycles in some Southeast Asian economies can lead to quick expansion, which, while positive, often requires significant capital injection, sometimes leading to increased borrowing.

Thirdly, economic fluctuations, supply chain disruptions (as we've seen recently), or unexpected market changes can quickly impact an SME's revenue, making it difficult to service multiple debts simultaneously. A consolidated loan can provide much-needed breathing room during such times. Fourthly, the administrative burden of managing multiple creditors, each with their own terms and deadlines, can be a significant drain on resources for small businesses that often operate with lean teams. Consolidating debts frees up time and mental energy that can be better spent on core business activities.

Moreover, a streamlined debt repayment plan can significantly improve a business's credit profile over time. By making consistent, single payments, you demonstrate financial responsibility, which can open doors to better financing options in the future. This is crucial for long-term sustainability and growth. Without consolidation, the risk of missing payments on one or more loans increases, potentially damaging your credit score and making future borrowing even more challenging.

Types of Debt Consolidation for SMEs Exploring Your Options

When it comes to debt consolidation for your SME, you've got a few main avenues to explore. Each has its own pros and cons, and the best choice for you will depend on your specific situation, creditworthiness, and the types of debt you're looking to consolidate.

Business Debt Consolidation Loans Understanding the Core Solution

This is perhaps the most straightforward approach. A business debt consolidation loan is essentially a new loan taken out to pay off several existing business debts. The goal is to secure a loan with a lower interest rate, a longer repayment period, or both, resulting in a single, more manageable monthly payment. These loans can be secured or unsecured. Secured loans typically require collateral, such as business assets (equipment, inventory, or even real estate), and often come with lower interest rates due to reduced risk for the lender. Unsecured loans don't require collateral but usually have higher interest rates and stricter eligibility criteria.

Many banks and financial institutions in Southeast Asia offer these products. For example, in Singapore, banks like DBS, OCBC, and UOB have various SME loan packages that can be adapted for consolidation. In Malaysia, Maybank, CIMB, and Public Bank are strong contenders. In emerging markets like Vietnam and the Philippines, local banks and even some international players are increasingly offering tailored SME financing solutions. When considering a business debt consolidation loan, pay close attention to the interest rate, loan tenure, any processing fees, and prepayment penalties.

Personal Loans for Business Debt When Your Personal and Business Finances Intersect

It's a common scenario for small business owners, especially in the early stages, to use personal funds or personal loans to finance their business. If you find yourself in this situation with multiple personal debts (credit cards, personal loans) that were used for business purposes, a personal loan for debt consolidation might be a viable option. This allows you to consolidate those personal debts into one, often at a lower interest rate than high-interest credit cards. However, it's crucial to understand that this blurs the line between personal and business finances, which can have implications for liability and tax. Always consult with a financial advisor to understand the full implications.

Many banks across Southeast Asia offer personal loans. For instance, in Indonesia, banks like Bank Mandiri or BCA provide personal loan products. In Thailand, Kasikornbank or Bangkok Bank might be options. The eligibility for personal loans often depends heavily on your personal credit score and income, rather than solely on your business's performance.

Balance Transfer Credit Cards A Short-Term Strategy for High-Interest Debt

If your primary debt consists of high-interest business credit card balances, a balance transfer credit card could be a short-term solution. These cards often offer an introductory period (e.g., 6 to 18 months) with a 0% or very low-interest rate on transferred balances. This can give you a crucial window to pay down a significant portion of your debt without accruing additional interest. However, it's vital to have a solid plan to pay off the transferred balance before the promotional period ends, as the interest rate will typically jump significantly afterward. Also, be mindful of balance transfer fees, which are usually a percentage of the transferred amount.

Major credit card issuers in Southeast Asia, such as those affiliated with Visa and Mastercard, often have balance transfer promotions. Check with local banks like BDO in the Philippines or Vietcombank in Vietnam for their current offerings. This strategy is best suited for managing smaller, high-interest credit card debts rather than large, long-term business loans.

Asset-Backed Financing Leveraging Your Business Assets for Consolidation

For businesses with significant tangible assets, asset-backed financing can be a powerful consolidation tool. This involves using assets like accounts receivable, inventory, or equipment as collateral for a new loan. This type of financing can often provide larger loan amounts and more favorable terms than unsecured options, as the risk to the lender is reduced. Factoring (selling your accounts receivable at a discount) is another form of asset-backed financing that can free up cash flow to pay down existing debts.

Many commercial banks and specialized finance companies in the region offer asset-backed lending. For example, in Singapore, companies like Capital Match or Funding Societies (though primarily P2P, they offer invoice financing) can be explored. In Malaysia, institutions like RHB or CIMB might have asset-backed loan products for SMEs. This option is particularly useful for businesses with strong balance sheets but perhaps temporary cash flow issues.

Comparing Specific Products and Providers in Southeast Asia

Let's dive into some specific examples and comparisons of products you might encounter in Southeast Asia. Remember, these are illustrative, and terms can change, so always do your own due diligence.

Singapore: A Hub for SME Financing

Singapore has a sophisticated financial market with numerous options for SMEs. Banks like DBS, OCBC, and UOB are major players. They offer various SME loans, including working capital loans and business term loans, which can be used for debt consolidation. For instance, a DBS Business Loan might offer competitive interest rates starting from around 4-6% p.a. for well-established SMEs, with loan tenures up to 5 years. Eligibility often requires a minimum annual revenue (e.g., S$100,000) and a certain operating history (e.g., 2-3 years). Processing fees typically range from 1-3% of the loan amount.

Beyond traditional banks, Singapore also has a thriving FinTech scene. Platforms like Funding Societies (Modalku in Indonesia) offer peer-to-peer lending and invoice financing. While not direct consolidation loans, they can provide quick access to capital to pay off urgent, high-interest debts. Interest rates can be higher, often ranging from 8-20% p.a., but approval processes are generally faster and more flexible for newer businesses.

Malaysia: Diverse Options for Growing Businesses

In Malaysia, major banks like Maybank, CIMB, Public Bank, and RHB are key providers of SME financing. A Maybank SME Clean Loan, for example, might offer financing up to RM1 million with repayment periods up to 7 years. Interest rates can vary widely based on the borrower's credit profile, typically from 6-12% p.a. Eligibility often includes a minimum business operating period (e.g., 2 years) and a certain annual turnover.

For businesses looking for government-backed schemes, agencies like SME Corp Malaysia often collaborate with financial institutions to offer subsidized loans or guarantee schemes, which can make debt consolidation more accessible and affordable. These schemes might have lower interest rates and more flexible terms, but often come with specific eligibility criteria related to business size, sector, or growth potential.

Indonesia: Navigating a Large and Diverse Market

Indonesia's vast market offers opportunities but also unique challenges. Banks like Bank Mandiri, BCA, BRI, and BNI are dominant. They offer various SME credit products. For instance, a Kredit Usaha Rakyat (KUR) from BRI is a government-backed micro-credit program aimed at small businesses, offering very low-interest rates (e.g., 6% p.a.) for working capital or investment. While not explicitly a consolidation loan, a new KUR loan could be used to pay off higher-interest debts. Eligibility for KUR is strict, focusing on micro and small enterprises with good credit history and specific business activities.

FinTech lenders are also growing rapidly in Indonesia. Modalku (Funding Societies) and KoinWorks are examples of platforms offering business loans and invoice financing. These can be alternatives for businesses that find traditional bank loans difficult to access. Interest rates on these platforms can range from 10-24% p.a., depending on risk assessment, but they offer faster disbursement and more flexible requirements.

Philippines: Emerging Opportunities for SMEs

In the Philippines, banks like BDO, BPI, Metrobank, and Landbank are primary sources of SME loans. A BDO SME Loan might offer working capital or term loans with interest rates typically ranging from 8-15% p.a., depending on the loan type and borrower's profile. Loan tenures can go up to 5 years. Requirements usually include a minimum operating history (e.g., 3 years) and audited financial statements.

The Philippines also has a growing number of online lenders and FinTech companies catering to SMEs, such as First Circle, which offers fast and flexible business loans. These platforms can be particularly useful for businesses needing quick access to funds to consolidate urgent debts, though interest rates might be higher than traditional banks.

Vietnam: Rapid Growth and Evolving Financial Services

Vietnam's economy is booming, and its financial sector is evolving. Banks like Vietcombank, BIDV, and Agribank are major players in SME lending. They offer various business loans for working capital, investment, and sometimes specific consolidation purposes. Interest rates for SME loans can range from 7-12% p.a., with loan terms up to 5 years. Eligibility often requires a minimum operating period and a clear business plan.

While FinTech is still developing compared to Singapore, platforms like Tima offer peer-to-peer lending, which can be an option for smaller, quicker loans to manage immediate debt. However, always exercise caution with newer platforms and ensure they are properly regulated.

Key Considerations Before Consolidating Your SME Debt

Before you jump into debt consolidation, take a moment to consider these crucial points. It's not just about getting a new loan; it's about setting your business up for long-term financial health.

Assessing Your Current Debt Profile A Comprehensive Overview

First things first, get a clear picture of all your existing debts. List them out: who are the creditors, what are the outstanding balances, what are the interest rates, and what are the monthly payments? Don't forget any hidden fees or penalties. This comprehensive overview will help you understand the total amount you need to consolidate and identify which debts are costing you the most. Prioritize paying off high-interest debts first, as they drain your cash flow the fastest.

Evaluating Your Business's Financial Health A Realistic Look

Lenders will scrutinize your business's financial health. Be prepared to provide financial statements, tax returns, and cash flow projections. Understand your current revenue, expenses, and profitability. A strong financial standing will improve your chances of securing a favorable consolidation loan. If your business is struggling, you might need to explore other options or work on improving your financial metrics before applying for consolidation.

Understanding Interest Rates and Fees The True Cost of Consolidation

The primary goal of debt consolidation is often to reduce your overall interest burden. Compare the interest rate of the new consolidation loan with the weighted average interest rate of your existing debts. Don't forget to factor in any upfront fees (origination fees, processing fees) and potential prepayment penalties. Sometimes, a slightly higher interest rate with no fees might be better than a lower rate with hefty upfront costs. Always calculate the total cost of the loan over its entire tenure.

Loan Tenure and Monthly Payments Finding the Right Balance

A longer loan tenure typically means lower monthly payments, which can significantly improve your cash flow. However, a longer tenure also means you'll pay more interest over the life of the loan. Find a balance that makes your monthly payments manageable without extending the debt repayment period unnecessarily. Use online calculators to model different scenarios and see how they impact your cash flow.

Impact on Your Credit Score Short-Term vs Long-Term Effects

Applying for a new loan will result in a hard inquiry on your credit report, which can temporarily ding your credit score. However, if you successfully consolidate and make consistent payments, your credit score will likely improve over the long term. A consolidated loan can reduce your credit utilization ratio (if you close old credit lines) and demonstrate responsible debt management. Be mindful of closing old accounts, as this can sometimes negatively impact your credit history length.

Regulatory Environment and Local Laws Navigating the Southeast Asian Landscape

As mentioned, each country in Southeast Asia has its own financial regulations. Understand the consumer protection laws, lending regulations, and any specific requirements for SME financing in your jurisdiction. For example, some countries might have caps on interest rates, while others might have specific disclosure requirements for lenders. Consulting with a local financial advisor or legal expert can be invaluable here.

Avoiding Debt Traps and Scams Due Diligence is Key

Unfortunately, where there's a need, there are sometimes unscrupulous actors. Be wary of lenders promising guaranteed approval regardless of credit, or those demanding upfront fees before any loan disbursement. Always verify the legitimacy of the lender, check their licensing, and read reviews. If an offer seems too good to be true, it probably is. Stick to reputable banks, licensed financial institutions, or well-known FinTech platforms.

Implementing Your Debt Consolidation Strategy and Beyond

Once you've chosen your consolidation path, the work isn't over. Successful debt consolidation is just the first step towards a healthier financial future for your SME.

Creating a Robust Repayment Plan Sticking to the Schedule

With a single, consolidated loan, you now have a clear repayment schedule. Create a detailed budget that incorporates this new payment. Ensure you have sufficient cash flow to meet your obligations consistently. Set up automatic payments to avoid missing deadlines and incurring late fees. Treat this repayment plan as a critical component of your business operations.

Monitoring Your Cash Flow and Financial Performance Regularly

Debt consolidation gives you better control over your cash flow. Regularly monitor your business's financial performance. Use accounting software or spreadsheets to track income and expenses. This will help you identify any potential shortfalls early and take corrective action. Proactive cash flow management is key to preventing future debt accumulation.

Building an Emergency Fund for Your Business Your Financial Safety Net

One of the biggest benefits of improved cash flow from consolidation is the ability to build an emergency fund. Aim to save at least 3-6 months of operating expenses. This fund will act as a buffer against unexpected events, such as a sudden drop in sales, equipment breakdown, or economic downturns, reducing the need to take on new debt in a crisis.

Reviewing and Adjusting Your Financial Strategy Periodically

The business environment in Southeast Asia is constantly changing. Your financial strategy should evolve with it. Periodically review your debt consolidation plan, your budget, and your overall financial goals. Are you still on track? Are there new opportunities or challenges that require adjustments? Flexibility and adaptability are crucial for long-term success.

Seeking Professional Financial Advice When in Doubt

Don't hesitate to seek advice from financial professionals. A business financial advisor or an accountant specializing in SMEs can provide invaluable guidance on managing your finances, optimizing your debt structure, and planning for future growth. They can help you navigate complex financial decisions and ensure you're making the best choices for your business in the unique Southeast Asian context.

Debt consolidation for your SME in Southeast Asia isn't just about getting out of debt; it's about building a stronger, more resilient business. By streamlining your finances, reducing your interest burden, and improving your cash flow, you're laying the groundwork for sustainable growth and long-term success in this exciting region. Take control of your debt, and empower your business to thrive!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)