The Impact of Debt Consolidation on Your Taxes What You Need to Know

Understand the potential tax implications of debt consolidation and how to plan accordingly.

Understand the potential tax implications of debt consolidation and how to plan accordingly.

The Impact of Debt Consolidation on Your Taxes What You Need to Know

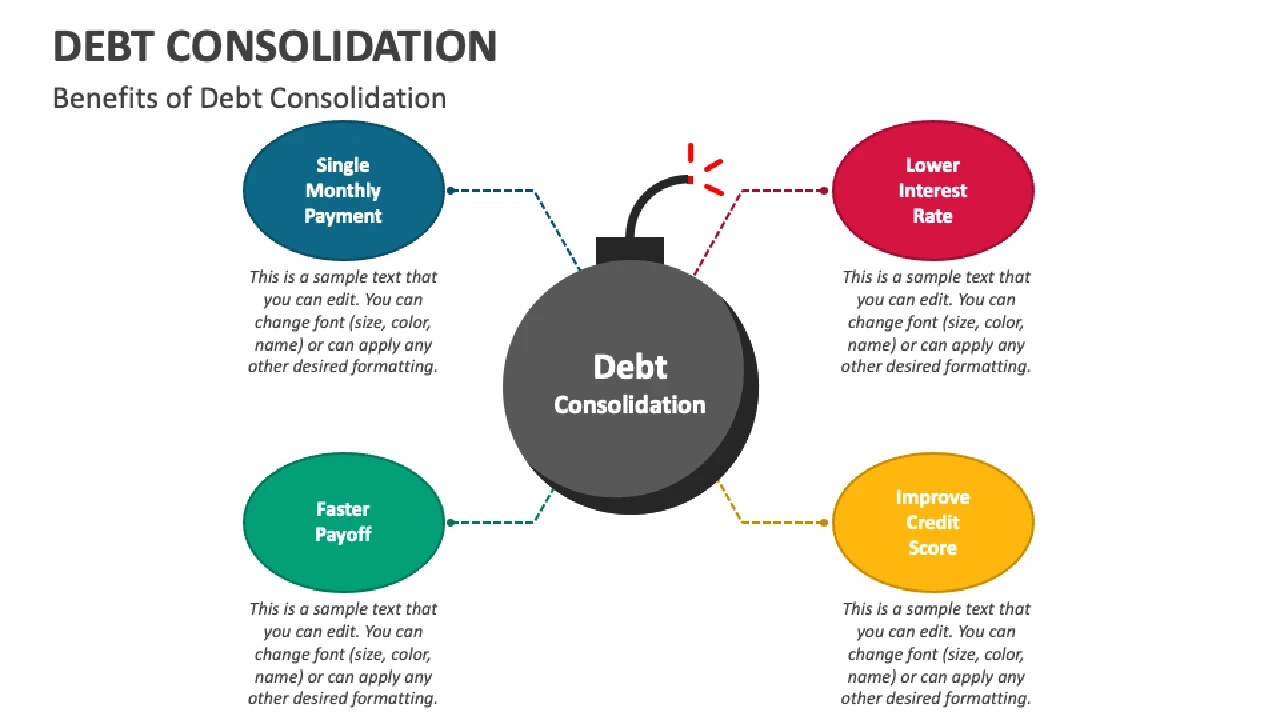

Debt consolidation is often hailed as a financial savior, a strategic move that can simplify your payments, reduce interest rates, and ultimately lead you to financial freedom. And for many, it absolutely is. But as with any significant financial decision, there are layers to peel back, nuances to understand, and potential pitfalls to avoid. One area that often gets overlooked in the excitement of lower monthly payments is the impact debt consolidation can have on your taxes. Yes, your taxes. It might not be the first thing that comes to mind when you're juggling multiple credit card statements, but ignoring the tax implications could lead to an unwelcome surprise come tax season.

This comprehensive guide will delve deep into the various ways debt consolidation can interact with your tax situation. We'll explore different types of debt consolidation, how each might affect your taxable income, and what steps you can take to plan effectively. Whether you're considering a personal loan, a balance transfer, a home equity loan, or even debt settlement, understanding the tax landscape is crucial for making an informed decision.

Understanding Debt Consolidation Basics and Tax Implications

Before we dive into the nitty-gritty of tax implications, let's quickly recap what debt consolidation entails. In essence, it's the process of combining multiple debts into a single, new loan, often with a lower interest rate or a more manageable monthly payment. The goal is to streamline your finances and accelerate your path to becoming debt-free. However, the 'type' of debt you consolidate and the 'method' you use can significantly alter the tax picture.

Generally speaking, the act of consolidating debt itself doesn't directly trigger a taxable event. You're not earning income; you're simply restructuring existing liabilities. The tax implications usually arise from specific scenarios related to interest deductions, forgiven debt, or the type of asset used to secure the new loan.

Interest Deductions and Debt Consolidation Tax Benefits

One of the most common questions people have about debt consolidation and taxes revolves around interest deductions. Can you deduct the interest you pay on your consolidated loan? The answer, as with many tax-related queries, is: it depends.

Home Equity Loans and HELOCs for Debt Consolidation Tax Deductible Interest

If you use a home equity loan or a Home Equity Line of Credit (HELOC) to consolidate debt, the interest you pay might be tax-deductible. Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, interest on home equity loans and HELOCs was generally deductible regardless of how the funds were used. However, the TCJA changed this. Now, for tax years 2018 through 2025, interest on home equity loans and HELOCs is only deductible if the funds are used to buy, build, or substantially improve the home that secures the loan. This means if you use a HELOC to pay off credit card debt or personal loans, the interest on that portion of the loan is generally not deductible.

Let's consider an example: Sarah takes out a $50,000 HELOC. She uses $30,000 to renovate her kitchen (a substantial improvement) and $20,000 to pay off high-interest credit card debt. The interest on the $30,000 used for the kitchen renovation would likely be deductible, assuming it meets other IRS criteria (like the total mortgage debt not exceeding the limits). However, the interest on the $20,000 used for credit card debt would not be deductible. It's crucial to keep meticulous records of how you use the funds from a home equity product if you intend to claim any interest deductions.

Product Recommendation: When considering HELOCs, major banks like Chase, Bank of America, and Wells Fargo offer competitive rates and terms. Online lenders such as Figure Technologies also provide streamlined application processes. Always compare interest rates, closing costs, and repayment terms. For instance, Chase's HELOCs often feature introductory rates and flexible repayment options, while Figure Technologies might offer a faster approval process. The best choice depends on your credit score, existing banking relationships, and how quickly you need the funds. For example, if you have excellent credit and an existing relationship with Bank of America, their HELOC might offer preferred rates. If speed is your priority and you're comfortable with a digital-first experience, Figure could be a strong contender. Always check their current rates and any promotional offers.

Personal Loans and Balance Transfers Tax Implications

For most other forms of debt consolidation, such as personal loans or balance transfer credit cards, the interest paid is generally not tax-deductible. This includes interest on credit card debt, personal loans, auto loans, and student loans (though student loan interest has its own specific deduction rules, which we'll touch on later). The IRS considers these types of interest as personal interest, which is not deductible.

So, if you take out a personal loan to consolidate your credit card debt, while you might save a significant amount on interest payments overall, you won't be able to claim those interest payments as a deduction on your tax return. This is an important distinction to understand when evaluating the true cost-benefit of different consolidation strategies.

Debt Forgiveness and Taxable Income What You Need to Know

This is perhaps the most significant tax implication of debt consolidation, particularly when it involves debt settlement or certain types of loan modifications. If a lender forgives or cancels a portion of your debt, the IRS generally considers that forgiven amount as taxable income.

Debt Settlement and Cancellation of Debt Income COD

Debt settlement involves negotiating with your creditors to pay back a lower amount than what you originally owe. While this can provide significant relief from overwhelming debt, the amount of debt that is forgiven or canceled is typically considered Cancellation of Debt (COD) income by the IRS. Your creditor is usually required to send you a Form 1099-C, 'Cancellation of Debt,' if they forgive $600 or more of your debt.

For example, if you owe $10,000 on a credit card and negotiate with the bank to settle the debt for $6,000, the $4,000 difference ($10,000 - $6,000) is considered COD income and must be reported on your tax return. This can significantly increase your taxable income for the year, potentially pushing you into a higher tax bracket or reducing your eligibility for certain credits.

Exceptions to Taxable Debt Forgiveness

Fortunately, there are several exceptions to the rule that forgiven debt is taxable. These exceptions can provide crucial relief for individuals facing severe financial hardship:

- Insolvency: If you are insolvent immediately before the debt is canceled, you might not have to pay tax on the forgiven debt. You are considered insolvent if your total liabilities exceed the fair market value of your total assets. You'll need to prove your insolvency with documentation of your assets and liabilities. The amount of debt forgiveness that is excluded from income due to insolvency is limited to the amount by which you are insolvent.

- Bankruptcy: Debt discharged through bankruptcy is generally not considered taxable income. This is a significant advantage for those who go through Chapter 7 or Chapter 13 bankruptcy.

- Qualified Principal Residence Indebtedness: For debt forgiven on your primary home, there was a temporary exclusion for qualified principal residence indebtedness. While this exclusion largely expired at the end of 2017, it was extended for certain situations through 2020 and 2021, and it's always worth checking current tax laws or consulting a tax professional if this applies to you.

- Certain Student Loan Discharges: In some cases, student loan debt that is discharged (e.g., due to death, disability, or certain income-driven repayment plans) may be excluded from income. The rules around this can be complex and have changed over time, so professional advice is recommended.

- Gift: If the lender intended the debt forgiveness as a gift, it might not be taxable. However, proving this intention can be difficult.

If you receive a Form 1099-C, it's imperative to consult with a tax professional to determine if any of these exceptions apply to your situation. Failing to report COD income or incorrectly claiming an exception can lead to penalties and interest from the IRS.

Student Loan Consolidation and Tax Considerations

Student loan consolidation is a common strategy for managing educational debt. While the act of consolidating federal student loans (e.g., through a Direct Consolidation Loan) or refinancing private student loans doesn't typically have direct tax implications, there are a few points to consider.

Student Loan Interest Deduction

You can generally deduct the amount of interest you paid during the year on a qualified student loan, up to a maximum of $2,500. This deduction is an above-the-line deduction, meaning it reduces your adjusted gross income (AGI). Consolidating or refinancing your student loans doesn't eliminate this deduction, as long as the new loan is still considered a qualified student loan and you meet the other IRS requirements (e.g., your modified AGI is below certain limits).

Product Recommendation: For federal student loan consolidation, the Direct Consolidation Loan program is the only option. It allows you to combine multiple federal loans into one, potentially lowering your monthly payment and simplifying repayment. For private student loan refinancing, companies like Sofi, Earnest, and CommonBond are popular choices. SoFi often offers competitive rates for borrowers with strong credit and income, while Earnest is known for its flexible payment options. CommonBond also provides good rates and a strong customer service reputation. Always compare their rates, repayment terms, and any fees. For example, if you have a high income and excellent credit, SoFi might give you the lowest interest rate. If you need more flexibility in your payment schedule, Earnest could be a better fit. These platforms often have pre-qualification tools that allow you to check rates without impacting your credit score.

Income-Driven Repayment IDR Plans and Potential Taxable Forgiveness

If you consolidate federal student loans and enroll in an Income-Driven Repayment (IDR) plan, any remaining loan balance after 20 or 25 years of qualifying payments may be forgiven. Historically, this forgiven amount was considered taxable income. However, the American Rescue Plan Act of 2021 made student loan forgiveness tax-free from 2021 through 2025. This is a significant temporary relief for borrowers who might otherwise face a substantial tax bill after their IDR plan forgiveness. It's crucial to stay updated on current tax laws, as this provision is set to expire.

Debt Consolidation and Your Credit Score Tax Implications

While not a direct tax implication, your credit score can indirectly affect your tax situation by influencing the interest rates you qualify for on future loans, including those that might have tax-deductible interest (like a mortgage). Debt consolidation can have both positive and negative impacts on your credit score:

- Positive: If you successfully consolidate high-interest credit card debt and make consistent, on-time payments, your credit utilization ratio can decrease, and your payment history will improve, both of which are good for your score.

- Negative: Applying for a new loan (like a personal loan or HELOC) results in a hard inquiry, which can temporarily ding your score. Closing old credit card accounts after consolidation can also negatively impact your credit utilization and length of credit history.

Maintaining a good credit score is vital for securing favorable interest rates on future loans, which can indirectly save you money that might otherwise be spent on non-deductible interest.

Planning for Tax Season After Debt Consolidation Key Strategies

To avoid any unpleasant surprises, proactive planning is essential when it comes to debt consolidation and taxes. Here are some key strategies:

Consult a Tax Professional Before Consolidating

This is perhaps the most important piece of advice. Before you commit to any debt consolidation strategy, especially one involving debt settlement or home equity, consult with a qualified tax advisor. They can assess your specific financial situation, explain the potential tax consequences, and help you plan accordingly. They can also advise you on how to document your insolvency if you anticipate debt forgiveness.

Keep Meticulous Records of Debt Consolidation

Maintain thorough records of all aspects of your debt consolidation. This includes:

- Loan agreements for the new consolidated loan.

- Statements from the original debts showing the amounts paid off.

- Documentation of how funds from home equity loans or HELOCs were used (e.g., receipts for home improvements).

- Any Forms 1099-C received from creditors.

- Proof of insolvency if you believe you qualify for that exclusion.

Good record-keeping will be invaluable if you need to justify deductions or exclusions to the IRS.

Understand the Difference Between Debt Consolidation and Debt Settlement

It's crucial to distinguish between these two. Debt consolidation is about restructuring debt, typically without any portion being forgiven. Debt settlement, on the other hand, explicitly involves a portion of the debt being forgiven, which almost always has tax implications. Make sure you understand which path you are taking and its associated tax consequences.

Budget for Potential Tax Liabilities

If you anticipate receiving a Form 1099-C for forgiven debt and don't qualify for an exclusion, start budgeting for the potential tax liability. Don't wait until April 15th to realize you owe a significant amount to the IRS. Setting aside funds throughout the year can prevent a financial shock.

Review Your Withholding or Estimated Payments

If your taxable income is expected to increase due to debt forgiveness, you might need to adjust your W-4 with your employer or make estimated tax payments throughout the year to avoid underpayment penalties. Your tax professional can help you determine the appropriate adjustments.

Specific Scenarios and Their Tax Nuances

Let's explore a few more specific scenarios that might arise during or after debt consolidation:

Consolidating Business Debt Tax Considerations

If you're a small business owner consolidating business debt, the tax rules can be different. Interest on business loans is generally tax-deductible as a business expense. If you consolidate business debt with a personal loan, it's crucial to maintain clear separation between personal and business finances to ensure you can deduct the appropriate interest. Commingling funds can complicate tax reporting and potentially lead to disallowed deductions.

Debt Consolidation and State Taxes

While this guide primarily focuses on federal tax implications, remember that state tax laws can also vary. Some states may treat forgiven debt differently than the federal government, or they may have different rules regarding interest deductions. Always check your state's tax regulations or consult a local tax professional.

The Mortgage Interest Deduction and Refinancing

If you refinance your primary mortgage to include other debts (a cash-out refinance), the interest on the portion of the loan used to pay off other debts is generally not deductible unless those funds were used to buy, build, or substantially improve your home. The mortgage interest deduction is limited to interest paid on up to $750,000 of qualified residence debt ($375,000 if married filing separately) for loans taken out after December 15, 2017. For older loans, the limit is $1 million ($500,000 if married filing separately).

Final Thoughts on Debt Consolidation and Taxes

Debt consolidation is a powerful tool for regaining control of your finances, but it's not a one-size-fits-all solution, and it's certainly not tax-free in all scenarios. The key takeaway is to be informed and proactive. Understand the type of debt you're consolidating, the method you're using, and the potential tax consequences before you sign on the dotted line.

By taking the time to research, keep meticulous records, and consult with tax professionals, you can navigate the complexities of debt consolidation with confidence, ensuring that your path to financial freedom isn't derailed by an unexpected tax bill. Your financial well-being depends not just on reducing your debt, but also on understanding all the implications of how you do it.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)