Common Myths About Debt Consolidation Debunked

Separate fact from fiction regarding debt consolidation and learn the truth about this popular debt management strategy.

Separate fact from fiction regarding debt consolidation and learn the truth about this popular debt management strategy.

Common Myths About Debt Consolidation Debunked

Debt consolidation. It’s a term you hear a lot when you’re looking for ways to manage your finances, especially if you’re feeling overwhelmed by multiple debts. It sounds like a magic bullet, right? One payment, lower interest, less stress. But like many financial solutions, debt consolidation is often surrounded by a cloud of misconceptions and myths. These myths can lead people to make poor decisions, or worse, avoid a potentially helpful strategy altogether. Let’s dive deep and debunk some of the most common myths about debt consolidation, separating fact from fiction to help you make an informed decision.

Myth 1 Debt Consolidation is Only for People with Bad Credit

This is one of the biggest misunderstandings out there. Many people assume that if you’re considering debt consolidation, it must mean your credit is in shambles. While it’s true that debt consolidation can be a lifesaver for those struggling with poor credit, it’s absolutely not exclusive to them. In fact, individuals with good to excellent credit often get the best rates and terms on debt consolidation loans, making the process even more beneficial.

Why Good Credit Matters for Debt Consolidation Loans

If you have a strong credit score (typically 670+ FICO), lenders see you as a lower risk. This means they’re more likely to offer you a lower Annual Percentage Rate (APR) on a debt consolidation loan. A lower APR translates directly into less money paid in interest over the life of the loan, which is the whole point of consolidating high-interest debts like credit cards. For example, if you have several credit cards with APRs ranging from 18% to 25%, and you can secure a personal loan for debt consolidation at 8% to 12%, that’s a significant saving.

Product Spotlight Best Debt Consolidation Loans for Excellent Credit

For those with excellent credit (740+ FICO), here are a few top-tier options that often provide competitive rates and terms:

- SoFi Personal Loan: SoFi is known for offering competitive rates to borrowers with strong credit. They often have no origination fees and offer flexible repayment terms. Their rates can start as low as 6.99% APR for well-qualified borrowers.

- LightStream Personal Loan: LightStream is another excellent choice for borrowers with good to excellent credit. They pride themselves on offering low rates and a wide range of loan purposes, including debt consolidation. Their rates can be incredibly low, sometimes starting below 6% APR, but they require a very strong credit profile.

- Marcus by Goldman Sachs Personal Loan: Marcus offers personal loans with no fees (no origination fees, no late fees, no prepayment fees). They cater to borrowers with good credit and offer fixed rates. Their rates typically start around 8.99% APR.

Product Spotlight Best Debt Consolidation Loans for Good Credit

If your credit score is in the 'good' range (670-739 FICO), you still have fantastic options:

- Discover Personal Loan: Discover offers personal loans specifically for debt consolidation with fixed rates and no origination fees. Their rates are competitive, often starting around 10.99% APR for good credit.

- Payoff Personal Loan (by Happy Money): Payoff specializes in consolidating credit card debt. They focus on helping people eliminate high-interest credit card balances and often offer rates starting around 11.99% APR for good credit.

Even if your credit isn't perfect, debt consolidation can still be a viable option. There are lenders who specialize in working with fair or even bad credit, though the interest rates will naturally be higher. The key is to find a loan that still offers a lower overall APR than your current debts.

Myth 2 Debt Consolidation Will Ruin Your Credit Score

This myth often stems from a misunderstanding of how credit scores work and the difference between debt consolidation and other debt relief options like debt settlement or bankruptcy. When done correctly, debt consolidation can actually improve your credit score over time.

How Debt Consolidation Can Positively Impact Your Credit

- Lower Credit Utilization: When you pay off high-balance credit cards with a consolidation loan, your credit utilization ratio (the amount of credit you're using compared to your total available credit) drops significantly. This is a major factor in your credit score, and a lower utilization ratio is generally good.

- Improved Payment History: Instead of juggling multiple payments, you now have one predictable monthly payment. Making this payment on time, every time, builds a positive payment history, which is the most important factor in your credit score.

- Diversification of Credit Mix: Replacing revolving credit (credit cards) with installment credit (a personal loan) can sometimes positively impact your credit mix, especially if you previously only had revolving accounts.

Potential Short-Term Credit Score Dips

It's important to acknowledge that there might be a temporary dip in your credit score when you first apply for a debt consolidation loan. This is due to:

- Hard Inquiry: When a lender checks your credit for a loan application, it results in a 'hard inquiry,' which can slightly lower your score for a few months.

- New Account: Opening a new loan account can also cause a temporary dip.

However, these dips are usually minor and short-lived, and the long-term benefits of improved credit utilization and payment history typically outweigh them. The key is to continue making all payments on time after consolidation.

Myth 3 Debt Consolidation is Just Moving Debt Around

While it's true that you're essentially moving debt from multiple accounts to one, the 'just' part of this myth is misleading. Debt consolidation is much more than a simple transfer; it's a strategic financial maneuver designed to improve your debt situation.

The Strategic Advantages of Consolidating Debt

- Lower Interest Rates: This is the primary benefit. By securing a loan with a lower interest rate than your existing debts, you reduce the total amount of money you pay over time. This frees up more of your payment to go towards the principal, helping you get out of debt faster.

- Simplified Payments: Juggling multiple due dates, minimum payments, and interest rates can be stressful and lead to missed payments. With consolidation, you have one payment, one due date, and one interest rate, making debt management much simpler.

- Fixed Repayment Schedule: Most debt consolidation loans are installment loans with a fixed repayment period. This means you know exactly when your debt will be paid off, providing a clear path to becoming debt-free.

- Reduced Stress: The psychological benefit of having a clear plan and a single, manageable payment cannot be overstated. It reduces financial anxiety and allows you to focus on other financial goals.

Example Scenario

Imagine you have three credit cards:

- Card A: $5,000 balance, 22% APR, $150 minimum payment

- Card B: $3,000 balance, 20% APR, $90 minimum payment

- Card C: $2,000 balance, 24% APR, $60 minimum payment

Total debt: $10,000. Total minimum payments: $300.

If you consolidate this into a $10,000 personal loan at 10% APR over 48 months, your new monthly payment might be around $253. Not only is your payment lower, but you're also paying significantly less in interest over the life of the loan, and you have a clear end date for your debt.

Myth 4 Debt Consolidation is a Quick Fix for Financial Problems

While debt consolidation can provide immediate relief by lowering monthly payments and simplifying your finances, it's not a magic wand that makes all your financial problems disappear. It's a tool, and like any tool, its effectiveness depends on how you use it.

The Importance of Addressing Underlying Spending Habits

If you consolidate your debt but don't address the spending habits that led to the debt in the first place, you're likely to find yourself in the same situation, or worse, a few years down the line. Debt consolidation provides a fresh start, but it requires a commitment to financial discipline.

- Budgeting: A crucial step after consolidating debt is to create and stick to a realistic budget. This helps you track your income and expenses, identify areas where you can cut back, and ensure you have enough to cover your consolidated loan payment.

- Emergency Fund: Building an emergency fund is vital. This prevents you from relying on credit cards again when unexpected expenses arise. Aim for at least 3-6 months of living expenses.

- Financial Education: Take the opportunity to educate yourself on personal finance. Understanding concepts like interest, credit, and saving can empower you to make better financial decisions in the future.

Myth 5 All Debt Consolidation Options Are the Same

This couldn't be further from the truth. There are several different methods of debt consolidation, each with its own pros and cons, suitability for different financial situations, and associated costs.

Comparing Different Debt Consolidation Products

- Personal Loans: These are unsecured installment loans. You borrow a lump sum and pay it back over a fixed period with fixed interest rates. They are popular for consolidating credit card debt.

- Balance Transfer Credit Cards: These cards offer a 0% introductory APR for a certain period (e.g., 12-21 months) on transferred balances. This can be a great option if you can pay off the transferred debt before the promotional period ends, but watch out for balance transfer fees (typically 3-5% of the transferred amount) and high regular APRs after the intro period.

- Home Equity Loans (HEL) or Home Equity Lines of Credit (HELOC): If you own a home and have equity, you can use it to secure a loan. These often come with lower interest rates because they are secured by your home. However, the significant risk is that if you default, you could lose your home.

- Debt Management Plans (DMPs): Offered by non-profit credit counseling agencies, DMPs involve the agency negotiating with your creditors for lower interest rates and a single monthly payment. You pay the agency, and they distribute the funds to your creditors. This isn't technically a loan, but it consolidates payments.

Product Comparison Table

| Product Type | Typical APR Range | Fees to Watch For | Pros | Cons | Best Use Case |

|---|---|---|---|---|---|

| Personal Loan | 6% - 36% | Origination fees (0-8%) | Fixed payments, clear end date, unsecured | Rates vary by credit, potential origination fees | Consolidating high-interest credit card debt, multiple small loans |

| Balance Transfer Card | 0% intro (6-21 months), then 15-29% | Balance transfer fees (3-5%) | 0% interest for intro period, can save a lot if paid off quickly | High APR after intro, balance transfer fees, requires discipline | Smaller debts that can be paid off within the intro period |

| Home Equity Loan/HELOC | 4% - 10% | Closing costs (2-5% of loan), annual fees (HELOC) | Lower interest rates, tax-deductible interest (sometimes) | Secured by home (risk of foreclosure), closing costs | Large debts, homeowners with significant equity, disciplined borrowers |

| Debt Management Plan (DMP) | N/A (negotiated rates) | Setup fees, monthly fees ($25-$50) | Lower interest rates, single payment, credit counseling support | Creditors may close accounts, not a loan, fees | Struggling with credit card debt, need structured support |

The 'best' option depends entirely on your individual financial situation, credit score, debt amount, and discipline. It's crucial to research and compare different products and lenders before committing.

Myth 6 Debt Consolidation is a Sign of Financial Failure

This myth carries a heavy emotional weight. Many people feel ashamed or embarrassed to consider debt consolidation, viewing it as an admission of financial failure. This couldn't be further from the truth. In reality, seeking debt consolidation is often a sign of financial maturity and a proactive step towards taking control of your money.

Reframing Your Perspective on Debt Consolidation

- Proactive Problem Solving: Recognizing you have a debt problem and actively seeking a solution is a sign of strength, not weakness. It shows you're committed to improving your financial health.

- Strategic Financial Planning: Smart individuals and businesses use consolidation to optimize their finances, reduce costs, and streamline operations. It's a strategic move, not a desperate one.

- A Fresh Start: Think of debt consolidation as hitting the reset button. It gives you an opportunity to learn from past mistakes, implement better financial habits, and build a stronger financial future.

Many successful people have faced financial challenges and used tools like debt consolidation to get back on track. It's about learning, adapting, and moving forward.

Myth 7 You Can Only Consolidate Credit Card Debt

While credit card debt is a very common target for consolidation due to its high interest rates, it's certainly not the only type of debt you can consolidate. Many other forms of debt can also be rolled into a single, more manageable payment.

Other Debts You Can Consolidate

- Personal Loans: If you have multiple small personal loans with varying interest rates, consolidating them into one new personal loan can simplify payments and potentially lower your overall interest.

- Medical Bills: High medical bills can be a significant burden. A debt consolidation loan can help you pay off these bills and manage them with a single, fixed payment.

- Payday Loans: These loans often come with exorbitant interest rates. Consolidating them into a personal loan with a much lower APR can save you a tremendous amount of money.

- Store Credit Cards: Similar to regular credit cards, store cards often have high interest rates. They are prime candidates for consolidation.

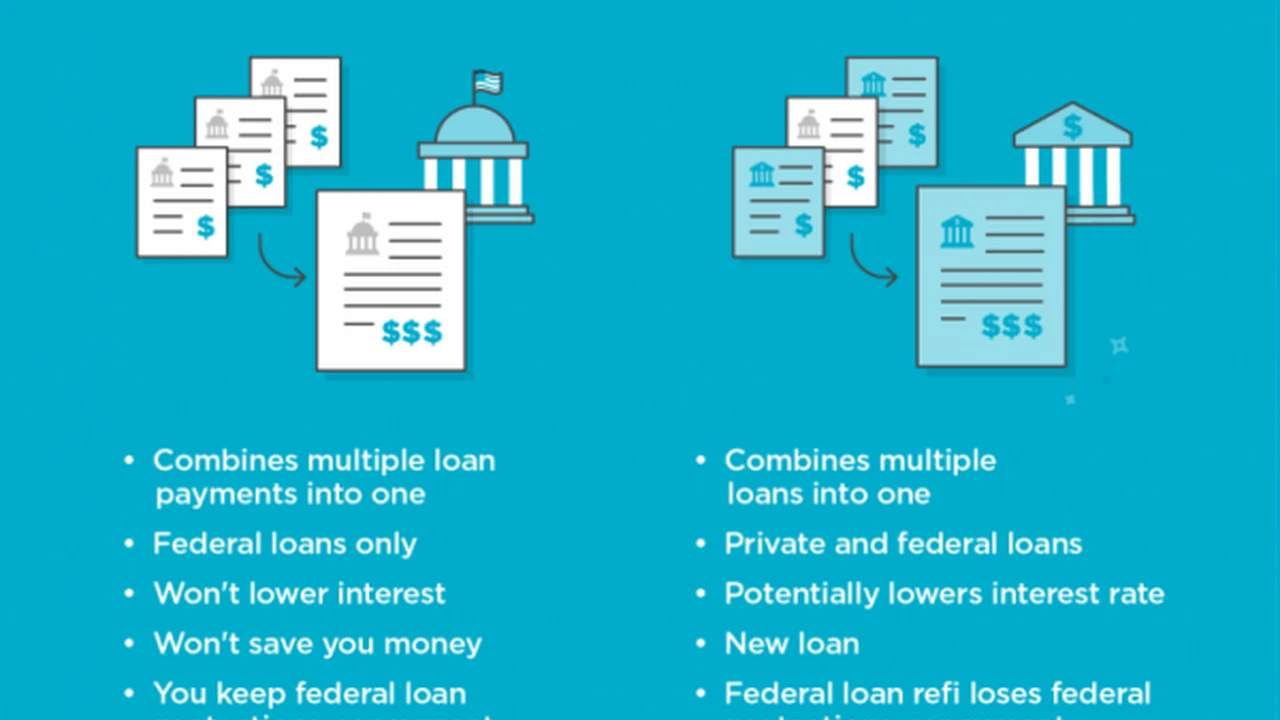

- Student Loans (with caveats): While federal student loans have specific consolidation programs, you can sometimes consolidate private student loans or a mix of federal and private loans with a private debt consolidation loan. However, be cautious, as consolidating federal loans into a private loan means losing federal protections like income-driven repayment plans.

The general rule is that if it's an unsecured debt with a high interest rate, it's likely a good candidate for consolidation via a personal loan or balance transfer. Secured debts like mortgages or auto loans are typically consolidated through refinancing specific to that asset.

Myth 8 Debt Consolidation is Too Complicated to Understand

The idea of financial products can often feel intimidating, leading people to believe they are too complex to grasp. While there are nuances, the core concept of debt consolidation is quite straightforward.

Breaking Down the Simplicity of Debt Consolidation

At its heart, debt consolidation is about taking several debts and combining them into one new debt. The goal is usually to:

- Reduce your interest rate: Pay less money overall.

- Lower your monthly payment: Make debt more affordable.

- Simplify your finances: One payment instead of many.

The 'complication' often comes from choosing the right product and understanding the terms. But with a little research and perhaps some guidance from a financial advisor or credit counselor, it's a very manageable process.

Steps to Simplify Your Debt Consolidation Journey

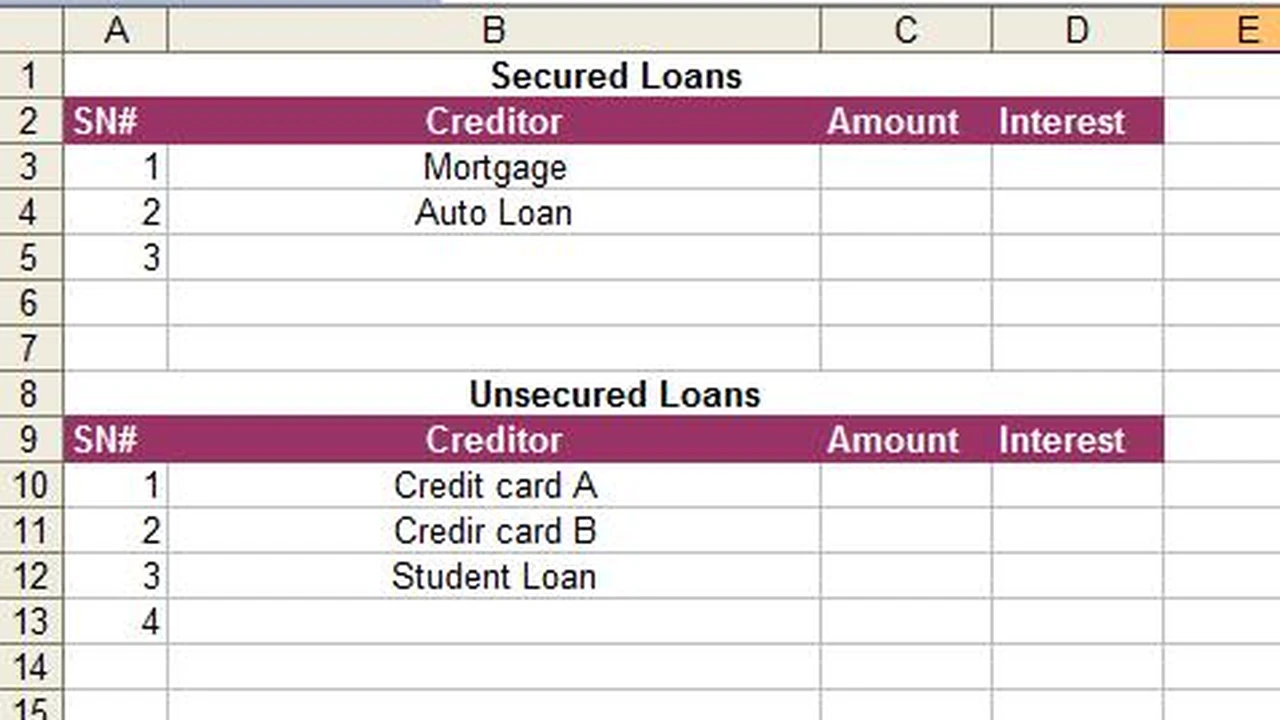

- List All Your Debts: Know exactly what you owe, to whom, the interest rate, and the minimum payment.

- Check Your Credit Score: This will give you an idea of what loan terms you might qualify for.

- Research Options: Look into personal loans, balance transfer cards, and other methods. Compare APRs, fees, and repayment terms.

- Apply for the Best Fit: Choose the option that offers the most savings and fits your financial situation.

- Commit to a Budget: Once consolidated, stick to a budget to ensure you pay off the new loan and avoid new debt.

It's a process, not a puzzle. By taking it step-by-step, you can navigate debt consolidation effectively.

Myth 9 Debt Consolidation is Always the Best Solution

While debt consolidation is a powerful tool, it's not a universal panacea. There are situations where it might not be the best option, or even a viable one.

When Debt Consolidation Might Not Be Right for You

- Very Low Debt Amounts: If you only have a small amount of debt that you can pay off quickly, the fees and application process of consolidation might not be worth it.

- Extremely Poor Credit: If your credit score is very low, you might not qualify for a consolidation loan with a lower interest rate than your current debts. In this case, a debt management plan or even debt settlement might be more appropriate.

- Uncontrolled Spending Habits: If you haven't addressed the root causes of your debt, consolidating might just be a temporary fix before you accumulate more debt.

- High Debt-to-Income Ratio: If your debt is simply too high relative to your income, even a consolidated payment might be unaffordable. In severe cases, bankruptcy might be the only realistic option.

It's crucial to honestly assess your financial situation and consider all alternatives. Sometimes, a combination of strategies, or a different approach entirely, will yield better results.

Myth 10 Debt Consolidation Companies Are All Scams

Unfortunately, the debt relief industry does have its share of unscrupulous actors, which contributes to this myth. However, there are many legitimate and reputable companies and financial institutions that offer valuable debt consolidation services.

How to Identify Legitimate Debt Consolidation Providers

- Check for Accreditation: For credit counseling agencies offering DMPs, look for accreditation from organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Reputable Lenders: For personal loans, stick to well-known banks, credit unions, and established online lenders. Check their reviews on independent sites like the Better Business Bureau (BBB) or Trustpilot.

- Transparent Fees: Legitimate providers will be upfront about all fees (origination fees, balance transfer fees, monthly fees). Be wary of companies that demand large upfront fees or promise unrealistic results.

- No Guarantees: No legitimate company can guarantee that your debts will be consolidated or that your interest rates will be drastically cut without first assessing your situation.

- Avoid High-Pressure Sales: Be cautious of companies that use aggressive sales tactics or pressure you into making quick decisions.

Do your due diligence. Research any company thoroughly before sharing your personal financial information or signing any agreements. A little caution goes a long way in protecting yourself from scams.

By understanding and debunking these common myths, you can approach debt consolidation with a clearer perspective. It's a powerful financial tool that, when used wisely, can significantly improve your financial health and put you on the path to becoming debt-free. Don't let misinformation prevent you from exploring an option that could genuinely help you take control of your finances.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)