Comparing Debt Consolidation Providers Across Southeast Asia

A comparative analysis of debt consolidation service providers in various Southeast Asian countries.

A comparative analysis of debt consolidation service providers in various Southeast Asian countries.

Comparing Debt Consolidation Providers Across Southeast Asia

Understanding Debt Consolidation Southeast Asia Overview

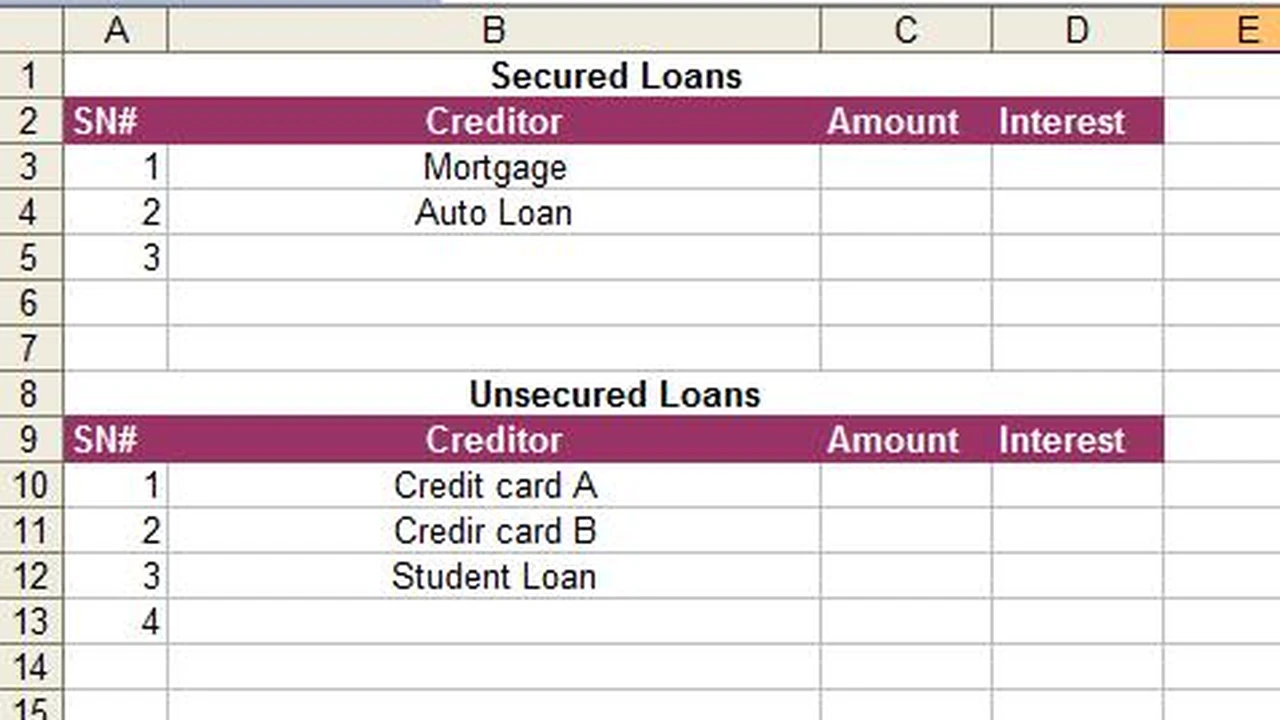

Navigating debt can be a daunting experience, especially when you're juggling multiple loans with varying interest rates and payment schedules. Debt consolidation offers a beacon of hope, simplifying your financial obligations into a single, more manageable payment, often with a lower interest rate. This strategy can free up cash flow, reduce stress, and accelerate your journey to financial freedom. While the core concept remains consistent, the landscape of debt consolidation providers and products varies significantly across Southeast Asia, influenced by local regulations, economic conditions, and banking practices. This comprehensive guide will delve into the specifics, comparing providers in key Southeast Asian markets like Singapore, Malaysia, Thailand, the Philippines, and Indonesia, offering insights into their offerings, typical scenarios, and what to look for.Debt Consolidation in Singapore Top Providers and Products

Singapore, a financial hub, boasts a sophisticated banking sector with numerous options for debt consolidation. The Monetary Authority of Singapore (MAS) regulates these services, ensuring a degree of consumer protection. Typically, debt consolidation in Singapore involves personal loans or balance transfer facilities offered by major banks.Key Providers in Singapore

- DBS Bank: DBS offers a Debt Consolidation Plan (DCP) designed for individuals with unsecured debts exceeding 12 times their monthly income. Their DCP typically features competitive interest rates and a fixed repayment period, simplifying budgeting. For example, a customer with S$50,000 in unsecured debt and a monthly income of S$4,000 might qualify for a DCP with an effective interest rate (EIR) of around 8-10% over a 5-year tenure.

- OCBC Bank: OCBC also provides a Debt Consolidation Plan, often with attractive promotional rates for new customers. They emphasize a streamlined application process and personalized financial advice. Their DCP might offer an EIR from 7.5% to 9.5% depending on the applicant's credit profile and loan amount.

- UOB Bank: UOB's Debt Consolidation Plan focuses on helping individuals regain control of their finances. They often highlight flexible repayment terms and the potential for significant interest savings. UOB's DCP rates are generally competitive, ranging from 8% to 10% EIR.

- Standard Chartered Bank: Standard Chartered offers personal loans that can be used for debt consolidation, often with quick approval times. While not always explicitly branded as a 'DCP,' their personal loan products can serve the same purpose, with interest rates varying based on creditworthiness, typically from 6% to 12% p.a.

Typical Scenarios and Pricing in Singapore

Singaporean providers generally target individuals with a stable income and a reasonable credit history. The effective interest rate (EIR) is a crucial metric to compare, as it includes all charges. For a S$30,000 debt consolidated over 5 years, you might expect monthly payments ranging from S$600 to S$650, depending on the EIR. Eligibility usually requires a minimum annual income (e.g., S$30,000) and a good credit score. Some providers might also offer balance transfer credit cards with 0% interest for an introductory period (e.g., 6-12 months), which can be a short-term consolidation strategy if you can repay the full amount within that period.Debt Consolidation in Malaysia Leading Institutions and Offerings

Malaysia's debt consolidation landscape is robust, with both conventional and Islamic banking options. Bank Negara Malaysia (BNM) oversees the financial sector, ensuring fair practices.Key Providers in Malaysia

- Maybank: As one of Malaysia's largest banks, Maybank offers personal loans that can be utilized for debt consolidation. They have a wide branch network and a strong online presence. Their personal loan interest rates can range from 5% to 10% p.a., depending on the loan amount and tenure.

- CIMB Bank: CIMB provides personal financing solutions suitable for debt consolidation, often with competitive rates and flexible repayment periods. They also offer Islamic personal financing options. Conventional personal loan rates might be around 6% to 9% p.a.

- Public Bank Berhad: Public Bank offers personal loans with varying interest rates based on the applicant's profile. They are known for their customer service and accessibility. Interest rates for personal loans typically fall between 5.5% and 9.5% p.a.

- RHB Bank: RHB offers personal financing products that can be used to consolidate debts. They often have promotions and packages tailored to different income groups. Their personal loan rates are generally in the range of 6% to 10% p.a.

- Bank Rakyat: For those seeking Islamic financing, Bank Rakyat is a prominent choice, offering Shariah-compliant personal financing for debt consolidation. Their profit rates are competitive, often around 4-7% p.a. for eligible civil servants or employees of GLCs.

Typical Scenarios and Pricing in Malaysia

Malaysian banks often cater to a broad spectrum of borrowers. For a consolidated debt of RM30,000 over 5 years, monthly payments could range from RM600 to RM700, depending on the interest rate. Eligibility criteria usually include a minimum income (e.g., RM2,000-RM3,000 per month) and a clean credit record (CTOS/CCRIS). Some banks might also offer specific debt consolidation packages with slightly lower rates than standard personal loans.Debt Consolidation in Thailand Options and Considerations

Thailand's financial market offers debt consolidation primarily through personal loans and specific debt restructuring programs from commercial banks. The Bank of Thailand (BOT) regulates the financial institutions.Key Providers in Thailand

- Kasikornbank (KBank): KBank offers personal loans that can be used for debt consolidation, often with a focus on digital application processes. Their personal loan interest rates can range from 15% to 25% p.a., reflecting the higher interest rate environment for unsecured loans in Thailand.

- Siam Commercial Bank (SCB): SCB provides personal loans and debt consolidation programs. They often have various loan products tailored to different income levels. Personal loan rates are typically between 16% and 28% p.a.

- Bangkok Bank: Bangkok Bank offers personal loans with competitive rates for eligible customers. They have a strong traditional banking presence. Personal loan interest rates are generally in the 15% to 25% p.a. range.

- Krungsri (Bank of Ayudhya): Krungsri offers personal loans and debt consolidation solutions, sometimes with promotional rates. Their personal loan rates are similar to other major banks, from 15% to 28% p.a.

Typical Scenarios and Pricing in Thailand

Due to generally higher interest rates for unsecured loans in Thailand, debt consolidation aims more at simplifying payments and potentially extending repayment periods rather than drastically reducing interest. For a consolidated debt of THB100,000 over 5 years, monthly payments could be around THB2,400 to THB2,800. Eligibility typically requires a minimum monthly income (e.g., THB15,000) and a good credit history with the National Credit Bureau (NCB).Debt Consolidation in the Philippines Providers and Local Nuances

The Philippines has a growing financial sector, with debt consolidation primarily offered through personal loans from banks and some specialized lending institutions. The Bangko Sentral ng Pilipinas (BSP) regulates the financial system.Key Providers in the Philippines

- BDO Unibank: BDO offers personal loans that can be used for debt consolidation, with a wide network of branches. Their personal loan interest rates can range from 1.2% to 1.5% per month (equivalent to 14.4% to 18% p.a. effective interest rate), depending on the loan amount and tenure.

- BPI (Bank of the Philippine Islands): BPI provides personal loans with competitive rates for qualified borrowers. They emphasize convenience and digital banking. Personal loan rates are typically around 1.2% to 1.3% per month.

- Metrobank: Metrobank offers personal loans for various purposes, including debt consolidation. They have a strong presence in the consumer lending market. Personal loan rates are generally in the range of 1.25% to 1.4% per month.

- UnionBank of the Philippines: UnionBank, known for its digital innovation, offers personal loans with a streamlined online application process. Their personal loan rates are competitive, often around 1.2% to 1.5% per month.

Typical Scenarios and Pricing in the Philippines

Debt consolidation in the Philippines focuses on providing a single, more manageable payment. For a consolidated debt of PHP100,000 over 3 years, monthly payments might range from PHP3,500 to PHP3,800. Eligibility usually requires a minimum gross monthly income (e.g., PHP15,000-PHP20,000) and a good credit standing with the Credit Information Corporation (CIC).Debt Consolidation in Indonesia Key Players and Market Dynamics

Indonesia's financial market is diverse, with both conventional and Islamic banks offering personal loans that can be used for debt consolidation. Otoritas Jasa Keuangan (OJK) regulates the financial services sector.Key Providers in Indonesia

- Bank Mandiri: As one of Indonesia's largest state-owned banks, Bank Mandiri offers KTA (Kredit Tanpa Agunan - unsecured personal loans) suitable for debt consolidation. Their KTA interest rates can range from 0.99% to 1.5% per month (equivalent to 11.88% to 18% p.a. effective interest rate), depending on the applicant's profile and loan amount.

- Bank Central Asia (BCA): BCA provides KTA products with competitive rates and a strong focus on customer service. Their KTA rates are typically around 1% to 1.3% per month.

- Bank Rakyat Indonesia (BRI): BRI, with its extensive network, offers KTA for various purposes, including debt consolidation. Their KTA rates are generally in the range of 1% to 1.4% per month.

- CIMB Niaga: CIMB Niaga offers personal loans (KTA) and also has a strong Islamic banking arm (CIMB Niaga Syariah) for Shariah-compliant financing. Conventional KTA rates are similar to other major banks, from 1% to 1.5% per month.

- Danamon: Danamon provides KTA products with varying interest rates based on creditworthiness. Their KTA rates are typically around 1.1% to 1.4% per month.

Typical Scenarios and Pricing in Indonesia

Indonesian debt consolidation aims to simplify payments and potentially reduce overall interest costs. For a consolidated debt of IDR50,000,000 over 3 years, monthly payments could range from IDR1,800,000 to IDR2,000,000. Eligibility usually requires a minimum monthly income (e.g., IDR3,000,000-IDR5,000,000) and a good credit history with SLIK OJK (Sistem Layanan Informasi Keuangan Otoritas Jasa Keuangan).Comparing Debt Consolidation Products Across Southeast Asia Key Differences

While the goal of debt consolidation is universal, the specific products, eligibility, and regulatory environments differ significantly across Southeast Asia.Product Types and Availability

- Personal Loans: This is the most common form of debt consolidation across all five countries. Banks offer unsecured personal loans that borrowers use to pay off existing debts.

- Debt Consolidation Plans (DCPs): Singapore explicitly offers DCPs, which are structured specifically for consolidating unsecured debts, often with more favorable terms than standard personal loans for eligible individuals. Other countries might have similar products but not always branded as 'DCPs.'

- Balance Transfer Credit Cards: Available in Singapore and to a lesser extent in Malaysia, these offer a short-term 0% interest period to transfer high-interest credit card balances. Less common as a primary consolidation tool in Thailand, the Philippines, and Indonesia due to different credit card market dynamics.

- Islamic Financing: Malaysia and Indonesia have strong Islamic banking sectors, offering Shariah-compliant personal financing options for debt consolidation, which adhere to principles like Murabahah or Ijarah.

Interest Rates and Fees

Interest rates vary widely. Singapore and Malaysia generally have lower effective interest rates for debt consolidation compared to Thailand, the Philippines, and Indonesia, reflecting different economic conditions and risk assessments. For instance, a good credit score in Singapore might get you an EIR of 8-10%, while in Thailand, a personal loan for consolidation could be 15-25% p.a. Fees like processing fees, late payment charges, and early settlement penalties are common across all markets, so it's crucial to read the fine print.Eligibility Criteria and Credit Scoring

All countries require a stable income and a good credit history. However, the minimum income requirements and the specifics of credit scoring systems differ:- Singapore: Strong emphasis on credit bureau reports (Credit Bureau Singapore - CBS) and income stability.

- Malaysia: Relies on CTOS and CCRIS reports. Income requirements are generally moderate.

- Thailand: National Credit Bureau (NCB) reports are key. Income requirements can be higher relative to the cost of living.

- Philippines: Credit Information Corporation (CIC) is the primary credit bureau. Income stability is crucial.

- Indonesia: SLIK OJK reports are used. Income requirements vary by bank and loan amount.

Regulatory Environment and Consumer Protection

Each country has its own central bank or financial authority (MAS, BNM, BOT, BSP, OJK) that regulates financial institutions. These bodies aim to protect consumers, but the level of protection and recourse can vary. It's always advisable to deal with licensed and reputable financial institutions.Choosing the Right Debt Consolidation Provider Tips for Southeast Asian Consumers

Making an informed decision is paramount when choosing a debt consolidation provider. Here are some practical tips:Research and Compare Interest Rates and Fees

Don't just look at the advertised interest rate. Ask for the effective interest rate (EIR) or annual percentage rate (APR), which includes all charges. Compare offers from at least 3-5 different banks or financial institutions. For example, if Bank A offers a personal loan at 10% p.a. with a 2% processing fee, and Bank B offers 11% p.a. with no processing fee, Bank B might actually be cheaper depending on the loan amount and tenure.Understand Eligibility Requirements

Before applying, ensure you meet the minimum income, age, and credit score requirements. This saves time and prevents unnecessary credit inquiries that could negatively impact your score. Some providers might have specific requirements for certain professions or employment types.Check Repayment Terms and Flexibility

Look for a repayment period that aligns with your budget. Longer terms mean lower monthly payments but more interest paid overall. Shorter terms mean higher monthly payments but less interest. Some providers offer flexibility in payment dates or allow for early settlement without hefty penalties.Read the Fine Print Loan Agreements and Terms

Always, always read the loan agreement thoroughly. Pay attention to clauses regarding late payment fees, early settlement fees, default interest rates, and any other hidden charges. If something is unclear, ask for clarification from the bank's representative.Consider Customer Service and Support

Good customer service can make a big difference, especially if you encounter issues or have questions during your repayment journey. Check online reviews and ask for recommendations from friends or family.Evaluate Your Credit Score and History

Before applying, obtain a copy of your credit report from your country's credit bureau (e.g., CBS in Singapore, CTOS/CCRIS in Malaysia, NCB in Thailand, CIC in the Philippines, SLIK OJK in Indonesia). A good credit score will significantly improve your chances of approval and help you secure better interest rates. If your score is not ideal, consider steps to improve it before applying.Seek Professional Financial Advice

If you're unsure, consider consulting a financial advisor or a credit counseling agency. They can provide unbiased advice tailored to your specific situation and help you navigate the complexities of debt consolidation.Real-World Examples and Product Recommendations

Let's look at some hypothetical scenarios and specific product recommendations based on typical offerings in each country.Scenario 1 Singapore High-Interest Credit Card Debt

Sarah in Singapore has S$40,000 in credit card debt across three cards, with an average interest rate of 25% p.a. Her monthly minimum payments are S$1,500, but she's barely making a dent in the principal. Recommended Product: DBS Debt Consolidation Plan. Why: DBS DCP is specifically designed for unsecured debts exceeding 12 times monthly income. With a typical EIR of 8-10% over 5 years, Sarah could reduce her monthly payment significantly and save thousands in interest. For S$40,000 over 5 years at 9% EIR, her monthly payment would be approximately S$830, a substantial saving compared to her current S$1,500 minimums. Alternative: OCBC Debt Consolidation Plan, UOB Debt Consolidation Plan. All offer similar benefits and competitive rates.Scenario 2 Malaysia Multiple Personal Loans

Ali in Malaysia has two personal loans and a car loan, totaling RM60,000, with varying interest rates from 7% to 12% p.a. He wants to simplify his payments and potentially lower his overall interest. Recommended Product: Maybank Personal Loan for Debt Consolidation. Why: Maybank, being a large and reputable bank, offers competitive personal loan rates (e.g., 6-8% p.a. for a good credit profile). Consolidating RM60,000 over 7 years at 7% p.a. would result in a monthly payment of approximately RM900, simplifying his finances and potentially reducing his overall interest burden if his existing loans were at higher rates. Alternative: CIMB Personal Financing, Public Bank Personal Loan. For Shariah-compliant options, Bank Rakyat Personal Financing.Scenario 3 Thailand Small Business Owner with Overdue Bills

Chai, a small business owner in Thailand, has accumulated THB150,000 in various overdue supplier bills and a small personal loan, with effective interest rates climbing due to penalties. Recommended Product: Kasikornbank Personal Loan. Why: While Thai personal loan rates are higher, consolidating these high-penalty debts into a single personal loan from KBank (or SCB, Bangkok Bank) can stop the bleeding from escalating penalties and provide a fixed, manageable payment. For THB150,000 over 5 years at 20% p.a., his monthly payment would be around THB4,000. This stabilizes his cash flow and allows him to focus on his business. Alternative: Siam Commercial Bank Personal Loan, Bangkok Bank Personal Loan.Scenario 4 Philippines Family with Multiple Debts

Maria and Juan in the Philippines have accumulated PHP200,000 in credit card debt and a small appliance loan, with high monthly payments and interest rates. Recommended Product: BDO Personal Loan. Why: BDO's personal loan offers competitive monthly add-on rates (e.g., 1.3% per month, equivalent to ~15.6% p.a. effective interest). Consolidating PHP200,000 over 3 years at this rate would result in a monthly payment of approximately PHP7,000, significantly lower than managing multiple high-interest debts separately. Alternative: BPI Personal Loan, Metrobank Personal Loan.Scenario 5 Indonesia Young Professional with Lifestyle Debts

Rina, a young professional in Indonesia, has IDR75,000,000 in various lifestyle debts (travel, gadgets) from different credit cards and online lenders, with high and confusing interest rates. Recommended Product: Bank Mandiri KTA (Kredit Tanpa Agunan). Why: Bank Mandiri's KTA offers competitive monthly interest rates (e.g., 1.1% per month, equivalent to ~13.2% p.a. effective interest). Consolidating IDR75,000,000 over 4 years at this rate would lead to a monthly payment of approximately IDR2,200,000, simplifying her finances and providing a clear path to debt freedom. Alternative: BCA KTA, BRI KTA, CIMB Niaga KTA.The Future of Debt Consolidation in Southeast Asia Digitalization and Fintech

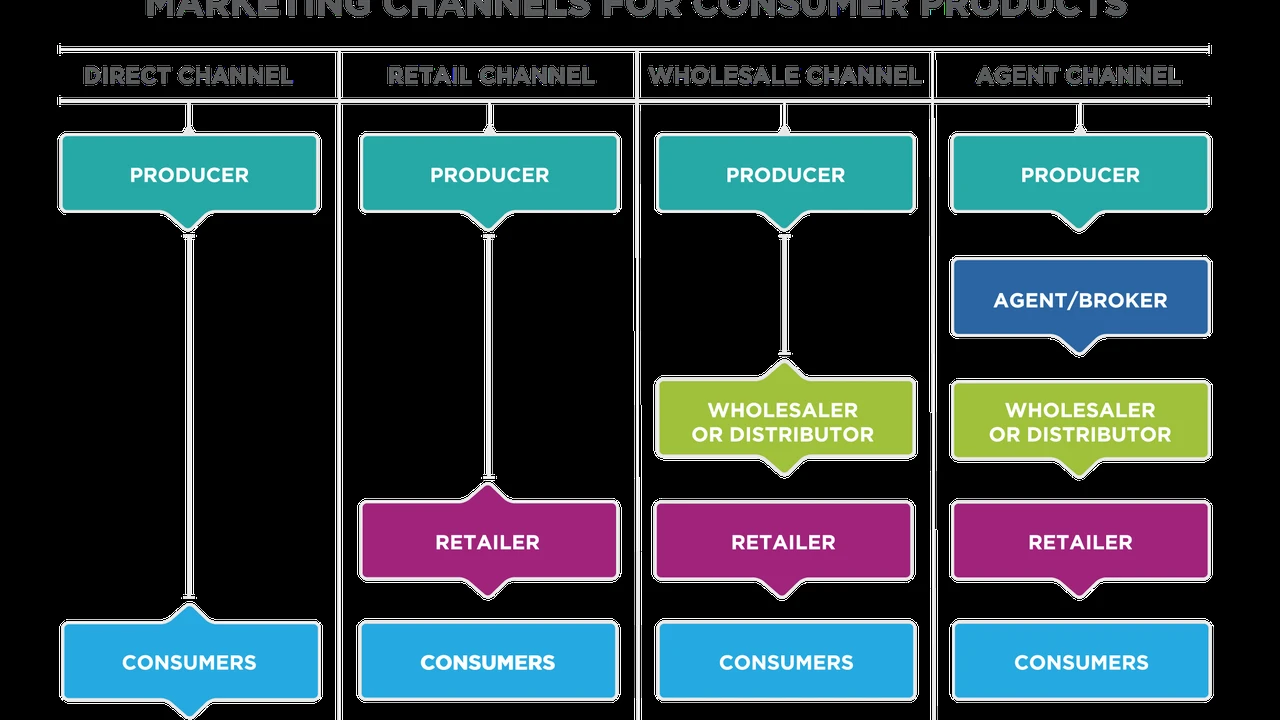

The financial landscape in Southeast Asia is rapidly evolving, with digitalization and fintech playing an increasingly significant role in debt consolidation. Online lenders and peer-to-peer (P2P) platforms are emerging as alternatives to traditional banks, offering faster application processes and sometimes more flexible criteria.Digital Lending Platforms

Platforms like Funding Societies (Singapore, Malaysia, Indonesia), Migo (Philippines), and Julo (Indonesia) are examples of fintech companies offering personal loans that can be used for debt consolidation. These platforms often leverage alternative data for credit scoring, potentially opening up options for individuals who might not qualify for traditional bank loans. However, interest rates on these platforms can sometimes be higher than traditional banks, especially for riskier borrowers.Comparison of Digital vs Traditional

- Speed: Digital platforms often boast quicker approval and disbursement times (sometimes within 24-48 hours) compared to traditional banks.

- Accessibility: Fintech lenders might be more accessible to individuals with limited credit history or those in remote areas.

- Interest Rates: Traditional banks generally offer lower interest rates for well-qualified borrowers. Digital lenders might have higher rates but compensate with speed and flexibility.

- Regulation: While fintech is increasingly regulated, traditional banks often have a longer history of stringent oversight, which can offer a sense of security.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)