Dealing with Unexpected Expenses After Debt Consolidation

Learn how to handle unforeseen financial challenges without jeopardizing your debt consolidation progress.

Dealing with Unexpected Expenses After Debt Consolidation

Understanding the Challenge of Unexpected Costs Post-Consolidation

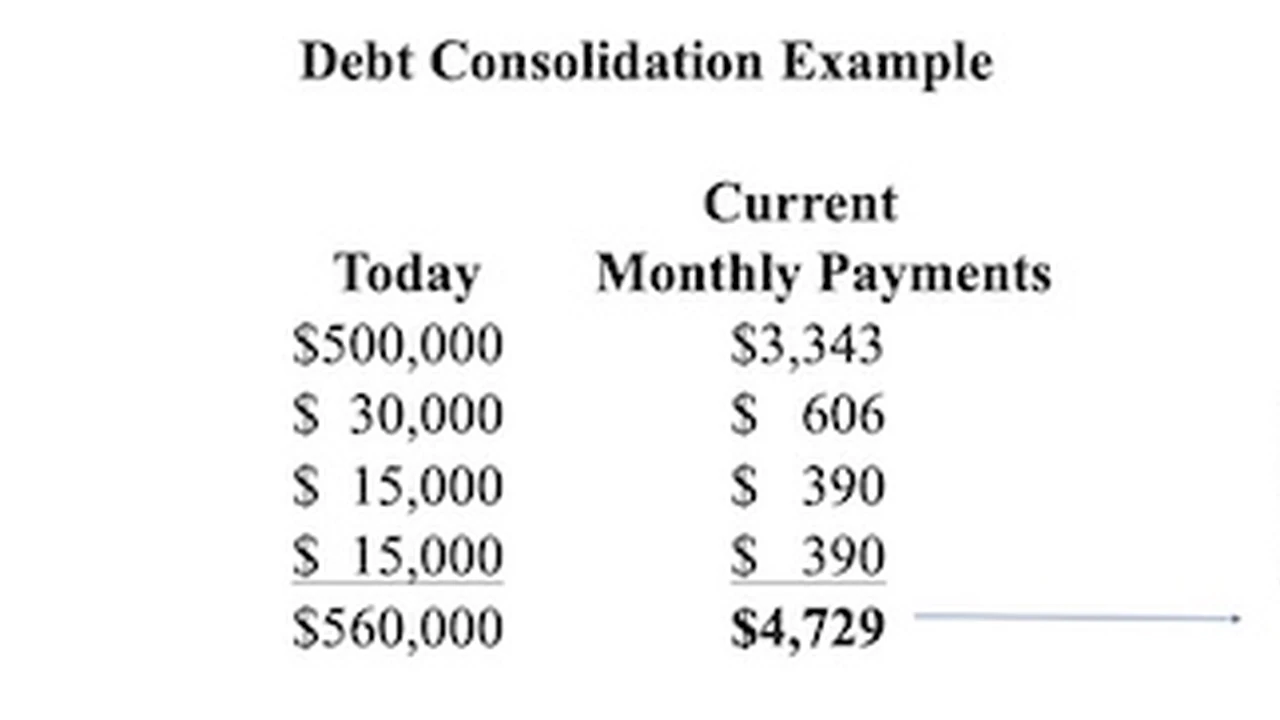

So, you've successfully consolidated your debts. Maybe you took out a personal loan, used a balance transfer card, or opted for a debt management plan. Whatever your strategy, the goal was to simplify, reduce interest, and accelerate your path to debt freedom. This is fantastic! However, the journey isn't over. Unexpected expenses are a fact of life, and they can feel particularly threatening when you're diligently working to pay down consolidated debt. The fear of adding new debt can be paralyzing. But instead of panicking, let's equip you with the knowledge and tools to face these challenges head-on. The key is proactive planning and having a solid strategy in place.Building Your Financial Fortress The Importance of an Emergency Fund

This is probably the most crucial piece of advice: build an emergency fund. Think of it as your financial fortress, protecting your debt consolidation efforts from unexpected attacks. An emergency fund is a stash of cash specifically set aside for unforeseen circumstances – not for a new gadget or a vacation. It's for those 'oh no' moments. Ideally, you want to aim for 3-6 months' worth of essential living expenses. Yes, that sounds like a lot, especially when you're focused on debt repayment. But even starting small makes a huge difference.How to Start and Grow Your Emergency Savings

- Start Small, Start Now: Even $500 or $1,000 can cover many minor emergencies. Don't wait until you have a perfect amount.

- Automate Your Savings: Set up an automatic transfer from your checking to a separate savings account every payday. Treat it like a bill you have to pay.

- Cut Unnecessary Expenses: Temporarily reduce discretionary spending. Every dollar saved is a dollar closer to your emergency fund goal.

- Boost Your Income: Consider a side hustle, selling unused items, or picking up extra shifts to accelerate your savings.

- Keep it Separate: Your emergency fund should be in a separate, easily accessible savings account, ideally one that earns a little interest. Don't link it to your checking account for everyday spending.

Revisiting Your Budget and Finding Flexibility for Unexpected Expenses

Your budget was essential for debt consolidation, and it remains your most powerful tool. After consolidating, it's a great time to revisit and refine it. Look for areas where you can create more wiggle room. This isn't about deprivation, but about smart allocation.Strategies for Budgeting with Unexpected Costs in Mind

- Create a 'Buffer' Category: Allocate a small amount each month to a 'miscellaneous' or 'unexpected' category. If you don't use it, roll it over to your emergency fund.

- Identify Flexible Expenses: What can you temporarily cut back on if an emergency arises? Dining out, entertainment, subscriptions? Knowing these ahead of time reduces stress.

- Track Everything: Continue to meticulously track your spending. This helps you identify leaks and ensures you're sticking to your plan.

- Zero-Based Budgeting: Every dollar has a job. This method ensures no money is left unaccounted for, making it easier to find funds for emergencies.

Smart Borrowing Options When Your Emergency Fund Isn't Enough

Sometimes, an emergency fund isn't fully built, or the expense is simply too large for it to cover. In these situations, you might need to borrow. The key is to do so smartly, minimizing interest and avoiding high-cost debt that could undo your consolidation efforts.Comparing Low-Interest Borrowing Solutions for Emergencies

Here are some options, ranked generally from most to least preferable:

-

Personal Loans for Emergency Situations

If you have good credit, a personal loan can be a lifesaver. They typically offer lower interest rates than credit cards and have fixed repayment terms, making them predictable. Many lenders offer quick approval and funding.

- Pros: Lower interest rates, fixed payments, quick access to funds, can be used for almost any purpose.

- Cons: Requires a decent credit score, can add another monthly payment.

- Recommended Products/Providers:

- SoFi Personal Loans: Known for competitive rates for good-credit borrowers, no origination fees, and flexible terms. They offer loans from $5,000 to $100,000.

- LightStream Personal Loans: Offers some of the lowest rates for excellent credit, with a wide range of loan amounts ($5,000 to $100,000) and terms. No fees.

- Marcus by Goldman Sachs Personal Loans: Good for borrowers with solid credit, offering no fees and competitive rates. Loan amounts from $3,500 to $40,000.

- Typical APR Range: 6% - 36% (highly dependent on credit score).

- Use Case: Large, unexpected expenses like major home repairs, significant medical bills, or emergency travel.

-

0% APR Credit Cards for Emergency Purchases

If you can get approved for a new credit card with a 0% introductory APR period (usually 12-21 months), this can be a good option for an emergency you know you can pay off within that promotional period. Be extremely disciplined, as interest rates skyrocket after the intro period.

- Pros: No interest if paid off within the promotional period, quick access to funds.

- Cons: High interest rates after the intro period, temptation to overspend, requires good credit for approval.

- Recommended Products/Providers:

- Chase Freedom Unlimited / Flex: Often offers 0% intro APR on purchases for 15 months.

- Citi Double Cash Card: Offers 0% intro APR on balance transfers (less common for purchases, but check current offers) and 2% cash back on everything.

- Wells Fargo Reflect Card: Known for one of the longest 0% intro APR periods on purchases and balance transfers, up to 21 months.

- Typical APR Range: 0% intro, then 18% - 29% variable.

- Use Case: Medium-sized emergencies that you are confident you can pay off before the 0% APR expires, like a car repair or appliance replacement.

-

HELOC or Home Equity Loan for Homeowners

If you own a home and have equity, a Home Equity Line of Credit (HELOC) or a Home Equity Loan can provide access to funds at relatively low interest rates. However, these use your home as collateral, so there's a risk of foreclosure if you can't repay. Only consider this for very large, critical emergencies.

- Pros: Lower interest rates, larger loan amounts possible, interest may be tax-deductible (consult a tax professional).

- Cons: Your home is collateral, longer application process, closing costs, variable interest rates for HELOCs.

- Recommended Products/Providers: Major banks like Bank of America, Chase, Wells Fargo, and local credit unions often offer competitive HELOCs and home equity loans. Rates and terms vary significantly by lender and location.

- Typical APR Range: 7% - 12% (variable for HELOCs, fixed for home equity loans).

- Use Case: Very large, critical home repairs (e.g., new roof, foundation issues) or other substantial emergencies where other options are insufficient.

-

Borrowing from Retirement Accounts (401k Loan)

Some 401k plans allow you to borrow from your own account. You pay interest back to yourself, and it doesn't affect your credit score. However, if you leave your job, you often have to repay the loan quickly, or it becomes a taxable withdrawal plus a penalty if you're under 59.5.

- Pros: No credit check, interest paid back to yourself, relatively low interest rates.

- Cons: Missed investment growth, potential for taxes and penalties if not repaid, reduces retirement savings.

- Recommended Products/Providers: Check with your 401k plan administrator (e.g., Fidelity, Vanguard, Empower).

- Typical APR Range: Often Prime Rate + 1% (e.g., 9-10% currently).

- Use Case: A last resort for significant emergencies when other options are unavailable, and you are confident in your ability to repay.

Options to Avoid for Emergency Funding

- Payday Loans: These come with exorbitant interest rates (often 400% APR or more) and can trap you in a cycle of debt. Avoid at all costs.

- Car Title Loans: Similar to payday loans, these use your car as collateral and carry extremely high interest rates. You risk losing your vehicle.

- High-Interest Credit Cards (if not 0% APR): If you don't have a 0% intro APR card, using a regular credit card for an emergency will quickly rack up high-interest debt, undermining your consolidation efforts.

Negotiating and Reducing Unexpected Costs

Sometimes, the best way to handle an unexpected expense is to reduce it before it even becomes a bill. Don't be afraid to negotiate!Tips for Lowering Emergency Expenses

- Medical Bills: Always ask for an itemized bill. Check for errors. Negotiate with the hospital or provider for a lower cash price or a payment plan. Many hospitals have financial assistance programs.

- Car Repairs: Get multiple quotes from different mechanics. Ask if they offer discounts or if there are cheaper, reliable aftermarket parts available.

- Home Repairs: Get at least three quotes. Ask about payment plans or if any work can be delayed without causing further damage.

- Insurance: Review your insurance policies regularly. Are you adequately covered? Could a higher deductible save you money on premiums, knowing you have an emergency fund?

Leveraging Your Support System and Community Resources

Don't be too proud to ask for help if you truly need it. Sometimes, a temporary loan from a trusted family member or friend can be a better option than high-interest debt, provided you have a clear repayment plan.Exploring Community and Government Assistance Programs

- Local Charities and Non-Profits: Many organizations offer assistance for utilities, rent, food, or medical expenses.

- Government Programs: Explore state and federal programs for housing assistance, food stamps, or unemployment benefits if your income is affected.

- Payment Plans: Many service providers (utilities, medical offices) are willing to work out a payment plan if you communicate with them proactively.

Maintaining Financial Discipline and Staying on Track

Successfully navigating unexpected expenses after debt consolidation isn't just about having money; it's about maintaining a strong financial mindset. It's about resilience.Strategies for Long-Term Financial Stability

- Regular Financial Check-ins: Make it a habit to review your budget, emergency fund, and debt repayment progress at least monthly.

- Celebrate Small Wins: Acknowledging your progress keeps you motivated. Paid off a small chunk of your consolidated debt? High five!

- Educate Yourself: Continue learning about personal finance. The more you know, the more confident you'll become in managing your money.

- Seek Professional Advice: If you feel overwhelmed, a non-profit credit counselor or financial advisor can offer guidance and support.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)