Debt Consolidation Success Stories Real Life Examples

Read inspiring real-life examples of individuals who successfully used debt consolidation to achieve financial freedom.

Debt Consolidation Success Stories Real Life Examples

Hey there! Are you feeling overwhelmed by debt? You're not alone. Millions of people struggle with multiple debts, high-interest rates, and the stress that comes with it. But here's the good news: debt consolidation can be a game-changer. It's not just a financial strategy; it's a pathway to regaining control and achieving financial freedom. In this article, we're going to dive into some real-life success stories, showing you how ordinary people transformed their financial lives through debt consolidation. We'll also look at some specific products and scenarios that made a difference for them, giving you practical insights you can apply to your own situation.

Understanding Debt Consolidation The Foundation of Success

Before we jump into the inspiring stories, let's quickly recap what debt consolidation is all about. Essentially, it's the process of combining multiple debts—like credit card balances, personal loans, or medical bills—into a single, more manageable payment. This often comes with a lower interest rate, a fixed repayment schedule, and a clear end date. The goal? To simplify your finances, reduce your monthly payments, and save money on interest over time. It’s like taking a tangled mess of yarn and winding it into one neat ball. Simple, right?

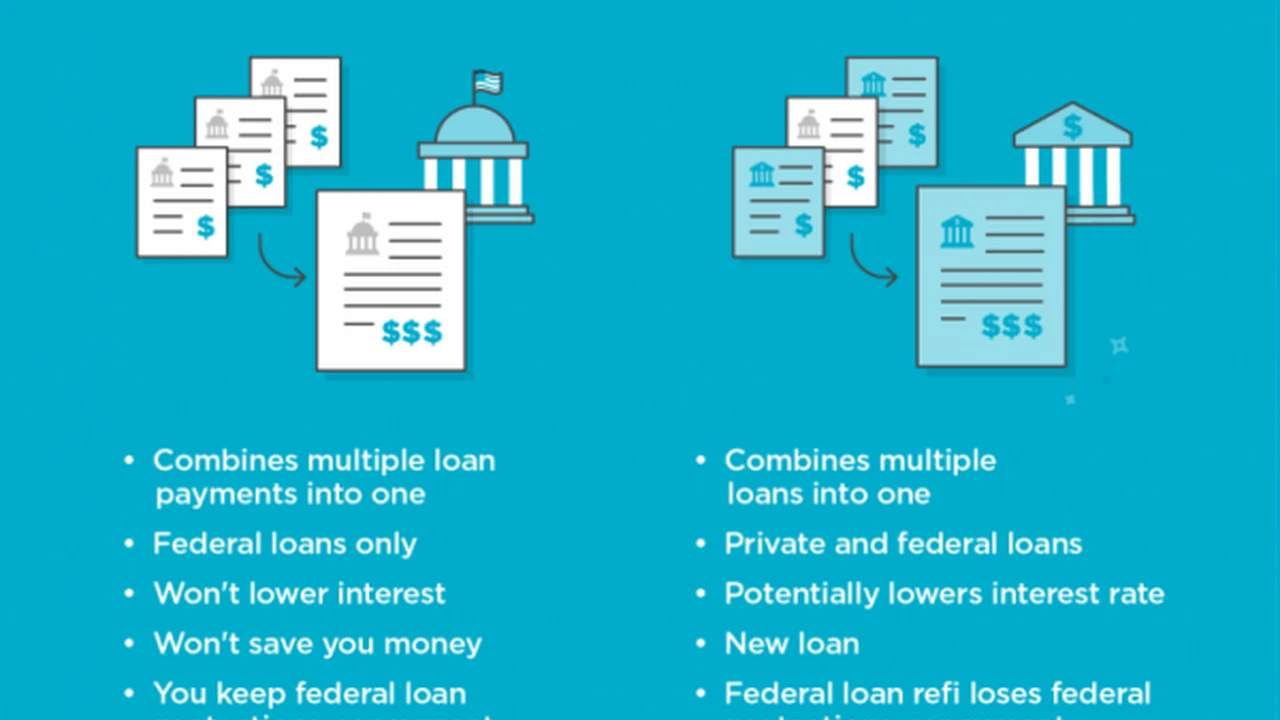

There are several common ways to consolidate debt, and the best option for you depends on your credit score, the amount of debt you have, and your financial goals. The most popular methods include:

- Debt Consolidation Loans: These are personal loans specifically designed to pay off other debts. You get a lump sum, pay off your creditors, and then make one monthly payment to the loan provider.

- Balance Transfer Credit Cards: If you have good credit, you might qualify for a credit card with a 0% introductory APR for a certain period (e.g., 12-18 months). You transfer your high-interest balances to this card and pay it down interest-free during the promotional period.

- Home Equity Loans or HELOCs: If you own a home, you can borrow against your home's equity. These often come with lower interest rates because your home acts as collateral, but they also carry the risk of foreclosure if you can't make payments.

- Debt Management Plans (DMPs): Offered by non-profit credit counseling agencies, DMPs involve the agency negotiating with your creditors for lower interest rates and a single monthly payment. You pay the agency, and they distribute the funds to your creditors.

Each of these methods has its own set of pros and cons, and understanding them is the first step toward choosing the right path for your own success story.

Sarah's Story Conquering Credit Card Chaos with a Personal Loan

Meet Sarah, a 34-year-old marketing professional from Atlanta, Georgia. Sarah loved her credit cards. A little too much, perhaps. Over the years, she accumulated about $25,000 in credit card debt across four different cards, with interest rates ranging from 18% to 24%. Her minimum payments alone were eating up a significant portion of her income, leaving her stressed and feeling like she was constantly treading water.

The Challenge High Interest Rates and Multiple Payments

Sarah's biggest pain points were the high interest rates and the sheer number of payments she had to track each month. She often missed payment due dates, leading to late fees and further damage to her credit score. She knew she needed a change, but didn't know where to start.

The Solution A Debt Consolidation Loan

After researching her options, Sarah decided to apply for a debt consolidation loan. Her credit score was decent, around 680, which allowed her to qualify for a competitive rate. She applied through LightStream, a popular online lender known for its competitive rates for borrowers with good credit. LightStream offered her a 5-year personal loan for $25,000 at an interest rate of 9.99% APR. This was a huge drop from her credit card rates!

Product Spotlight LightStream Personal Loans

- Key Features: Unsecured personal loans, competitive fixed rates, no fees, flexible loan terms (2-7 years).

- Use Case: Ideal for borrowers with good to excellent credit (typically 660+ FICO) looking to consolidate high-interest credit card debt or other personal loans.

- Pros: No origination fees, no prepayment penalties, quick funding, rate beat program.

- Cons: Strict credit requirements, not suitable for those with poor credit.

- Typical Rates: As low as 6.99% APR for excellent credit, up to 20.49% APR for lower credit scores.

- Scenario: Sarah used LightStream to consolidate $25,000 in credit card debt. Her previous average monthly payment was around $800, with most of it going to interest. With the LightStream loan, her new monthly payment was approximately $530, saving her nearly $270 per month and significantly reducing the total interest paid over the life of the loan.

The Outcome Financial Freedom and Peace of Mind

With the LightStream loan, Sarah paid off all her credit cards. Her monthly payment dropped significantly, and she had a clear repayment schedule. The single, lower payment made budgeting much easier, and she no longer worried about juggling multiple due dates. Within five years, Sarah was completely debt-free, a feat she thought was impossible just a few years prior. She even started an emergency fund with the money she saved each month.

David's Journey From Student Loans to a Single Payment with a HELOC

David, a 45-year-old architect from Seattle, Washington, found himself burdened by a different kind of debt: student loans. He had accumulated over $70,000 in student loan debt from his undergraduate and graduate degrees, with varying interest rates and servicers. On top of that, he had a small car loan and some lingering medical bills. While his student loan rates weren't as high as Sarah's credit cards, the sheer volume of debt and the multiple payments were a constant source of stress.

The Challenge Juggling Multiple Loan Types and Payments

David's main issue was the complexity of his debt. He had federal student loans, private student loans, a car loan, and medical bills. Each had different payment dates, interest rates, and terms. He owned a home with significant equity, and he wondered if he could leverage that to simplify his financial life.

The Solution A Home Equity Line of Credit (HELOC)

After consulting with a financial advisor, David decided to use a Home Equity Line of Credit (HELOC) to consolidate his debts. His home had appreciated significantly, and he had about $150,000 in available equity. He applied for a HELOC through his local credit union, BECU (Boeing Employees' Credit Union), known for its competitive rates and excellent member service.

Product Spotlight BECU Home Equity Line of Credit (HELOC)

- Key Features: Revolving credit line secured by your home, variable interest rates (often tied to prime rate), interest-only payment options during the draw period, flexible access to funds.

- Use Case: Ideal for homeowners with significant equity looking for lower interest rates than unsecured loans, or those who need flexible access to funds over time. Can be used for debt consolidation, home improvements, or other large expenses.

- Pros: Lower interest rates than personal loans or credit cards, potential tax deductibility of interest (consult a tax advisor), flexible access to funds.

- Cons: Variable interest rates mean payments can increase, your home is collateral (risk of foreclosure), closing costs can apply.

- Typical Rates: Often Prime Rate + a margin, currently around 8.5% - 10% APR, depending on credit and LTV.

- Scenario: David secured a $75,000 HELOC at a variable rate of 8.75% APR. He used this to pay off his $70,000 in student loans, his $3,000 car loan, and $2,000 in medical bills. His previous combined monthly payments were around $1,100. With the HELOC, his initial monthly payment was significantly lower, around $550 (interest-only during the draw period), giving him much-needed breathing room. He then focused on paying down the principal aggressively.

The Outcome Simplified Payments and Reduced Stress

David successfully consolidated all his debts into one manageable HELOC payment. The lower interest rate and simplified payment structure significantly reduced his financial stress. He was able to pay off his HELOC within 10 years, much faster than he would have paid off his individual student loans. He also learned the importance of understanding different debt types and how to leverage assets responsibly.

Maria's Turnaround Using a Balance Transfer Card for Quick Wins

Maria, a 28-year-old graphic designer in Singapore, had a different kind of debt problem. She had about $10,000 in credit card debt spread across two cards, both with high interest rates (around 25% APR). Her credit score was excellent, thanks to a history of on-time payments, but she was struggling to make a dent in the principal due to the exorbitant interest charges.

The Challenge High Interest on Manageable Debt

Maria's debt wasn't massive, but the high interest rates meant she was paying a lot for the privilege of carrying a balance. She wanted to pay off her debt quickly without incurring more interest.

The Solution A Balance Transfer Credit Card

Given her excellent credit score, Maria was a perfect candidate for a balance transfer credit card. She applied for the UOB One Card, which at the time offered a 0% introductory APR for 6 months on balance transfers in Singapore.

Product Spotlight UOB One Card (Singapore)

- Key Features: Cashback rewards, often includes promotional 0% APR balance transfer offers, widely accepted in Singapore and internationally.

- Use Case: Excellent for individuals with good credit looking to consolidate credit card debt and pay it off interest-free during a promotional period. Also good for everyday spending with cashback benefits.

- Pros: 0% APR introductory period can save a lot on interest, cashback rewards, widely available.

- Cons: Balance transfer fees (typically 3-5%), high APR after the promotional period, requires discipline to pay off debt before the intro period ends.

- Typical Rates: 0% APR for 6-12 months on balance transfers, then standard purchase APR (e.g., 26.9% p.a. in Singapore).

- Scenario: Maria transferred her $10,000 credit card debt to the UOB One Card. She paid a 3% balance transfer fee ($300), but this was a small price to pay for 6 months of interest-free payments. She committed to paying $1,667 per month to pay off the entire balance before the 0% APR period ended. This saved her thousands in interest she would have paid on her old cards.

The Outcome Debt-Free in Six Months

Maria's disciplined approach paid off. By making aggressive payments during the 0% APR period, she was completely debt-free in just six months. This strategy worked perfectly for her because she had a manageable amount of debt and the discipline to pay it off quickly. She learned the power of leveraging promotional offers and the importance of a solid repayment plan.

The Johnson Family's Fresh Start with a Debt Management Plan

The Johnson family, a couple with two young children in Kuala Lumpur, Malaysia, faced a more complex debt situation. They had accumulated about RM 50,000 (approximately $11,000 USD) in various unsecured debts, including credit cards, a personal loan, and some outstanding utility bills. Their credit scores were fair, but not good enough for a low-interest consolidation loan, and they felt overwhelmed by the sheer number of creditors calling them.

The Challenge Multiple Creditors and Strained Budget

The Johnsons were struggling to keep up with minimum payments, and their budget was stretched thin. They needed a solution that would not only consolidate their debts but also potentially lower their interest rates and stop the harassing calls from creditors.

The Solution A Debt Management Plan (DMP)

They reached out to AKPK (Agensi Kaunseling dan Pengurusan Kredit), Malaysia's Credit Counselling and Debt Management Agency. AKPK is a non-profit organization established by Bank Negara Malaysia (the central bank) to help individuals manage their finances and debt. After a thorough assessment, AKPK recommended a Debt Management Plan (DMP).

Product Spotlight AKPK Debt Management Program (Malaysia)

- Key Features: Non-profit credit counseling, negotiation with creditors for lower interest rates and extended repayment terms, single monthly payment to AKPK, protection from legal action by creditors.

- Use Case: Ideal for individuals in Malaysia struggling with unsecured debts who cannot qualify for traditional consolidation loans. It provides structured repayment and protection from creditors.

- Pros: Lower interest rates, single monthly payment, stops creditor harassment, no upfront fees (though some DMPs in other countries might have fees).

- Cons: Can negatively impact credit score (though less severe than bankruptcy), requires strict adherence to the payment plan, not all creditors may agree to participate.

- Typical Rates: AKPK negotiates with creditors to reduce interest rates, often to 0% or very low rates, and extends repayment periods up to 10 years.

- Scenario: AKPK helped the Johnsons consolidate their RM 50,000 debt. They negotiated with the banks to reduce the average interest rate from 15-20% to a flat 5% and extended the repayment period to 7 years. Their previous combined monthly payments were around RM 1,200. Under the DMP, their new single monthly payment was RM 700, freeing up RM 500 in their budget and providing immense relief.

The Outcome A Structured Path to Debt Freedom

The DMP provided the Johnsons with a structured and affordable path out of debt. The reduced interest rates and single payment made their debt manageable, and the protection from creditor calls brought much-needed peace. They diligently followed their plan, and within seven years, they were debt-free, having learned invaluable lessons about budgeting and financial planning. This story highlights the importance of seeking help from non-profit organizations when traditional options aren't viable.

Tips for Your Own Debt Consolidation Success Story

These stories aren't just anecdotes; they're blueprints for how you can tackle your own debt. Here are some key takeaways and tips to help you write your own success story:

Assess Your Situation Honestly Your Starting Point

Before you do anything, take a hard look at your finances. How much debt do you have? What are the interest rates? What's your credit score? Knowing these details will help you determine the best consolidation method for you. Don't shy away from the numbers; they tell your story.

Research Your Options Thoroughly Find the Right Fit

As you've seen, there are different paths to debt consolidation. Don't just jump at the first offer. Compare interest rates, fees, repayment terms, and eligibility requirements. Look at online lenders, traditional banks, credit unions, and even non-profit credit counseling agencies. What works for one person might not work for another.

Create a Realistic Budget Your Roadmap to Repayment

Debt consolidation is only half the battle. The other half is sticking to a budget that allows you to make your new, consolidated payment on time and, ideally, pay down the principal faster. Track your income and expenses, identify areas where you can cut back, and commit to your budget. This is crucial for long-term success.

Stay Disciplined and Focused Your Secret Weapon

Debt repayment is a marathon, not a sprint. There will be times when you feel discouraged, but staying disciplined and focused on your goal of financial freedom is key. Celebrate small victories, remind yourself why you started, and don't be afraid to seek support from friends, family, or financial advisors.

Avoid New Debt Break the Cycle

This might seem obvious, but it's worth repeating: once you've consolidated your debt, avoid taking on new debt, especially high-interest credit card debt. Cut up those old credit cards if you need to, and focus on building healthy financial habits. The goal is to break the cycle of debt, not just rearrange it.

Consider Professional Help When You Need It

If you're feeling overwhelmed or unsure about the best path forward, don't hesitate to seek professional help. A certified credit counselor or financial advisor can provide personalized guidance and help you create a plan that's tailored to your unique situation. Organizations like AKPK in Malaysia or the National Foundation for Credit Counseling (NFCC) in the US are great resources.

Final Thoughts on Your Debt Consolidation Journey

Debt consolidation isn't a magic bullet, but as these real-life examples show, it can be a powerful tool for transforming your financial life. It offers a fresh start, simplifies your payments, and can save you a significant amount of money in interest. Whether you choose a personal loan, a balance transfer card, a HELOC, or a debt management plan, the key is to understand your options, make an informed decision, and commit to a disciplined repayment strategy.

Remember, every journey to financial freedom starts with a single step. These success stories are proof that with the right strategy and determination, you too can conquer your debt and achieve the financial peace of mind you deserve. So, take inspiration from Sarah, David, and Maria, and start writing your own debt consolidation success story today!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)