Debt Consolidation with a Co-signer Boosting Your Approval Chances

Learn how a co-signer can improve your eligibility and terms for a debt consolidation loan and the responsibilities involved.

Debt Consolidation with a Co-signer Boosting Your Approval Chances

Hey there! Are you looking to get your finances in order, maybe by consolidating some pesky debts, but finding it tough to get approved for a good loan on your own? You're not alone. Many people face hurdles when trying to secure a debt consolidation loan, especially if their credit score isn't stellar or their income isn't quite where lenders want it to be. That's where a co-signer can come into play, potentially opening doors to better rates and more favorable terms. But what exactly does it mean to have a co-signer, and what are the ins and outs of this arrangement? Let's dive deep into how a co-signer can be your secret weapon in the world of debt consolidation, and what you both need to consider before taking this step.

Understanding the Co-signer Role in Debt Consolidation Loans

First things first, let's clarify what a co-signer is. A co-signer is essentially someone who agrees to take on legal responsibility for your debt if you're unable to make the payments. Think of them as a financial guarantor. When you apply for a debt consolidation loan with a co-signer, the lender considers both your financial profiles. This means they'll look at your credit history, income, and debt-to-income ratio, as well as your co-signer's. If your co-signer has a strong credit score and a stable financial background, it significantly reduces the risk for the lender. This increased confidence from the lender can translate into a higher chance of approval for you, and often, better interest rates and more flexible repayment terms.

Why would someone agree to be a co-signer? Usually, it's a close family member or friend who trusts you and wants to help you achieve financial stability. They understand that you're trying to improve your situation and are willing to put their financial standing on the line to support you. However, it's crucial for both parties to understand the gravity of this commitment. It's not just a formality; it's a serious financial obligation.

Benefits of Having a Co-signer for Your Debt Consolidation Loan

Improved Approval Odds for Debt Consolidation

This is perhaps the most obvious and immediate benefit. If your credit score is on the lower side, or if you have a limited credit history, lenders might be hesitant to approve you for a significant loan amount or offer you competitive rates. A co-signer with excellent credit can bridge this gap. Their strong credit profile essentially 'backs up' your application, making you a much more attractive borrower to lenders. This is particularly helpful if you've been rejected for debt consolidation loans in the past or have only been offered loans with sky-high interest rates.

Access to Lower Interest Rates and Better Loan Terms

Beyond just getting approved, a co-signer can significantly impact the cost of your debt consolidation. Lenders offer their best interest rates to borrowers they perceive as low risk. If your co-signer has a high credit score, it signals to the lender that the loan is less likely to default. This reduced risk often translates into a lower interest rate for you. Over the life of a loan, even a percentage point or two difference in interest can save you hundreds, if not thousands, of dollars. Lower interest rates mean more of your monthly payment goes towards the principal, helping you pay off your debt faster and more efficiently. You might also qualify for longer repayment periods, which can lower your monthly payments, making the debt more manageable.

Building Your Own Credit History with a Co-signed Loan

This is a fantastic long-term benefit. When you successfully manage a co-signed debt consolidation loan, making all your payments on time, this positive payment history is reported to credit bureaus under both your name and your co-signer's. This means that as you responsibly repay the consolidated debt, your own credit score will gradually improve. This can be a stepping stone to financial independence, allowing you to qualify for future loans or credit cards on your own terms, without needing a co-signer. It's a win-win: you get the immediate benefit of debt consolidation, and the long-term benefit of a stronger credit profile.

Risks and Responsibilities for the Co-signer in Debt Consolidation

Full Legal Responsibility for the Debt

This is the most critical point for any potential co-signer to understand. When you co-sign a loan, you are not just a backup; you are equally responsible for the entire debt. If the primary borrower (you) misses a payment or defaults on the loan, the lender has every right to pursue the co-signer for the full amount due, including any late fees and penalties. This means the co-signer's assets, like their savings or even their home, could be at risk. It's a serious commitment that should not be taken lightly.

Impact on the Co-signer's Credit Score and Future Borrowing

Just as the loan can help your credit score, it can also affect your co-signer's. Every payment, whether on time or late, is reported on both credit reports. If you miss payments, your co-signer's credit score will take a hit, just like yours. Furthermore, the co-signed loan will appear on their credit report as their own debt. This increases their debt-to-income ratio, which could make it harder for them to qualify for other loans or credit in the future, such as a mortgage or a car loan, even if they have excellent credit. They might be denied credit or offered less favorable terms because lenders see them as having more existing debt.

Potential Strain on Relationships Due to Financial Stress

Money matters can be a huge source of stress, and when they involve close relationships, things can get complicated. If you struggle to make payments, or if the co-signer ends up having to step in, it can put a significant strain on your relationship. Resentment, guilt, and frustration can easily arise, potentially damaging even the strongest bonds. Open and honest communication from the very beginning, and throughout the loan term, is absolutely essential to mitigate this risk.

Choosing the Right Co-signer for Your Debt Consolidation Journey

Ideal Co-signer Characteristics for Debt Consolidation Success

So, who makes a good co-signer? Ideally, you're looking for someone with a strong credit history, a high credit score (think 700+), a stable income, and a low debt-to-income ratio. They should also have a clear understanding of the responsibilities involved and be financially secure enough to absorb the payments if, for some unforeseen reason, you can't. Most importantly, it should be someone you trust implicitly and who trusts you just as much. This is often a parent, spouse, or a very close sibling.

Open and Honest Communication is Key for Co-signed Loans

Before anyone agrees to co-sign, have a frank and detailed conversation. Discuss your current financial situation, why you need the co-signer, and your plan for repayment. Be transparent about any potential challenges you foresee. The co-signer needs to understand the risks involved and be comfortable with them. It's also a good idea to discuss what would happen in a worst-case scenario – for example, if you lose your job. Having these difficult conversations upfront can prevent misunderstandings and protect your relationship down the line.

Formalizing the Co-signer Agreement for Debt Consolidation

While the lender's agreement will outline the co-signer's legal obligations, you might consider creating a separate, informal agreement between yourselves. This could detail your repayment plan, what happens if you miss a payment, and how you'll communicate about the loan. While not legally binding in the same way as the lender's contract, it can serve as a clear understanding and commitment between you and your co-signer, reinforcing trust and accountability.

Steps to Take When Applying for a Co-signed Debt Consolidation Loan

Researching Debt Consolidation Lenders and Loan Products

Before you even approach a co-signer, do your homework. Look for lenders that offer debt consolidation loans and are known to work with co-signers. Some lenders are more co-signer-friendly than others. Compare interest rates, fees (like origination fees), repayment terms, and customer reviews. Look for lenders that offer pre-qualification options, which allow you to see potential rates without impacting your credit score. This way, you can present a well-researched plan to your potential co-signer.

Here are a few types of lenders and products to consider, keeping in mind that availability and specific terms can vary widely based on your location (US vs. Southeast Asia) and individual financial profiles:

- Online Lenders: Companies like LightStream (US), SoFi (US), and Marcus by Goldman Sachs (US) are popular for personal loans that can be used for debt consolidation. They often have competitive rates for borrowers with good credit and may allow co-signers. In Southeast Asia, digital lending platforms are emerging, but specific co-signer options might be less common or vary by country. For example, in Singapore, banks like DBS or OCBC offer personal loans, and while they might not explicitly advertise co-signer options, a joint application with a strong co-borrower (which functions similarly) is often possible.

- Traditional Banks: Major banks such as Chase, Bank of America, Wells Fargo (US), or Maybank, CIMB (Malaysia), BDO, Metrobank (Philippines) offer personal loans. They might be more amenable to co-signed applications, especially if the co-signer is an existing customer with a good relationship with the bank.

- Credit Unions: Often known for more personalized service and potentially lower rates, credit unions like Navy Federal Credit Union (US, for military members and their families) or local credit unions in your area can be excellent options. They are generally more flexible and might be more willing to work with co-signed applications.

Gathering Necessary Documentation for Debt Consolidation

Once you've identified potential lenders, you'll need to gather all the required documents. This typically includes proof of income (pay stubs, tax returns), identification (driver's license, passport), bank statements, and details of the debts you wish to consolidate (account numbers, balances, interest rates). Your co-signer will also need to provide similar documentation to verify their financial standing. Having everything organized and ready will streamline the application process.

Submitting the Joint Application for Debt Consolidation

With all your documents in hand and your co-signer on board, you'll submit the loan application. Be prepared to answer questions about your financial history and your repayment plan. The lender will perform a hard credit inquiry on both you and your co-signer, which will temporarily ding both credit scores. This is normal, but it's another reason why careful research and choosing the right lender are important – you don't want multiple hard inquiries if you can avoid it.

Managing Your Co-signed Debt Consolidation Loan Responsibly

Setting Up Automatic Payments for Your Consolidated Debt

Once approved, the absolute best way to manage a co-signed loan is to set up automatic payments. This ensures that payments are never missed, protecting both your credit score and your co-signer's. It also removes the mental burden of remembering due dates. Most lenders offer this option, and some even provide a small interest rate discount for enrolling in autopay.

Maintaining Open Communication with Your Co-signer

Even after the loan is secured, keep the lines of communication open with your co-signer. Provide them with updates on your repayment progress. If you anticipate any difficulty in making a payment, inform them immediately. This transparency builds trust and allows you both to address potential issues proactively, rather than letting them escalate.

Monitoring Your Credit Report and the Loan Status

Regularly check your credit report (and encourage your co-signer to check theirs) to ensure that payments are being reported correctly. You can get free copies of your credit report annually from AnnualCreditReport.com. Also, keep an eye on the loan's status through the lender's online portal. This vigilance helps you catch any discrepancies early and ensures that your efforts to improve your credit are accurately reflected.

When a Co-signer Might Not Be the Best Option for Debt Consolidation

If Your Co-signer is Reluctant or Unsure

If your potential co-signer expresses any hesitation or discomfort, it's a red flag. Pushing someone into such a significant financial commitment can lead to resentment and relationship damage. It's better to explore other options than to jeopardize a valuable relationship. Remember, a co-signer should be a willing and informed participant.

If You Have a History of Financial Irresponsibility

If you have a pattern of not managing your finances well, or if you've defaulted on loans in the past, a co-signed loan might not be the solution. While it might get you approved, the underlying issues that led to your debt could resurface, putting your co-signer at risk. In such cases, focusing on credit counseling, budgeting, and developing better financial habits might be a more sustainable first step before taking on new debt, even consolidated debt.

Exploring Alternatives to Co-signed Debt Consolidation Loans

If a co-signer isn't an option, or if you decide it's not the right path for you, don't despair! There are other avenues to explore for debt consolidation and relief:

- Secured Personal Loans: If you have an asset like a car or savings account, you might qualify for a secured personal loan. These loans use your asset as collateral, reducing the risk for the lender and potentially offering better rates, even with less-than-perfect credit.

- Debt Management Plans (DMPs): Offered by non-profit credit counseling agencies, DMPs involve the agency negotiating with your creditors to lower interest rates and combine your payments into one monthly sum. You pay the agency, and they distribute the funds to your creditors. This doesn't require a co-signer and can be a good option if you're struggling with high-interest credit card debt.

- Balance Transfer Credit Cards: If you have good enough credit to qualify, a balance transfer card with a 0% introductory APR can allow you to move high-interest credit card debt to a new card and pay it off interest-free for a period (usually 12-18 months). Be mindful of balance transfer fees and ensure you can pay off the balance before the promotional period ends.

- Home Equity Loan or HELOC: If you're a homeowner with significant equity, you could use a home equity loan or a Home Equity Line of Credit (HELOC) to consolidate debt. These typically offer lower interest rates because your home serves as collateral. However, this also means your home is at risk if you default, so proceed with caution.

- Negotiating with Creditors: Sometimes, simply calling your creditors and explaining your situation can lead to reduced interest rates or a more manageable payment plan. It's worth a try!

Real-World Examples of Co-signed Debt Consolidation Success

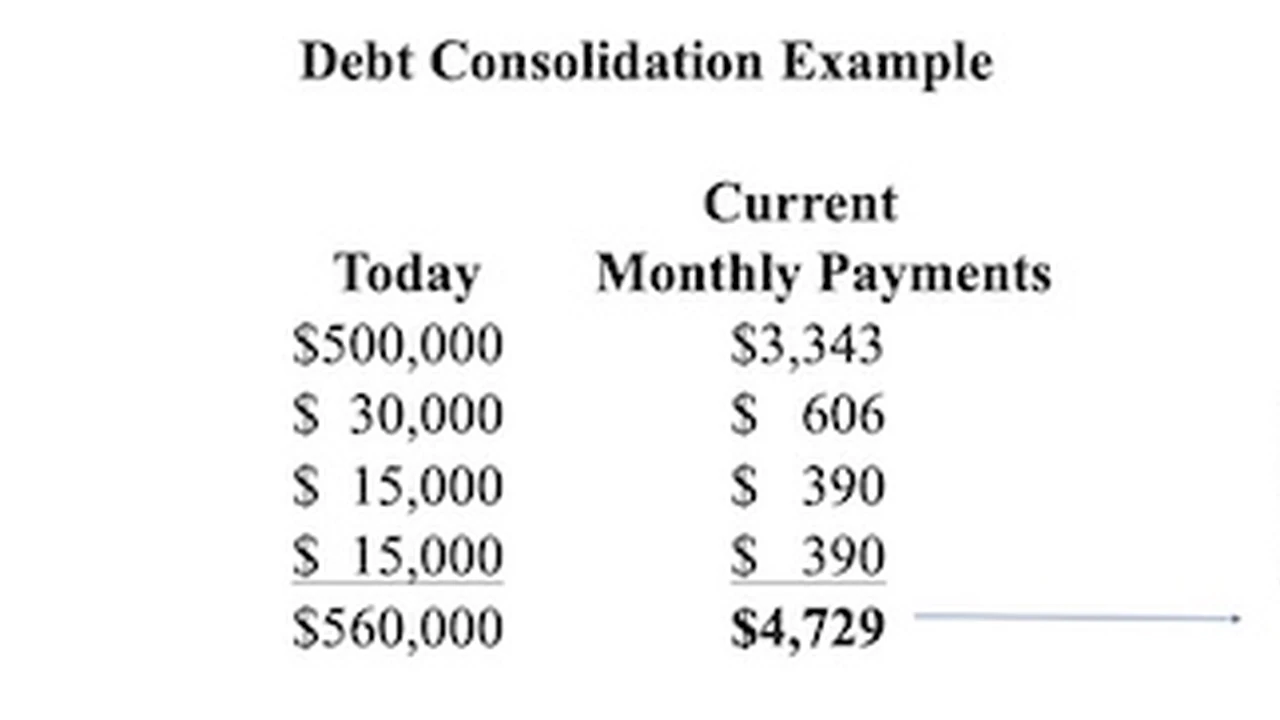

Let's look at a couple of hypothetical scenarios to illustrate how co-signing can work in practice:

Case Study 1: Sarah's Credit Card Debt in the US

Sarah, a recent college graduate in the US, had accumulated $15,000 in credit card debt across three different cards, with interest rates ranging from 18% to 24%. Her credit score was around 620, making it difficult to qualify for a low-interest personal loan on her own. Her father, John, who had an excellent credit score of 780 and a stable income, agreed to co-sign a debt consolidation loan for her. They applied to LightStream, an online lender known for competitive rates. With John as a co-signer, Sarah was approved for a $15,000 personal loan at an interest rate of 8.99% over a 5-year term. Her monthly payments dropped significantly, and she saved thousands in interest. John monitored the payments but never had to step in, and Sarah's credit score steadily improved as she made her payments on time.

Case Study 2: Mark's Multiple Loans in Singapore

Mark, working in Singapore, had several small personal loans and a few credit card balances totaling S$20,000. His credit utilization was high, and his credit score was average. He wanted to simplify his payments and reduce his overall interest. His older sister, Emily, who had a strong financial history and a good relationship with DBS Bank, agreed to be a co-borrower (which functions similarly to a co-signer in many Singaporean bank contexts) on a new personal loan. With Emily's stronger financial profile, DBS approved them for a S$20,000 loan at a much lower effective interest rate than Mark was paying on his individual debts. This allowed Mark to consolidate his debts into one manageable payment, and Emily felt secure knowing Mark was committed to improving his financial health.

Final Thoughts on Co-signing for Debt Consolidation

Using a co-signer for a debt consolidation loan can be a powerful tool to help you achieve financial stability, especially if you're facing challenges with your credit or income. It can unlock better interest rates, improve your approval odds, and even help you build your own credit history. However, it's a decision that carries significant weight and responsibility for both parties. Open communication, a clear understanding of the risks, and a commitment to responsible repayment are paramount to making this arrangement a success and preserving your valuable relationships. Always consider all your options and choose the path that best suits your unique financial situation and goals.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)