Government Initiatives Supporting Debt Consolidation in Southeast Asia

Review government programs and initiatives aimed at assisting citizens with debt consolidation in Southeast Asia.

Government Initiatives Supporting Debt Consolidation in Southeast Asia

Understanding Government Support for Debt Relief Programs

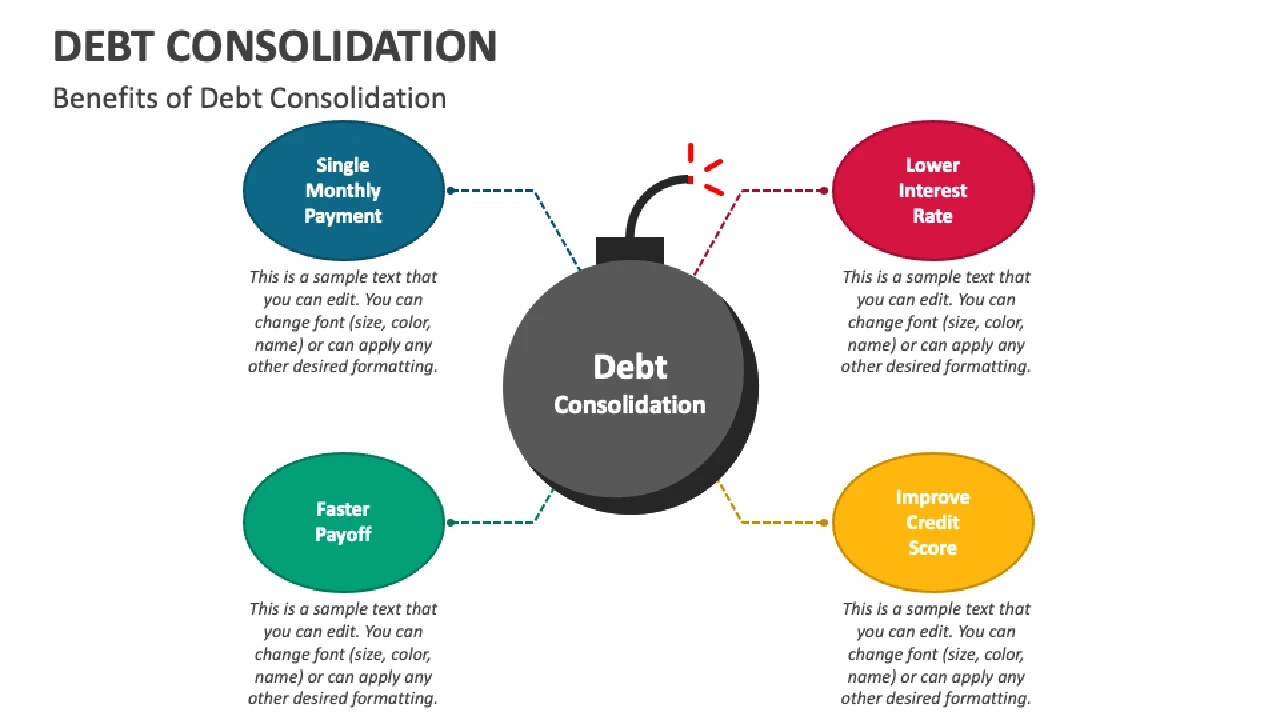

Debt can be a heavy burden, not just for individuals but for entire economies. In Southeast Asia, a region characterized by dynamic growth but also varying levels of financial literacy and access to credit, governments are increasingly recognizing the need to support their citizens in managing and consolidating debt. These initiatives aren't just about helping individuals; they're about fostering financial stability, promoting economic growth, and preventing widespread financial distress. From direct financial aid to regulatory frameworks and educational programs, governments across the ASEAN bloc are stepping up to offer a lifeline to those struggling with multiple debts.

The approaches vary significantly from country to country, reflecting different economic structures, cultural norms, and levels of financial development. However, the common thread is a commitment to improving the financial well-being of their populations. This article will delve into some of these key government initiatives, highlighting specific programs, their target audiences, and how they aim to make debt consolidation more accessible and effective for citizens in Southeast Asia.

Singapore Government Initiatives for Debt Management and Consolidation

Singapore, known for its robust financial sector and high standard of living, also faces challenges with consumer debt. The government, through various agencies, has implemented several programs to assist its citizens. One of the most prominent is the Credit Counselling Singapore (CCS). While not a direct government agency, CCS is heavily supported by the Monetary Authority of Singapore (MAS) and other financial institutions. It provides free and confidential credit counseling, helping individuals understand their financial situation and explore options like Debt Management Programs (DMPs) or even bankruptcy if necessary. CCS acts as an intermediary between debtors and creditors, facilitating repayment plans that are manageable for the individual.

Another indirect but significant initiative is the regulatory oversight by MAS, which ensures responsible lending practices and consumer protection. This includes setting limits on unsecured credit and promoting financial literacy. For instance, the Total Debt Servicing Ratio (TDSR) framework, while primarily for property loans, indirectly encourages responsible borrowing across all debt types by limiting how much an individual can borrow based on their income. This proactive approach aims to prevent individuals from accumulating unmanageable debt in the first place.

While Singapore doesn't have a direct government-run debt consolidation loan product, its emphasis on financial education and robust regulatory environment creates a supportive ecosystem for individuals seeking to consolidate debt through commercial banks. Banks like DBS, OCBC, and UOB offer various personal loans and balance transfer options that can be used for debt consolidation, often with competitive rates for eligible borrowers. CCS's role is crucial here, as they can guide individuals towards the most suitable commercial products and help them negotiate with banks.

Malaysia Government Programs for Debt Restructuring and Consolidation

In Malaysia, the government has been proactive in addressing household debt, which has historically been a concern. Agensi Kaunseling dan Pengurusan Kredit (AKPK), established by Bank Negara Malaysia (BNM), is the cornerstone of Malaysia's government-backed debt management efforts. AKPK offers free financial education, credit counseling, and a Debt Management Program (DMP). Similar to CCS in Singapore, AKPK's DMP helps individuals restructure their unsecured debts with participating financial institutions into a single, more manageable monthly payment, often with reduced interest rates.

AKPK's services are comprehensive. They assess an individual's financial situation, develop a personalized financial plan, and then negotiate with creditors on behalf of the debtor. This can significantly alleviate the stress of dealing with multiple creditors and provide a clear path to becoming debt-free. Eligibility for AKPK's DMP typically requires that the individual's total unsecured debt does not exceed a certain threshold (e.g., RM50,000 for some programs, though this can vary) and that they have a stable income.

Beyond AKPK, the Malaysian government also promotes financial literacy through various campaigns and educational materials, aiming to empower citizens with the knowledge to make informed financial decisions and avoid excessive debt. While direct government-issued debt consolidation loans are rare, the framework provided by AKPK makes commercial debt consolidation products more accessible and effective for those who qualify.

Thailand Government Initiatives for Debt Relief and Financial Rehabilitation

Thailand has also seen its share of household debt challenges, particularly among vulnerable groups. The Bank of Thailand (BOT) plays a crucial role in overseeing financial stability and promoting responsible lending. One notable initiative is the Debt Clinic, a collaborative effort between the BOT, commercial banks, and the Thai Bankers' Association. The Debt Clinic aims to help individuals with multiple unsecured debts (credit cards, personal loans) from different financial institutions consolidate them into a single loan with a lower interest rate and extended repayment period.

The Debt Clinic targets individuals who are struggling to repay their debts but are not yet in severe default. It offers a structured approach to debt resolution, providing financial counseling and facilitating negotiations with creditors. Eligibility criteria typically include having multiple unsecured debts with at least two creditors, a certain level of income, and a commitment to the repayment plan. The goal is to prevent individuals from falling into bankruptcy and to help them regain financial footing.

Furthermore, the Thai government has, at times, introduced specific measures to alleviate debt burdens during economic downturns or crises, such as temporary debt moratoriums or special low-interest loan programs through state-owned banks. These are often ad-hoc responses to specific economic conditions but demonstrate a commitment to supporting citizens through difficult financial periods.

Philippines Government Efforts in Debt Management and Financial Inclusion

The Philippines, with its large and diverse population, faces unique challenges in financial inclusion and debt management. The Bangko Sentral ng Pilipinas (BSP) is at the forefront of promoting financial literacy and consumer protection. While a direct government-run debt consolidation program similar to AKPK or the Debt Clinic is not as prominent, the BSP actively encourages financial institutions to offer responsible credit products and provides guidelines for debt restructuring.

One significant area of government focus is on microfinance and supporting small and medium-sized enterprises (SMEs), which indirectly helps in managing debt by providing access to formal credit and business development. The Department of Trade and Industry (DTI), for example, offers various programs to support entrepreneurs, which can help them manage business-related debt more effectively.

For individual consumers, the emphasis is often on financial education and consumer awareness. The BSP regularly issues advisories and conducts campaigns to educate the public on responsible borrowing, managing credit, and avoiding predatory lending practices. While direct debt consolidation products are primarily offered by commercial banks and lending companies, the regulatory environment aims to ensure these products are fair and transparent. The government also supports various non-profit organizations that provide financial counseling and assistance to indebted individuals.

Indonesia Government Initiatives for Financial Stability and Debt Resolution

Indonesia, as Southeast Asia's largest economy, has a growing middle class but also a significant portion of its population that can be vulnerable to debt. The Otoritas Jasa Keuangan (OJK), Indonesia's financial services authority, plays a key role in regulating financial institutions and protecting consumers. OJK encourages banks and other financial service providers to offer debt restructuring and consolidation options to their customers.

During economic crises or periods of high financial stress, the OJK has often issued regulations or guidelines to facilitate debt restructuring for individuals and businesses. This might include allowing banks to extend loan tenures, reduce interest rates, or offer grace periods. These measures are designed to prevent a wave of defaults and maintain financial system stability.

While there isn't a single, overarching government-run debt consolidation agency, the OJK's regulatory framework supports the development of such services within the commercial banking sector. Banks like Bank Mandiri, BCA, and BRI offer personal loans and balance transfer facilities that can be utilized for debt consolidation. The government's focus is also on improving financial literacy, especially in rural areas, to empower citizens to make better financial decisions and manage their debts proactively.

Vietnam Government Support for Financial Inclusion and Debt Management

Vietnam's rapidly developing economy has led to increased access to credit, but also a rise in consumer debt. The State Bank of Vietnam (SBV) is the central authority responsible for monetary policy and banking supervision. The SBV encourages financial institutions to develop products that cater to the needs of various segments of the population, including those seeking to manage multiple debts.

Similar to other countries in the region, Vietnam's government primarily influences debt consolidation through regulatory frameworks and by promoting financial stability. During the COVID-19 pandemic, for instance, the SBV issued directives to commercial banks to restructure debts for affected customers, including extending repayment periods and reducing interest rates. These measures, while temporary, demonstrate the government's willingness to intervene to prevent widespread financial distress.

Financial literacy programs are also gaining traction in Vietnam, often supported by the government and implemented through educational institutions and non-governmental organizations. The aim is to equip citizens with the knowledge to manage their finances responsibly, including understanding the implications of borrowing and the benefits of debt consolidation. Commercial banks in Vietnam offer personal loans and balance transfer options that can be used for debt consolidation, and the SBV's oversight ensures a degree of consumer protection.

Comparing Government Initiatives and Their Effectiveness

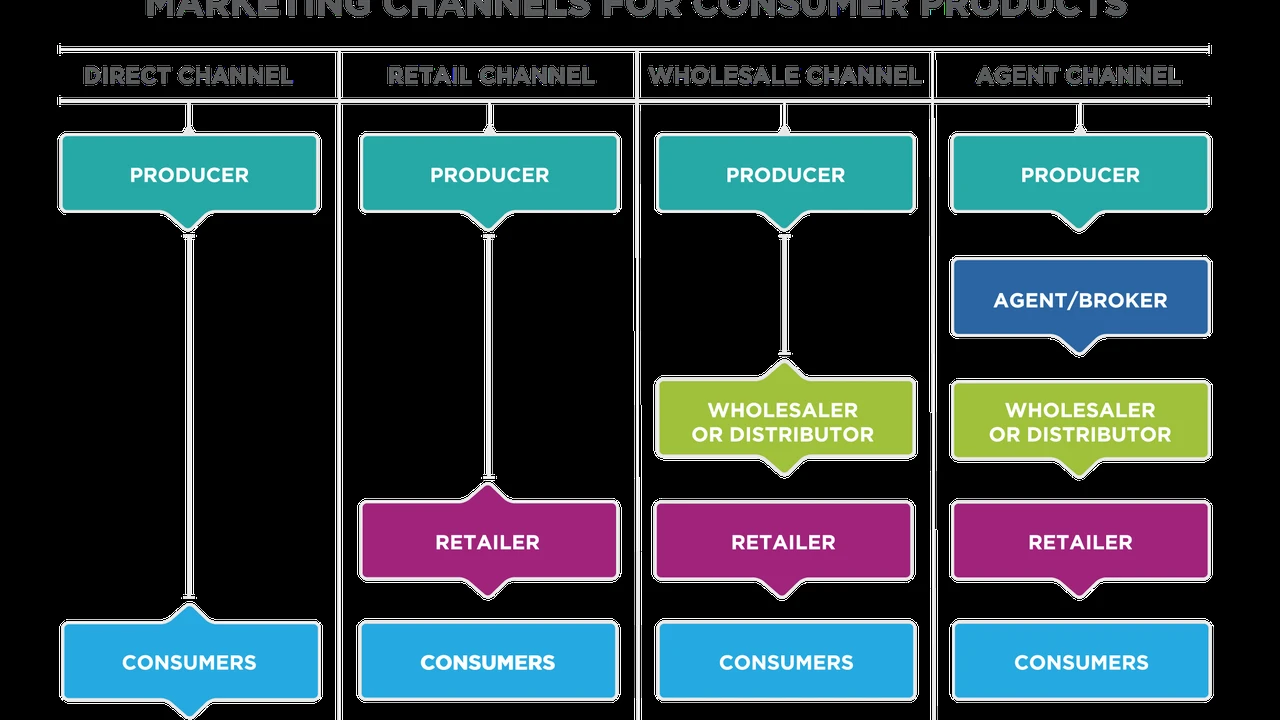

When we look across Southeast Asia, a pattern emerges: governments are actively involved in debt management, but their methods vary. Singapore and Malaysia have established dedicated, government-backed agencies (CCS and AKPK) that provide direct counseling and facilitate DMPs. Thailand has its Debt Clinic, a collaborative effort. The Philippines, Indonesia, and Vietnam tend to rely more on regulatory oversight, financial literacy campaigns, and encouraging commercial banks to offer debt restructuring options.

The effectiveness of these initiatives can be measured by several factors: the number of people they assist, the success rate of their programs, and their impact on overall household debt levels. Agencies like AKPK and CCS have demonstrated significant success in helping thousands of individuals get back on track. Their structured programs, combined with financial education, provide a holistic approach to debt resolution.

However, challenges remain. Awareness of these programs can be low, especially in rural areas. Eligibility criteria can sometimes exclude those most in need. And the sheer volume of individuals struggling with debt often overwhelms the capacity of these agencies. Therefore, continuous government support, expansion of services, and innovative approaches are crucial.

Specific Products and Scenarios for Debt Consolidation in Southeast Asia

While government initiatives provide the framework and support, the actual debt consolidation often happens through commercial products. Here's a look at some common products and scenarios, along with examples and approximate details (note: rates and terms are indicative and subject to change based on market conditions, individual creditworthiness, and specific bank policies):

Personal Loans for Debt Consolidation Across ASEAN

Many commercial banks in Southeast Asia offer personal loans specifically marketed for debt consolidation. These loans typically have fixed interest rates and repayment terms, making it easier to budget. They are unsecured, meaning no collateral is required, but approval and interest rates depend heavily on your credit score and income.

- Product Example: DBS Personal Loan (Singapore)

- Use Case: Consolidating multiple high-interest credit card debts or smaller personal loans into one manageable payment.

- Comparison: Generally offers competitive rates for good credit scores. Repayment terms can range from 1 to 7 years.

- Indicative Rates/Fees: Interest rates can range from 3.88% p.a. (EIR from 7.5% p.a.) for prime customers, up to 15-20% p.a. for others. Processing fees might apply, typically 1-3% of the loan amount.

- Product Example: Maybank Personal Loan (Malaysia)

- Use Case: Similar to DBS, for consolidating various unsecured debts. Maybank is a major player with a wide reach.

- Comparison: Often has a broader range of eligibility, including for those with moderate credit scores, though rates will be higher.

- Indicative Rates/Fees: Rates can start from around 5-6% p.a. for civil servants or those with excellent credit, going up to 10-15% p.a. for others. Processing fees are common.

- Product Example: Bank Mandiri Kredit Tanpa Agunan (KTA) - Unsecured Loan (Indonesia)

- Use Case: For employees of partner companies or those with stable income looking to consolidate credit card debt or other small loans.

- Comparison: Often requires a stable employment history and minimum income.

- Indicative Rates/Fees: Interest rates typically range from 0.65% to 1.5% per month (around 7.8% to 18% p.a.). Administration fees and early repayment penalties may apply.

Balance Transfer Credit Cards for Short-Term Debt Consolidation

Balance transfer credit cards allow you to move existing credit card balances to a new card, often with a 0% or low-interest introductory period. This can be a powerful tool if you can pay off the consolidated debt within that promotional period.

- Product Example: Citibank Balance Transfer (Singapore, Malaysia, Thailand, Philippines)

- Use Case: Consolidating high-interest credit card debt from multiple cards into one, with the goal of paying it off quickly during the promotional period.

- Comparison: Offers a temporary reprieve from high interest. Requires discipline to pay off the balance before the promotional rate expires.

- Indicative Rates/Fees: 0% interest for 6-12 months is common, but a balance transfer fee (typically 1-5% of the transferred amount) usually applies upfront. After the promotional period, the interest rate reverts to the standard credit card rate (e.g., 24-28% p.a.).

Debt Management Programs (DMPs) Facilitated by Government-Backed Agencies

As discussed, agencies like AKPK (Malaysia) and CCS (Singapore) facilitate DMPs, which are not loans but structured repayment plans negotiated with creditors.

- Product Example: AKPK Debt Management Program (Malaysia)

- Use Case: For individuals with multiple unsecured debts (credit cards, personal loans) who are struggling to make payments and need a structured, lower-interest repayment plan.

- Comparison: Not a loan, but a facilitated negotiation. Can significantly reduce interest rates and extend repayment terms. Requires commitment to the plan.

- Indicative Rates/Fees: Services are free. Interest rates on consolidated debts are often reduced to a single-digit percentage (e.g., 5-8% p.a.) as negotiated with creditors.

- Product Example: Credit Counselling Singapore (CCS) Debt Management Program (Singapore)

- Use Case: Similar to AKPK, for individuals facing financial difficulty with unsecured debts.

- Comparison: Provides counseling and negotiation services. Can help avoid bankruptcy.

- Indicative Rates/Fees: Initial consultation is free. A small administrative fee might be charged for ongoing DMP services (e.g., S$30-S$50 per month), but the benefits of reduced interest and simplified payments usually far outweigh this.

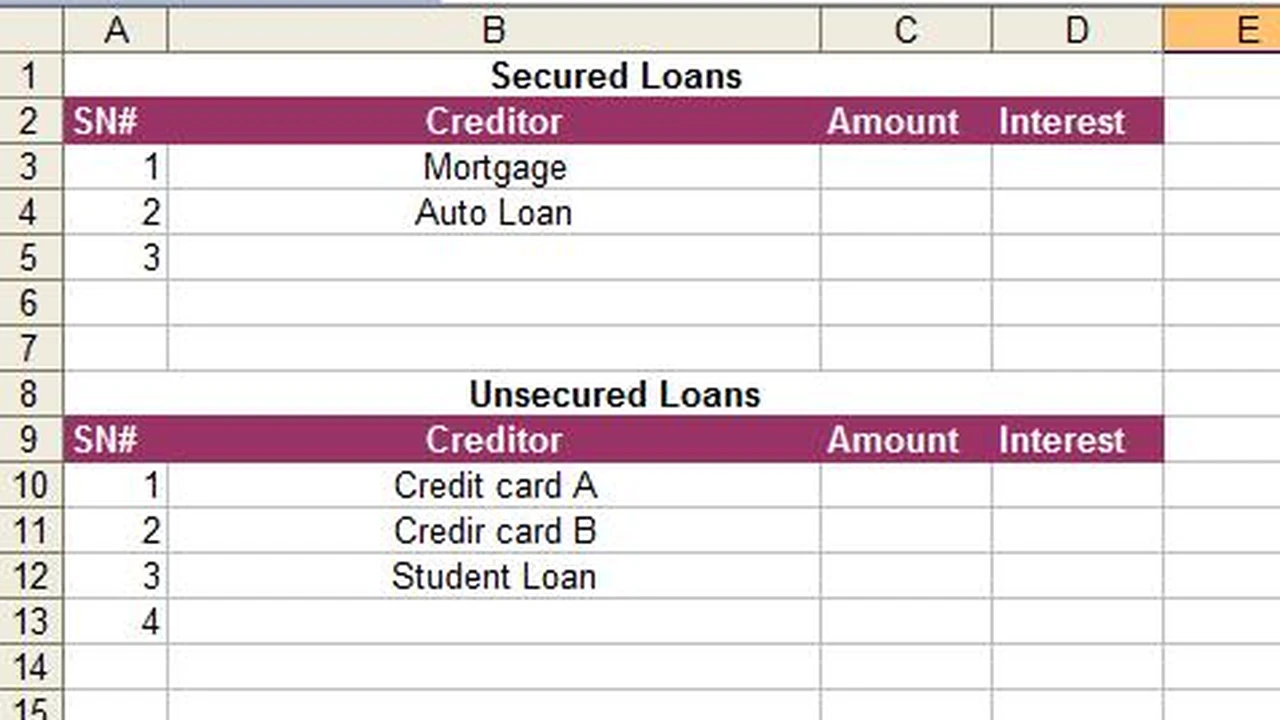

Secured Loans for Debt Consolidation Home Equity Loans

For homeowners, using home equity can be a powerful way to consolidate debt, often at much lower interest rates than unsecured loans. This is available in countries where homeownership is high and property markets are stable.

- Product Example: OCBC Home Equity Loan (Singapore)

- Use Case: Consolidating large amounts of high-interest debt (e.g., multiple personal loans, car loans, credit card debt) using your home as collateral.

- Comparison: Offers significantly lower interest rates and longer repayment terms than unsecured loans. However, it puts your home at risk if you default.

- Indicative Rates/Fees: Interest rates are typically tied to the Singapore Interbank Offered Rate (SIBOR) or the bank's internal board rate, often starting from 2-4% p.a. Processing fees and valuation fees for the property may apply.

- Product Example: Public Bank Home Equity Loan (Malaysia)

- Use Case: Similar to OCBC, for Malaysian homeowners with substantial equity looking to consolidate significant debt.

- Comparison: Lower rates, longer terms, but higher risk.

- Indicative Rates/Fees: Rates often start from Base Lending Rate (BLR) minus a certain percentage, typically resulting in rates around 3-5% p.a. Legal fees, stamp duty, and valuation fees are common.

The Future of Government Support for Debt Consolidation in Southeast Asia

The landscape of debt and financial management in Southeast Asia is constantly evolving. Governments are likely to continue playing a crucial role, adapting their initiatives to new economic realities and technological advancements. We can expect to see:

- Increased Digitalization: More government-backed services and financial literacy programs will likely move online, making them more accessible to a wider population, especially in remote areas.

- Enhanced Data Sharing: Better data sharing between government agencies and financial institutions could lead to more targeted and effective debt relief programs.

- Focus on Prevention: A stronger emphasis on financial education from a young age to prevent debt accumulation in the first place.

- Tailored Programs: More specialized debt consolidation programs for specific demographics, such as small business owners, farmers, or low-income households.

- Regional Cooperation: Greater collaboration among ASEAN nations to share best practices and potentially harmonize some aspects of debt management policies.

Ultimately, the goal of these government initiatives is to create a more financially resilient population and a stable economic environment. By providing support, regulation, and education, governments in Southeast Asia are helping their citizens navigate the complexities of debt and work towards a more secure financial future. It's a continuous journey, but the commitment to supporting citizens in their debt consolidation efforts is clear and growing.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)