The Role of Financial Advisors in Debt Consolidation Planning

Understand how financial advisors can assist in developing a comprehensive debt consolidation plan tailored to your needs.

The Role of Financial Advisors in Debt Consolidation Planning

Hey there! So, you're thinking about debt consolidation, huh? That's a smart move. It can be a real game-changer for your finances, helping you simplify payments, potentially lower interest rates, and get a clearer path to becoming debt-free. But let's be honest, navigating the world of debt consolidation can feel a bit like trying to solve a Rubik's Cube blindfolded. There are so many options: personal loans, balance transfers, debt management plans, home equity loans… it's enough to make your head spin! This is where a financial advisor can become your secret weapon. They're not just for the super-rich; they're for anyone who wants to make smart financial decisions, especially when it comes to something as crucial as debt.

Think of a financial advisor as your personal financial coach. They're there to help you understand your current financial situation, explore all the available debt consolidation avenues, and craft a plan that's perfectly tailored to your unique needs and goals. It's not just about finding the cheapest loan; it's about building a sustainable financial future. Let's dive into how these pros can make a real difference in your debt consolidation journey.

Why Consider a Financial Advisor for Your Debt Consolidation Strategy

You might be wondering, "Can't I just figure this out myself?" And sure, you can try. But a financial advisor brings a level of expertise, objectivity, and strategic thinking that's hard to replicate on your own. Here's why they're worth considering:

Expert Guidance Through Complex Debt Consolidation Options

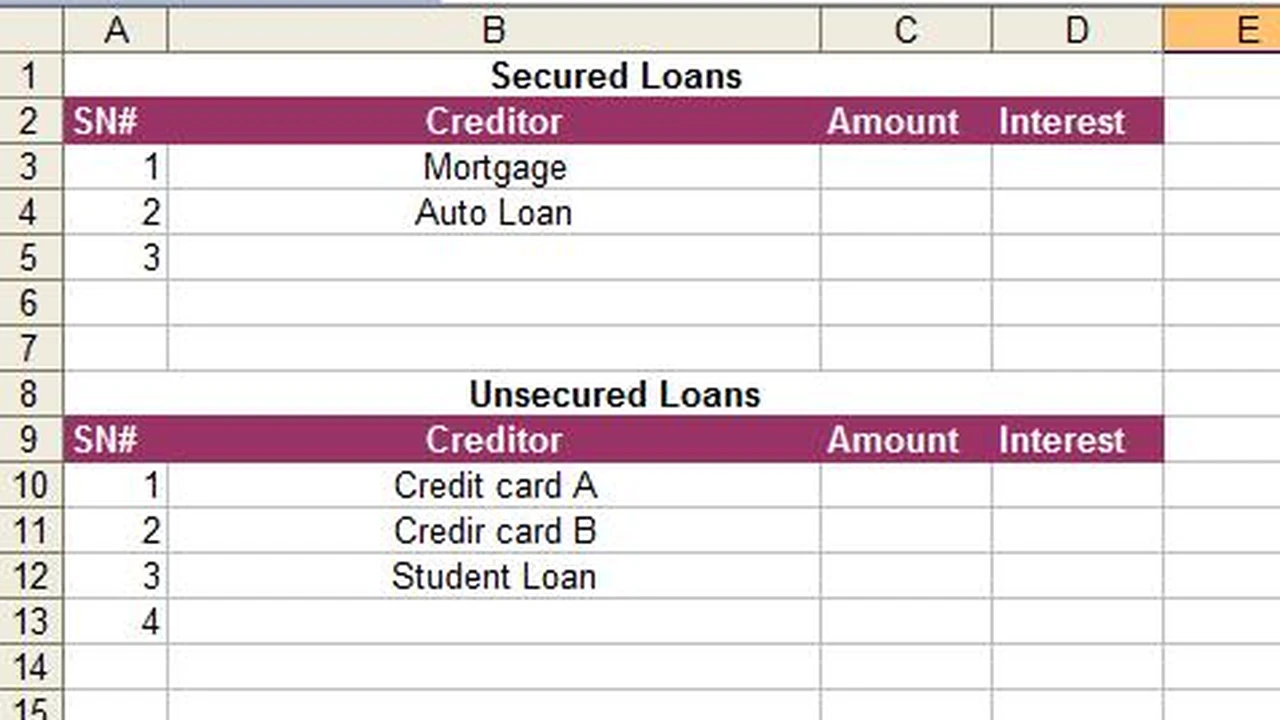

The debt consolidation landscape is vast and varied. There are secured loans, unsecured loans, different types of credit cards, and even government-backed programs. Each has its own set of pros, cons, eligibility requirements, and potential impact on your credit score. A financial advisor has a deep understanding of all these options. They can explain the nuances in plain English, helping you grasp the implications of each choice. For instance, they can clarify the difference between a debt consolidation loan and a debt management plan, or when a balance transfer card might be more beneficial than a personal loan. They'll help you cut through the jargon and make sense of it all.

Personalized Debt Consolidation Plan Development and Goal Setting

Your financial situation is unique, and your debt consolidation plan should be too. A good financial advisor won't offer a one-size-fits-all solution. Instead, they'll take the time to understand your income, expenses, assets, liabilities, and most importantly, your financial goals. Do you want to be debt-free in three years? Five years? Are you also saving for a down payment on a house or retirement? They'll integrate your debt consolidation strategy into your broader financial picture, ensuring it aligns with your long-term aspirations. This personalized approach means you're not just getting rid of debt; you're building a stronger financial foundation.

Objective Analysis of Your Debt Consolidation Situation and Best Fit Solutions

When you're stressed about debt, it's easy to make emotional decisions. A financial advisor provides an objective, unbiased perspective. They're not emotionally invested in your debt in the same way you are, which allows them to analyze your situation logically and recommend the best course of action without personal bias. They can help you see the bigger picture, evaluate the true costs and benefits of each option, and avoid common pitfalls that people often fall into when trying to manage debt on their own.

Negotiation Skills and Access to Debt Consolidation Resources

While financial advisors typically don't directly negotiate with creditors for debt consolidation loans (that's more the realm of debt settlement companies, which are different), they often have a network of resources. They might be able to connect you with reputable lenders offering competitive rates for debt consolidation loans or point you towards credit counseling agencies that can help with debt management plans. Some advisors might even offer guidance on how to approach your creditors if you're considering a direct negotiation for a hardship program, though this is less common for consolidation itself.

What a Financial Advisor Does in the Debt Consolidation Process

So, what exactly does a financial advisor do when you bring them your debt consolidation challenge? It's a multi-step process designed to empower you with knowledge and a clear action plan.

Assessing Your Current Financial Health and Debt Consolidation Needs

The first step is always a thorough financial check-up. Your advisor will ask for details about all your debts – credit cards, personal loans, medical bills, student loans, car loans, etc. – including interest rates, minimum payments, and outstanding balances. They'll also look at your income, expenses, savings, and assets. This comprehensive overview helps them understand the full scope of your financial situation and identify the most pressing areas for debt consolidation.

Exploring Various Debt Consolidation Strategies and Their Suitability

Once they have a clear picture, your advisor will walk you through the different debt consolidation options. They'll explain:

- Debt Consolidation Loans: These are personal loans used to pay off multiple smaller debts. They typically come with a fixed interest rate and a set repayment period. Your advisor will help you understand if your credit score qualifies you for a good rate and if the monthly payment is manageable.

- Balance Transfer Credit Cards: These cards offer a 0% or low-interest introductory period, allowing you to transfer high-interest credit card balances. The advisor will highlight the importance of paying off the balance before the promotional period ends to avoid high deferred interest.

- Home Equity Loans or HELOCs: If you own a home, you might consider using your home equity. Your advisor will explain the risks involved, such as putting your home at collateral, and whether this is a wise move for your specific situation.

- Debt Management Plans (DMPs): Offered by non-profit credit counseling agencies, DMPs involve the agency negotiating with your creditors for lower interest rates and a single monthly payment. Your advisor can help you determine if a DMP is a better fit than a consolidation loan, especially if your credit isn't strong enough for favorable loan terms.

- Other Options: They might also touch upon less common strategies or specific programs you might qualify for.

Analyzing Interest Rates Fees and Repayment Terms for Debt Consolidation

This is where the numbers game comes in. Your advisor will meticulously analyze the interest rates, fees (like origination fees on loans or balance transfer fees on cards), and repayment terms of each potential debt consolidation product. They'll help you calculate the total cost of each option, showing you how much you could save in interest over time. They'll also ensure the new consolidated payment fits comfortably within your budget, preventing you from falling into more debt.

Developing a Realistic Budget and Post-Consolidation Financial Plan

Debt consolidation is just the first step. The real work begins after. Your advisor will help you create a realistic budget that accounts for your new consolidated payment, ensuring you have enough money for living expenses, savings, and even a little fun. They'll also help you develop a long-term financial plan to prevent future debt accumulation, build an emergency fund, and start working towards other financial goals like retirement or investing. This holistic approach is key to lasting financial freedom.

Choosing the Right Financial Advisor for Your Debt Consolidation Journey

Just like there are different types of debt consolidation, there are different types of financial advisors. Finding the right one is crucial. Here's what to look for:

Fiduciary Standard Advisors Prioritizing Your Best Interests

Always look for a financial advisor who operates under a fiduciary standard. This means they are legally obligated to act in your best interest, putting your financial well-being ahead of their own commissions or incentives. This is a critical distinction from advisors who operate under a suitability standard, who only need to recommend products that are 'suitable' for you, even if they're not the absolute best option.

Certifications and Qualifications for Debt Consolidation Expertise

Look for advisors with relevant certifications. A Certified Financial Planner (CFP®) is a good starting point, as they have extensive training in various areas of financial planning, including debt management. Other relevant certifications might include Chartered Financial Analyst (CFA) or Personal Financial Specialist (PFS). While not all advisors specialize solely in debt, a CFP® will have a strong foundational understanding.

Fee Structure Understanding How Your Financial Advisor is Paid

Financial advisors typically charge in a few ways:

- Fee-only: They charge a flat fee, an hourly rate, or a percentage of assets under management. This is generally preferred as it minimizes conflicts of interest.

- Commission-based: They earn commissions from selling financial products. This can create a conflict of interest, as they might be incentivized to recommend products that pay them higher commissions, even if they're not the best for you.

- Fee-based: A hybrid model where they charge fees but also earn commissions.

For debt consolidation advice, a fee-only advisor is often the most transparent and trustworthy option. Make sure you understand their fee structure upfront.

Experience and Specialization in Debt Management and Consolidation

While a general financial planner can certainly help, an advisor with specific experience in debt management and consolidation can be a huge asset. Don't hesitate to ask about their experience with clients in similar situations to yours. Ask for case studies (anonymized, of course) or testimonials related to debt consolidation.

Communication Style and Client Relationship Building

You'll be sharing sensitive financial information with your advisor, so it's important to feel comfortable and trust them. Look for someone with a communication style that resonates with you – someone who listens, explains things clearly, and makes you feel empowered, not judged. A good advisor will be a partner in your financial journey.

Specific Products and Services a Financial Advisor Might Recommend for Debt Consolidation

While a financial advisor won't sell you a specific loan, they will guide you towards the best types of products and help you evaluate offers. Here are some examples of what they might discuss and compare:

Debt Consolidation Loans Comparing Top Lenders and Features

Your advisor will help you compare offers from various lenders. They might highlight:

- SoFi Personal Loans: Known for competitive rates for borrowers with good to excellent credit, often with no origination fees. They offer flexible terms and can be used for various types of debt.

- LightStream Personal Loans: Offers some of the lowest rates for highly qualified borrowers, with a wide range of loan amounts and terms. They pride themselves on a quick online application process.

- Marcus by Goldman Sachs Personal Loans: Popular for no fees (origination, late, or prepayment) and fixed rates. They offer a personalized loan experience and are a strong contender for those with good credit.

- Discover Personal Loans: Offers fixed rates, no origination fees, and direct payment to creditors, which can simplify the consolidation process.

Usage Scenario: Ideal for individuals with multiple high-interest debts (credit cards, medical bills) who have a good credit score and want a single, predictable monthly payment. Your advisor will help you compare the APR, loan term, and total cost of each to find the best fit.

Balance Transfer Credit Cards Maximizing Introductory Offers

For credit card debt, balance transfer cards can be powerful. Your advisor will help you understand the fine print:

- Chase Slate Edge: Often features a long 0% intro APR period on balance transfers and purchases, with no annual fee. The balance transfer fee is typically 3% or 5%.

- Citi Simplicity Card: Known for one of the longest 0% intro APR periods on balance transfers, also with no annual fee. The balance transfer fee is usually 3% or 5%.

- BankAmericard Credit Card: Offers a competitive 0% intro APR on balance transfers and purchases, with no annual fee. Balance transfer fees apply.

Usage Scenario: Best for individuals with primarily credit card debt who are confident they can pay off the transferred balance within the introductory 0% APR period. Your advisor will stress the importance of avoiding new purchases on the card and having a solid repayment plan.

Home Equity Loans and HELOCs Understanding the Risks and Rewards

If you're a homeowner, these can offer lower interest rates, but they come with significant risk. Your advisor will discuss:

- Local Banks and Credit Unions: Often offer competitive rates on home equity products. Examples include Wells Fargo, Bank of America, or your local credit union.

- Online Lenders: Some online lenders also offer HELOCs, but often with stricter requirements.

Usage Scenario: Suitable for homeowners with substantial equity and a disciplined approach to repayment. Your advisor will ensure you understand that your home is collateral and that defaulting could lead to foreclosure. They'll help you weigh the lower interest rate against the increased risk.

Debt Management Plans Through Non-Profit Credit Counseling Agencies

If your credit isn't strong enough for a good consolidation loan, or if you need more structured support, a DMP might be recommended. Your advisor might suggest reputable agencies like:

- National Foundation for Credit Counseling (NFCC) members: A network of non-profit agencies offering certified credit counseling.

- GreenPath Financial Wellness: A well-known non-profit offering DMPs and financial education.

Usage Scenario: Ideal for individuals struggling with multiple unsecured debts who need help negotiating with creditors and creating a structured repayment plan. Your advisor will explain that while DMPs can lower interest rates, they might negatively impact your credit score in the short term.

Beyond Consolidation Building a Strong Financial Future

A good financial advisor's role doesn't end once your debt is consolidated. They're there to help you build a robust financial future, ensuring you stay debt-free and achieve your other financial aspirations.

Establishing an Emergency Fund and Savings Goals

One of the first things your advisor will emphasize is building an emergency fund. This cash cushion (typically 3-6 months of living expenses) prevents you from relying on credit cards when unexpected expenses arise, which is a common reason people fall back into debt. They'll help you set realistic savings goals and strategies to achieve them.

Investing for Retirement and Other Long-Term Financial Objectives

Once your debt is under control and an emergency fund is in place, your advisor will guide you on investing. Whether it's contributing to a 401(k), IRA, or other investment vehicles, they'll help you understand risk tolerance, asset allocation, and how to grow your wealth for retirement, a child's education, or other long-term goals. They'll ensure your investment strategy aligns with your overall financial plan.

Credit Score Improvement and Maintenance Strategies

Your credit score is a vital component of your financial health. Your advisor will provide strategies to improve and maintain a good credit score post-consolidation, such as making on-time payments, keeping credit utilization low, and regularly checking your credit report for errors. A healthy credit score opens doors to better interest rates on future loans and other financial opportunities.

Ongoing Financial Review and Adjustments to Your Plan

Life happens, and your financial situation will evolve. A good financial advisor will schedule regular check-ins to review your progress, assess any changes in your income or expenses, and make necessary adjustments to your financial plan. This ongoing support ensures you stay on track and adapt to new challenges or opportunities.

So, if you're feeling overwhelmed by debt and considering consolidation, don't go it alone. A financial advisor can be an invaluable partner, providing the expertise, guidance, and personalized plan you need to not only consolidate your debt effectively but also build a solid foundation for a truly secure financial future. It's an investment in yourself and your peace of mind.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)