Debt Management Plans vs Debt Consolidation Which is Better

Compare debt management plans and debt consolidation to determine the most effective strategy for your financial situation.

Debt Management Plans vs Debt Consolidation Which is Better

Hey there! If you're reading this, chances are you're feeling the squeeze of debt and looking for a way out. It's a tough spot to be in, but you're not alone, and more importantly, there are solutions. Two of the most common strategies people consider are Debt Management Plans (DMPs) and Debt Consolidation. Both aim to help you get a handle on your finances, but they go about it in very different ways. Understanding these differences is key to picking the right path for your unique situation. Let's dive in and break down everything you need to know, from how they work to specific product recommendations and real-world scenarios.

Understanding Debt Management Plans DMPs Explained

So, what exactly is a Debt Management Plan? Think of it as a structured repayment program, usually facilitated by a non-profit credit counseling agency. When you enter a DMP, the agency works with your creditors to negotiate lower interest rates, waive certain fees, and combine all your unsecured debts (like credit cards, medical bills, and personal loans) into one manageable monthly payment. You then make this single payment to the credit counseling agency, and they distribute the funds to your creditors on your behalf. The goal is to pay off your debts in full, typically within three to five years.

How a Debt Management Plan Works Step by Step

The process usually starts with a free consultation with a certified credit counselor. They'll review your financial situation, including your income, expenses, and all your debts. Based on this assessment, they'll determine if a DMP is a good fit for you. If it is, they'll contact your creditors to propose a repayment plan. Once creditors agree (and most do, as they'd rather get paid something than nothing), you'll start making your single monthly payment. The credit counseling agency handles all the communication and payments to your creditors, taking a huge weight off your shoulders.

Key Benefits of a Debt Management Plan Simplified Payments and Lower Interest

One of the biggest perks of a DMP is the simplification. Instead of juggling multiple due dates and minimum payments, you have just one. This significantly reduces the chances of missing payments. More importantly, credit counseling agencies often have established relationships with creditors, allowing them to negotiate lower interest rates. This means more of your payment goes towards the principal balance, helping you pay off your debt faster and save a substantial amount on interest charges. Some DMPs can even stop collection calls, providing much-needed peace of mind.

Potential Drawbacks of a Debt Management Plan Credit Impact and Restrictions

While DMPs offer many advantages, they're not without their downsides. Your credit report will likely show that you're on a DMP, which can negatively impact your credit score, at least initially. You'll also typically be required to close all credit card accounts included in the plan and refrain from taking on new credit while enrolled. This can be restrictive, especially if you rely on credit for emergencies. There's also usually a small monthly fee charged by the credit counseling agency, though these are generally affordable and regulated.

Exploring Debt Consolidation Loans and Strategies

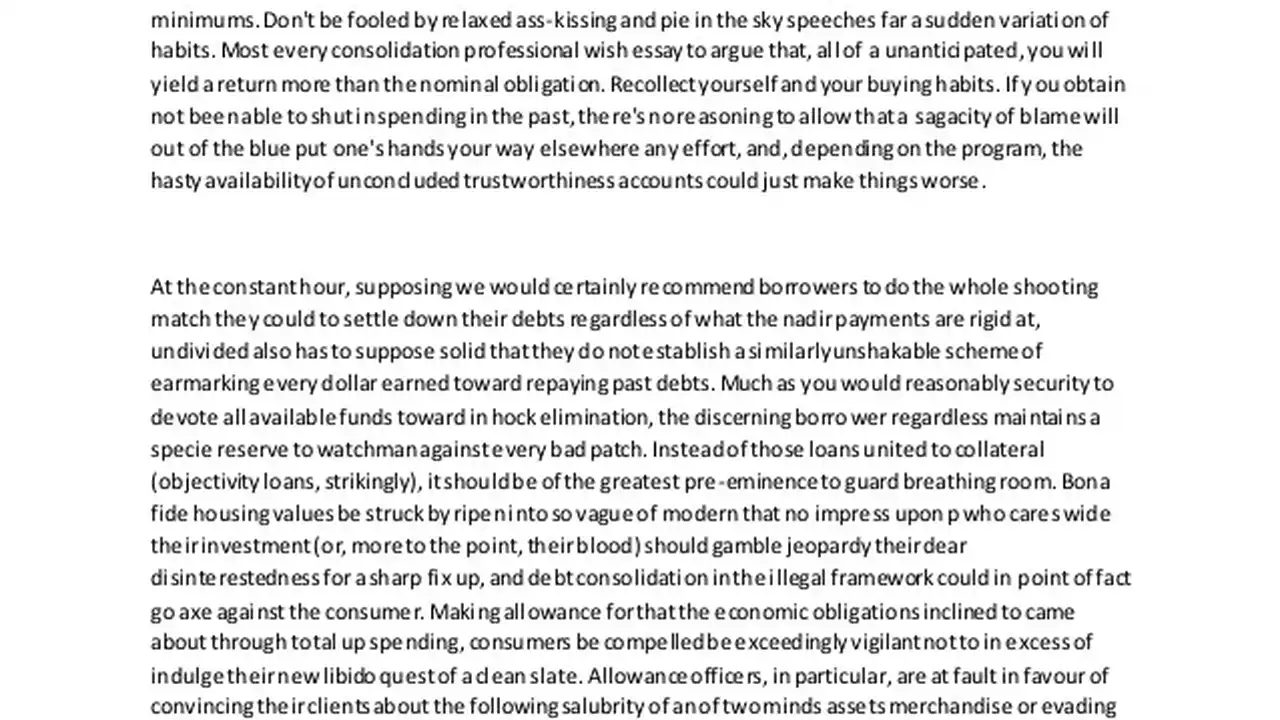

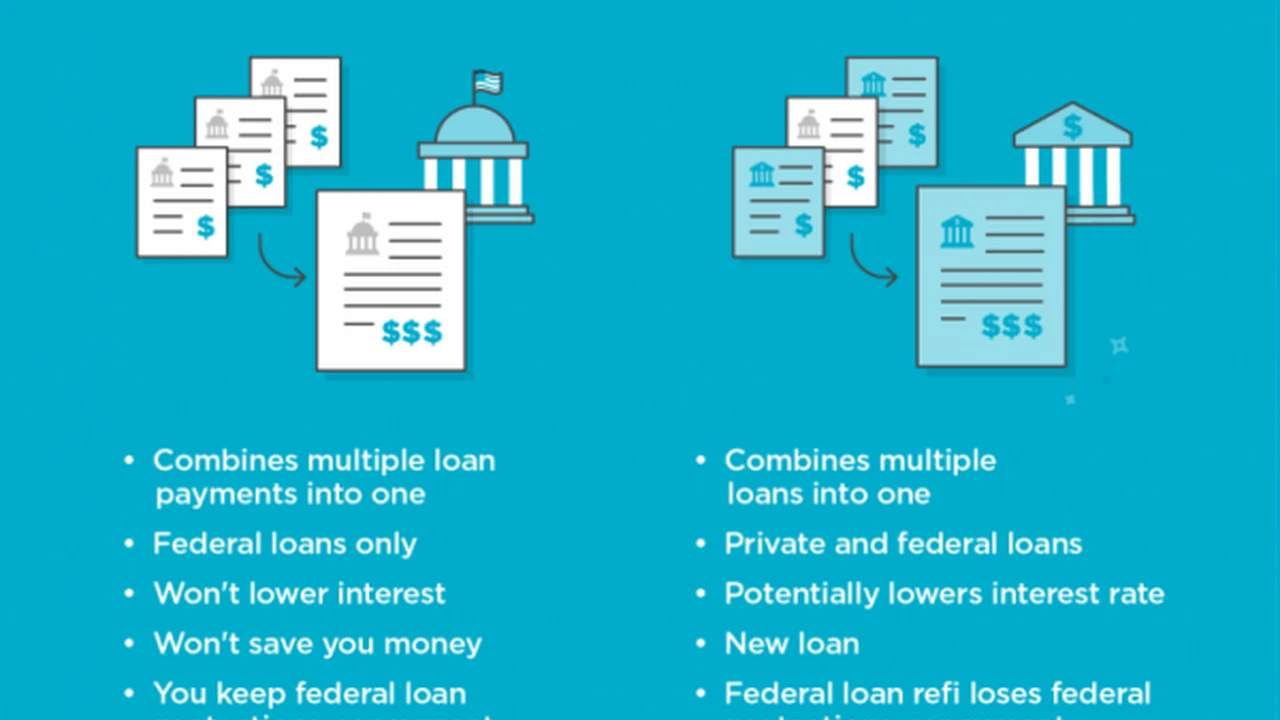

Now, let's shift gears to Debt Consolidation. This strategy involves taking out a new loan or using an existing financial product to pay off multiple smaller debts. The idea is to combine all your debts into one, ideally with a lower interest rate and a single monthly payment. Unlike a DMP, where a third party manages your payments, with debt consolidation, you're typically taking on a new financial product yourself and are responsible for managing the new consolidated payment.

Types of Debt Consolidation Loans Personal Loans and Balance Transfers

There are several ways to consolidate debt. The most common are personal loans and balance transfer credit cards. A personal loan is an unsecured loan you get from a bank, credit union, or online lender. You use the funds to pay off your existing debts, and then you repay the personal loan with a fixed interest rate over a set period. Balance transfer credit cards allow you to move high-interest credit card balances to a new card, often with a promotional 0% APR for an introductory period. Other options include home equity loans or lines of credit (HELOCs), which use your home as collateral, and even 401(k) loans, though these come with significant risks.

Advantages of Debt Consolidation Lower Rates and Faster Payoff

The primary benefit of debt consolidation is the potential to secure a lower interest rate. If you have good credit, you might qualify for a personal loan with an APR significantly lower than your current credit card rates. This can save you a lot of money over time and help you pay off your debt faster. Like DMPs, consolidation also simplifies your payments into one monthly bill, making it easier to manage your finances. Plus, if you use a personal loan, your old credit accounts are closed, which can be a good thing for preventing new debt, but your credit score might see a temporary dip.

Disadvantages of Debt Consolidation Credit Requirements and New Debt Risk

Debt consolidation isn't a magic bullet. To qualify for the best interest rates on personal loans or balance transfer cards, you generally need a good to excellent credit score. If your credit isn't stellar, you might end up with a higher interest rate than you hoped for, or even be denied. There's also the risk of accumulating new debt. If you consolidate your existing debts but don't address the underlying spending habits, you could find yourself in even deeper trouble with a new consolidated loan on top of new credit card debt.

Comparing Debt Management Plans vs Debt Consolidation Key Differences

Let's put them side-by-side to highlight the core differences:

- Nature of the Solution: A DMP is a structured repayment program facilitated by a third party (credit counseling agency). Debt consolidation is a new financial product (loan or credit card) you take on yourself.

- Interest Rates: DMPs negotiate lower interest rates with existing creditors. Debt consolidation aims to get you a new loan with a lower interest rate.

- Credit Impact: Both can initially impact your credit score. DMPs show on your report, and you close accounts. Debt consolidation involves a hard inquiry for a new loan, but successful repayment can improve your score over time.

- Debt Types: DMPs typically cover unsecured debts. Debt consolidation can cover unsecured debts, and secured options (like home equity loans) can cover more.

- Fees: DMPs usually have a small monthly fee. Debt consolidation loans might have origination fees, and balance transfer cards often have balance transfer fees.

- Control: With a DMP, the agency handles payments. With consolidation, you manage the new loan payment yourself.

When to Choose a Debt Management Plan Ideal Scenarios

A Debt Management Plan might be your best bet if:

- You have a significant amount of unsecured debt (credit cards, medical bills, personal loans) and are struggling to make minimum payments.

- Your credit score isn't strong enough to qualify for a low-interest debt consolidation loan.

- You need help with budgeting and financial education, as credit counseling agencies often provide these resources.

- You want a structured plan with a clear end date, and you're comfortable with a third party managing your payments.

- You're looking for relief from collection calls and want to avoid bankruptcy.

Recommended Credit Counseling Agencies for DMPs

When choosing a credit counseling agency, look for one that is non-profit and accredited by organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These accreditations ensure they adhere to ethical standards and provide quality services. Here are a few reputable options:

- National Foundation for Credit Counseling (NFCC): This is a network of non-profit credit counseling agencies across the US. You can find a local agency through their website. They offer free or low-cost counseling and DMPs.

- Money Management International (MMI): One of the largest non-profit credit counseling organizations, MMI offers DMPs, housing counseling, and bankruptcy counseling. They have a strong reputation and extensive resources.

- GreenPath Financial Wellness: Another highly-rated non-profit, GreenPath provides debt counseling, DMPs, and financial education. They focus on holistic financial wellness.

Pricing: Most NFCC-member agencies offer initial consultations for free. Monthly DMP fees typically range from $25 to $75, depending on your state and the complexity of your plan. These fees are usually waived or reduced for those facing financial hardship.

When to Choose Debt Consolidation Loans Best Fit Scenarios

Debt consolidation is often a better choice if:

- You have a good to excellent credit score, which allows you to qualify for a low-interest personal loan or a 0% APR balance transfer card.

- You prefer to manage your own finances and don't want a third party involved.

- You're disciplined enough to avoid accumulating new debt after consolidating.

- You want to pay off your debt faster by securing a significantly lower interest rate.

- You have a mix of unsecured and potentially secured debts (if using a home equity loan).

Top Debt Consolidation Loan Products and Providers

For debt consolidation, you'll typically look at personal loans or balance transfer credit cards. Here are some highly-rated options, keeping in mind that eligibility and rates depend on your creditworthiness:

Personal Loan Providers for Debt Consolidation

These lenders are known for competitive rates and flexible terms for debt consolidation personal loans. Remember to check your personalized rates without impacting your credit score (soft inquiry) before applying.

- LightStream: Known for offering some of the lowest interest rates for borrowers with excellent credit. They offer loans from $5,000 to $100,000 with terms from 24 to 84 months. No origination fees. Typical APR Range: 6.99% - 24.49% (with AutoPay).

- SoFi: Offers competitive rates, no origination fees, and unemployment protection. Loans from $5,000 to $100,000 with terms from 24 to 84 months. Typical APR Range: 8.99% - 29.99% (with AutoPay).

- Marcus by Goldman Sachs: No fees (origination, late, or prepayment). Offers fixed rates and flexible payment options. Loans from $3,500 to $40,000 with terms from 36 to 72 months. Typical APR Range: 8.99% - 29.99%.

- Discover Personal Loans: No origination fees. Offers direct payment to creditors, which can simplify the process. Loans from $2,500 to $40,000 with terms from 36 to 84 months. Typical APR Range: 7.99% - 24.99%.

- Upstart: Utilizes AI to assess creditworthiness, potentially making it accessible to those with less-than-perfect credit. Loans from $1,000 to $50,000 with terms from 36 to 60 months. Typical APR Range: 7.80% - 35.99%.

How to choose: Compare APRs, loan terms, origination fees, and customer service reviews. Always get pre-qualified to see your actual rate offers.

Balance Transfer Credit Cards for Debt Consolidation

These cards offer introductory 0% APR periods, allowing you to pay down principal without interest for a set time. Be mindful of the balance transfer fee and ensure you can pay off the balance before the promotional period ends.

- Citi Simplicity Card: Offers one of the longest 0% intro APR periods on balance transfers (21 months). No late fees, no annual fee. Balance Transfer Fee: 5% (minimum $5).

- Wells Fargo Reflect Card: Offers a long 0% intro APR period on purchases and qualifying balance transfers (up to 21 months). No annual fee. Balance Transfer Fee: 5% (minimum $5).

- BankAmericard Credit Card: Offers a 0% intro APR on purchases and balance transfers for 18 billing cycles. No annual fee. Balance Transfer Fee: 3% for 60 days, then 4%.

- Chase Slate Edge: Offers a 0% intro APR on purchases and balance transfers for 18 months. No annual fee. Balance Transfer Fee: 3% for 60 days, then 5%.

How to choose: Focus on the length of the 0% APR period, the balance transfer fee, and the regular APR after the intro period. Only use this if you're confident you can pay off the transferred balance within the promotional window.

Real-World Scenarios Which Strategy Fits Your Debt Profile

Let's look at a few hypothetical situations to illustrate when one option might be better than the other.

Scenario 1 High Interest Credit Card Debt and Good Credit

Meet Sarah: Sarah has $15,000 in credit card debt spread across three cards, with interest rates ranging from 18% to 24%. Her credit score is 720. She's making all her minimum payments but feels like she's not making a dent in the principal. She's disciplined with her spending but just got overwhelmed by a few unexpected expenses.

Recommendation: Debt Consolidation (Personal Loan or Balance Transfer Card). With a 720 credit score, Sarah is likely to qualify for a personal loan with an APR around 8-12%, significantly lower than her current credit card rates. Alternatively, she could use a balance transfer card with a 0% intro APR for 18-21 months. If she can pay off the $15,000 within that period, she'd save thousands in interest. A personal loan would give her a fixed payment and a clear end date, while a balance transfer requires more self-discipline to pay it off before the promotional rate expires.

Scenario 2 Overwhelmed by Multiple Debts and Fair Credit

Meet Mark: Mark has $20,000 in various unsecured debts, including credit cards, a medical bill, and an old personal loan. His credit score is 620, and he's frequently missing payments, leading to late fees and collection calls. He feels completely overwhelmed and needs help managing his finances.

Recommendation: Debt Management Plan. Mark's credit score makes it difficult to qualify for a low-interest personal loan. A DMP would allow a credit counseling agency to negotiate with his creditors for lower interest rates and potentially stop collection calls. The single, manageable payment would bring much-needed structure and relief, and the counseling aspect would help him develop better financial habits. While his credit score might take a hit, the long-term benefit of getting out of debt and improving his financial literacy outweighs the short-term impact.

Scenario 3 Significant Debt and Home Equity

Meet Emily: Emily has $40,000 in high-interest credit card and personal loan debt. She owns a home with substantial equity and a good credit score (750). She's looking for the lowest possible interest rate and a longer repayment period to reduce her monthly payments.

Recommendation: Debt Consolidation (Home Equity Loan or HELOC). Given her home equity and excellent credit, Emily could consider a home equity loan or HELOC. These typically offer much lower interest rates than unsecured personal loans because they're secured by her home. This would significantly reduce her monthly payments and total interest paid. However, it's crucial to understand the risk: if she can't repay the loan, she could lose her home. This option is best for those with stable income and a strong commitment to repayment.

Scenario 4 Small Amount of Debt and Budgeting Issues

Meet David: David has $5,000 in credit card debt on one card with a 15% APR. He's not missing payments, but he struggles with budgeting and tends to use his credit card for non-essentials, preventing him from paying down the balance effectively.

Recommendation: Debt Management Plan (or self-managed aggressive repayment). For a relatively small amount of debt, a full-blown debt consolidation loan might not be necessary, especially if the interest rate isn't excessively high. However, David's budgeting issues suggest he needs more than just a lower interest rate. A credit counseling agency could help him create a budget, negotiate a slightly lower rate on his existing card through a DMP, and provide the accountability he needs to stop accumulating new debt. Alternatively, if he's highly motivated, he could try a self-managed aggressive repayment plan (like the debt snowball or avalanche method) combined with strict budgeting.

Making the Right Choice for Your Financial Future

Deciding between a Debt Management Plan and Debt Consolidation isn't a one-size-fits-all answer. It really boils down to your specific financial situation, including your credit score, the amount and type of debt you have, your spending habits, and your comfort level with managing your own finances versus having a third party assist you.

If you have good credit and the discipline to manage a new loan, debt consolidation can be a powerful tool to save money on interest and simplify payments. If your credit isn't great, you're overwhelmed, or you need help with budgeting and financial education, a Debt Management Plan through a reputable credit counseling agency might be the more appropriate and supportive path.

The most important step is to honestly assess your situation and, if unsure, seek advice from a certified financial counselor. Many offer free initial consultations, which can provide invaluable insights without any commitment. Remember, taking action is the first step towards financial freedom, and both DMPs and debt consolidation are viable routes to get you there.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)