Comparing Debt Consolidation Loan Terms and Repayment Periods

Understand how to compare loan terms and repayment periods to select a debt consolidation loan that fits your budget.

Comparing Debt Consolidation Loan Terms and Repayment Periods

Hey there! So, you're looking into debt consolidation, which is a fantastic step towards getting your finances in order. One of the biggest decisions you'll face when choosing a debt consolidation loan isn't just about the interest rate, but also about the loan terms and repayment periods. These two factors are super important because they directly impact your monthly payments, the total amount you'll pay over time, and how quickly you can become debt-free. Let's dive deep into understanding these elements so you can pick the best loan for your unique situation.

Understanding Debt Consolidation Loan Terms What Are They Really

When we talk about 'loan terms,' we're essentially referring to the entire agreement between you and the lender. This includes a bunch of stuff like the interest rate, any fees involved, and, crucially, the repayment period. Think of it as the rulebook for your loan. A good understanding of these terms is your superpower in securing a deal that truly benefits you.

Interest Rates and APR The Real Cost of Borrowing for Debt Consolidation

First up, let's chat about interest rates. This is the percentage charged by the lender for borrowing their money. A lower interest rate means you pay less over the life of the loan. But here's a pro tip: always look at the Annual Percentage Rate (APR) instead of just the interest rate. The APR includes not only the interest rate but also any additional fees, like origination fees, giving you a more accurate picture of the total cost of borrowing. For example, a loan might advertise a 7% interest rate, but with a 2% origination fee, the APR could jump to 7.5% or even higher depending on the loan term. Always compare APRs when shopping for debt consolidation loans.

Origination Fees and Other Charges Hidden Costs of Debt Consolidation Loans

Speaking of fees, origination fees are common with personal loans, which are often used for debt consolidation. This is a one-time fee charged by the lender for processing your loan. It's usually a percentage of the loan amount, typically ranging from 1% to 8%. Some lenders don't charge origination fees, which can be a huge saving, especially on larger loan amounts. Other fees might include late payment fees or prepayment penalties, though prepayment penalties are less common with personal loans these days. Always read the fine print to avoid any surprises!

Decoding Repayment Periods How Long Will You Be Paying for Debt Consolidation

The repayment period, also known as the loan term, is the length of time you have to pay back the loan. This is usually expressed in months or years. Common repayment periods for debt consolidation loans range from 24 months (2 years) to 84 months (7 years), though some lenders might offer shorter or longer options. This choice significantly impacts your monthly payment and the total interest you'll pay.

Shorter Repayment Periods Lower Total Cost Higher Monthly Payments for Debt Consolidation

Opting for a shorter repayment period, say 24 or 36 months, means you'll pay off your debt faster. The big win here is that you'll pay less in total interest because the money is borrowed for a shorter duration. However, the trade-off is that your monthly payments will be higher. This option is great if you have a stable income and can comfortably afford the larger monthly payments. It's like a sprint to financial freedom!

Longer Repayment Periods Lower Monthly Payments Higher Total Cost for Debt Consolidation

On the flip side, a longer repayment period, like 60 or 84 months, will result in lower monthly payments. This can make your debt more manageable, freeing up cash flow for other expenses or savings. The downside? You'll end up paying more in total interest over the life of the loan because the money is borrowed for a longer time. This option is often preferred if you need to reduce your monthly financial burden and prioritize cash flow, even if it means paying a bit more in the long run. It's more of a marathon.

Finding Your Sweet Spot Balancing Monthly Payments and Total Cost for Debt Consolidation

The key is to find a balance that works for your budget and financial goals. There's no one-size-fits-all answer. You need to consider your current income, your other expenses, and how quickly you want to be debt-free. A good strategy is to calculate the total cost of the loan (principal + total interest paid) for different repayment periods and compare it with the monthly payment. Many online loan calculators can help you with this.

Comparing Specific Debt Consolidation Loan Products and Their Terms

Let's look at some real-world examples of lenders and their typical offerings. Keep in mind that these are general ranges, and your specific terms will depend on your credit score, income, and other factors.

LightStream Personal Loans for Debt Consolidation Excellent Credit Options

LightStream, a division of Truist, is known for offering competitive rates to borrowers with excellent credit (typically 700+ FICO score). They offer loans from $5,000 to $100,000. Their repayment periods can range from 24 to 84 months. For example, for a $20,000 loan with a 60-month term, someone with excellent credit might get an APR as low as 5.99%. There are no origination fees, which is a huge plus. The catch? You really need top-tier credit to qualify for their best rates. If you have a strong credit history, LightStream is definitely worth checking out for its low APRs and flexible terms.

SoFi Personal Loans for Debt Consolidation Good to Excellent Credit

SoFi is another popular choice, especially for those with good to excellent credit (typically 680+ FICO score). They offer loans from $5,000 to $100,000 with repayment terms ranging from 24 to 84 months. SoFi also boasts no origination fees, no late fees, and no prepayment penalties. Their APRs can start from around 7.99% for well-qualified borrowers. SoFi is also known for its unemployment protection program, which can be a great safety net. For a $20,000 loan over 60 months, you might see an APR of 8.99%, leading to a monthly payment of around $410. SoFi is a solid option if you have good credit and appreciate the extra borrower protections.

Marcus by Goldman Sachs Personal Loans for Debt Consolidation Good Credit Focus

Marcus by Goldman Sachs targets borrowers with good credit (typically 660+ FICO score). They offer loans from $3,500 to $40,000 with repayment terms from 36 to 72 months. Marcus stands out for its transparency: no origination fees, no late fees, and no prepayment penalties. Their APRs can start from around 6.99%. For a $15,000 loan with a 48-month term, you might get an APR of 9.99%, resulting in a monthly payment of approximately $380. Marcus is a great choice if you have good credit and prefer a straightforward loan with no hidden fees.

Upgrade Personal Loans for Debt Consolidation Fair to Good Credit Options

Upgrade is a good option for borrowers with fair to good credit (typically 600+ FICO score). They offer loans from $1,000 to $50,000 with repayment terms from 24 to 84 months. Upgrade does charge an origination fee, which can range from 2.9% to 8% of the loan amount, deducted from your loan proceeds. Their APRs can start from around 8.49%. For a $10,000 loan over 36 months, with an origination fee of 5%, your effective APR might be closer to 12.99%, leading to a monthly payment of around $336. Upgrade can be a viable option if your credit isn't perfect, but be mindful of the origination fee.

Avant Personal Loans for Debt Consolidation Fair Credit Accessibility

Avant caters to borrowers with fair credit (typically 580+ FICO score). They offer loans from $2,000 to $35,000 with repayment terms from 24 to 60 months. Avant also charges an administration fee (similar to an origination fee) of up to 4.75%. Their APRs can be higher, starting from around 9.95%. For a $7,000 loan over 36 months, with a 4.75% admin fee, your APR could be around 24.99%, resulting in a monthly payment of approximately $278. Avant is an option if you have limited credit history or a lower credit score, but be prepared for higher interest rates and fees.

Using a Loan Calculator to Compare Debt Consolidation Scenarios

Before you commit to any loan, it's super helpful to use an online loan calculator. Most lenders have one on their website, or you can find generic ones. Input the loan amount you need, different interest rates (APRs), and various repayment periods. This will instantly show you the estimated monthly payment and the total interest paid over the life of the loan. This visual comparison can be incredibly enlightening and help you make an informed decision.

For example, let's say you need to consolidate $15,000 in debt. Here's how different terms might look:

- Scenario 1: Shorter Term, Lower APR (e.g., excellent credit)

- Loan Amount: $15,000

- APR: 7%

- Repayment Period: 36 months

- Estimated Monthly Payment: ~$463

- Total Interest Paid: ~$1,668

- Total Paid: ~$16,668

- Scenario 2: Medium Term, Medium APR (e.g., good credit)

- Loan Amount: $15,000

- APR: 12%

- Repayment Period: 60 months

- Estimated Monthly Payment: ~$334

- Total Interest Paid: ~$5,040

- Total Paid: ~$20,040

- Scenario 3: Longer Term, Higher APR (e.g., fair credit)

- Loan Amount: $15,000

- APR: 18%

- Repayment Period: 84 months

- Estimated Monthly Payment: ~$298

- Total Interest Paid: ~$9,992

- Total Paid: ~$24,992

As you can see, the monthly payment in Scenario 3 is much lower than Scenario 1, but the total interest paid is significantly higher. This illustrates the importance of balancing these factors based on your personal financial situation.

Factors Influencing Your Debt Consolidation Loan Terms and Repayment Options

Several factors play a role in what kind of loan terms and repayment periods you'll be offered. Understanding these can help you prepare and potentially improve your chances of getting a better deal.

Your Credit Score The Ultimate Determinant for Debt Consolidation Rates

Your credit score is probably the most critical factor. Lenders use it to assess your creditworthiness and the likelihood of you repaying the loan. A higher credit score (generally 700+) indicates lower risk, leading to lower interest rates and more favorable terms. If your credit score is on the lower side, you might still qualify for a debt consolidation loan, but expect higher interest rates and potentially shorter repayment periods to mitigate the lender's risk.

Debt-to-Income Ratio How Much Debt Can You Handle for Consolidation

Your debt-to-income (DTI) ratio is another key metric. This is the percentage of your gross monthly income that goes towards paying your monthly debt payments. Lenders prefer a lower DTI ratio, as it suggests you have enough income to comfortably manage new debt. A high DTI ratio might make lenders hesitant or offer less attractive terms. Aim to keep your DTI below 36% if possible, though some lenders might accept up to 43%.

Loan Amount and Purpose How Much You Need to Consolidate

The amount you want to borrow can also influence the terms. Larger loan amounts might come with slightly different rate structures or require a stronger credit profile. While the purpose is debt consolidation, some lenders might view certain types of debt (e.g., medical debt vs. credit card debt) differently, though this is less common with general personal loans.

Lender Specific Policies and Underwriting for Debt Consolidation

Every lender has its own set of underwriting criteria. Some might be more lenient with credit scores but charge higher fees, while others might be very strict on credit but offer rock-bottom rates. It's why shopping around and getting quotes from multiple lenders is so important. Don't just go with the first offer you get!

Strategies for Securing the Best Debt Consolidation Loan Terms

Now that you know what to look for, how can you actually get the best deal?

Improve Your Credit Score Before Applying for Debt Consolidation

If you have some time before you need the loan, work on improving your credit score. Pay bills on time, reduce your credit utilization, and dispute any errors on your credit report. Even a small bump in your score can lead to significantly better interest rates.

Shop Around and Compare Multiple Debt Consolidation Loan Offers

This is probably the most crucial piece of advice. Don't settle for the first offer. Apply for pre-qualification with several lenders. Pre-qualification usually involves a soft credit inquiry, which doesn't hurt your credit score, and gives you an idea of the rates and terms you might receive. Compare the APRs, origination fees, and available repayment periods from at least three to five different lenders.

Consider a Co-signer for Better Debt Consolidation Terms

If your credit score isn't ideal, or if you want to secure an even lower rate, consider applying with a co-signer who has excellent credit. A co-signer shares responsibility for the loan, reducing the lender's risk and potentially opening the door to better terms. Just make sure both parties understand the implications, as the co-signer is equally responsible for the debt.

Negotiate with Lenders for Debt Consolidation Loan Terms

While not always possible with online lenders, if you're working with a local bank or credit union, there might be some room for negotiation, especially if you have a good relationship with them or if you've received a better offer elsewhere. It never hurts to ask!

The Importance of a Budget Post-Debt Consolidation

Once you've secured your debt consolidation loan, your work isn't over. In fact, a new chapter begins. The whole point of consolidating debt is to simplify your payments and save money, but it's also a golden opportunity to reset your financial habits. Creating and sticking to a budget is paramount.

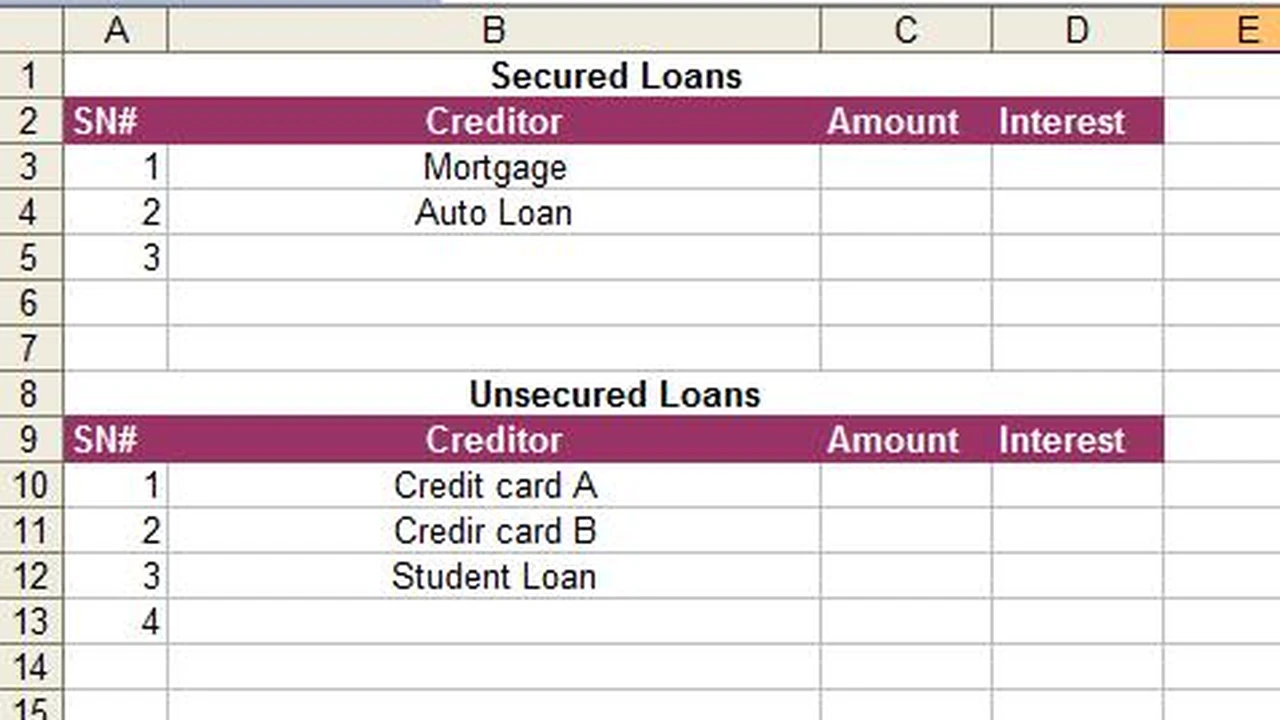

Tracking Your Spending to Maintain Debt Consolidation Progress

Start by tracking every dollar you spend for a month or two. This will give you a clear picture of where your money is actually going. You might be surprised by how much you spend on non-essentials. Use budgeting apps, spreadsheets, or even a simple notebook – whatever works for you.

Allocating Funds for Your Consolidated Debt Payment

Your new consolidated loan payment should be a top priority in your budget. Make sure you allocate enough funds to cover it comfortably each month. Set up automatic payments if possible, so you never miss a due date. Missing payments can negate the benefits of consolidation by incurring late fees and damaging your credit score.

Building an Emergency Fund After Debt Consolidation

One of the biggest reasons people fall back into debt is unexpected expenses. Once your debt is consolidated and your monthly payments are manageable, focus on building an emergency fund. Aim for at least three to six months' worth of living expenses. This fund acts as a buffer, so you don't have to rely on credit cards when life throws a curveball.

Avoiding New Debt Post-Consolidation

This is crucial. Debt consolidation is a tool for managing existing debt, not an excuse to accumulate new debt. Be mindful of your spending habits. If you find yourself reaching for credit cards again, re-evaluate your budget and spending triggers. Consider cutting up old credit cards or freezing them to remove temptation.

Setting New Financial Goals Beyond Debt Consolidation

Once you're on track with your consolidated debt, start thinking about your next financial goals. Maybe it's saving for a down payment on a house, investing for retirement, or funding your child's education. Having clear goals will keep you motivated and focused on building a stronger financial future.

Final Thoughts on Debt Consolidation Loan Terms and Repayment

Choosing the right debt consolidation loan terms and repayment period is a critical decision that can significantly impact your financial journey. Take your time, do your research, compare offers, and understand all the fine print. Remember, the goal is not just to get a loan, but to get a loan that truly helps you achieve financial freedom and peace of mind. By carefully considering all the factors discussed, you'll be well-equipped to make the best choice for your unique financial situation and set yourself up for long-term success.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)