Microfinance and Debt Consolidation in Rural Southeast Asia

Explore the role of microfinance institutions in providing debt consolidation options in rural areas of Southeast Asia.

Microfinance and Debt Consolidation in Rural Southeast Asia

Hey there! Let's chat about something super important for folks in the countryside of Southeast Asia: microfinance and how it's helping with debt consolidation. When we talk about rural areas, we're often looking at communities where traditional banking services are either scarce or just not accessible. This is where microfinance steps in, offering small loans and other financial services to low-income individuals or groups who typically lack access to conventional banking. And guess what? It's becoming a real game-changer for debt consolidation in these regions.

Imagine you're a farmer in a remote village in Vietnam or a small vendor in a fishing community in the Philippines. You might have taken out several small loans from different sources – maybe a local moneylender, a relative, or even a supplier – each with its own interest rate and repayment schedule. Juggling these can be a nightmare, leading to stress and sometimes even more debt. That's where microfinance-led debt consolidation can be a lifesaver. It's all about combining those multiple, often high-interest, debts into a single, more manageable loan, usually with a lower interest rate and a clearer repayment plan. This isn't just about financial relief; it's about empowering communities and fostering economic stability.

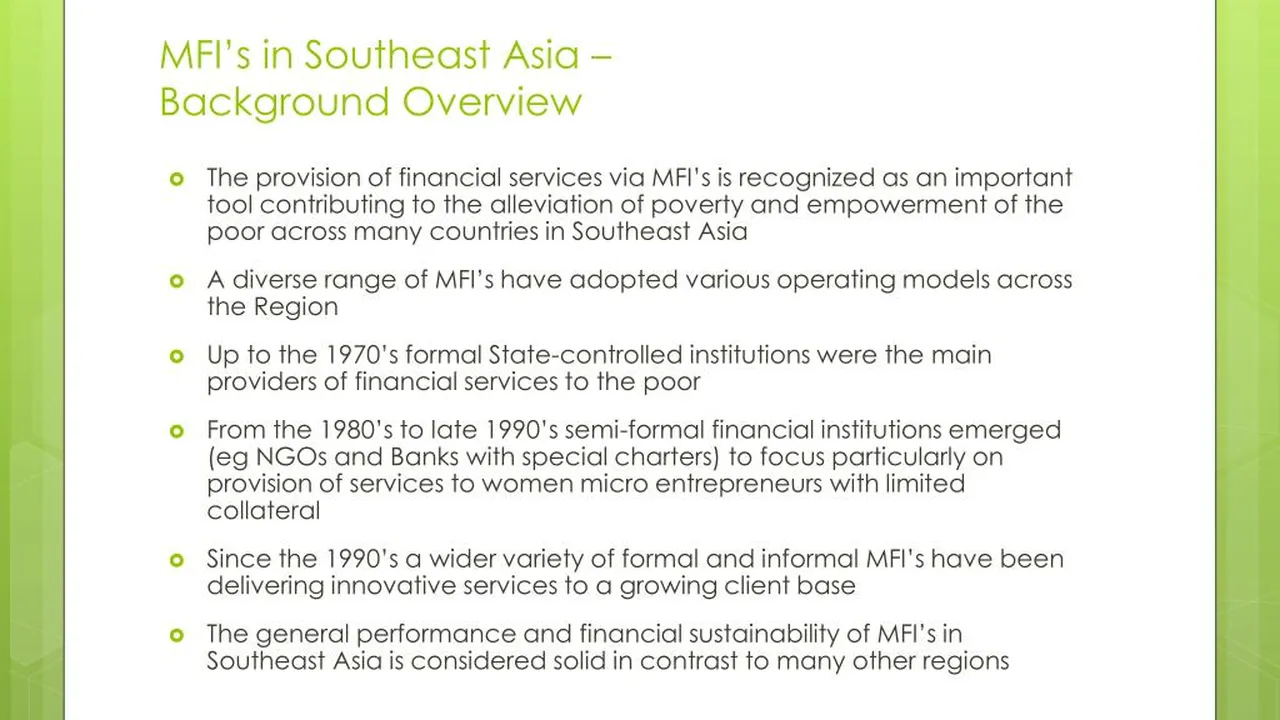

Understanding Microfinance Its Core Principles and Impact

So, what exactly is microfinance? At its heart, microfinance is about providing financial services to those who are traditionally excluded from the mainstream financial system. This includes microcredit (small loans), microsavings, microinsurance, and payment services. The philosophy behind it is that even small amounts of capital can make a huge difference in the lives of the poor, enabling them to start or expand small businesses, manage household expenses, and cope with emergencies. In rural Southeast Asia, where agriculture and small-scale entrepreneurship are often the backbone of the economy, microfinance institutions (MFIs) play a crucial role.

Unlike commercial banks that often require collateral or a strong credit history, MFIs typically rely on group lending models, social collateral, or character-based lending. This means that a group of borrowers collectively guarantees each other's loans, fostering a sense of community and mutual responsibility. This approach has proven incredibly effective in regions where individual collateral is rare. The impact goes beyond just financial transactions; it builds trust, strengthens social networks, and often includes financial literacy training, which is invaluable for long-term financial health.

The Debt Consolidation Challenge in Rural Southeast Asia

Why is debt consolidation such a big deal in rural Southeast Asia? Well, it's a complex mix of factors. Many rural households rely on informal credit sources, which, while accessible, often come with exorbitant interest rates. Think about a farmer needing quick cash for seeds or an unexpected medical emergency. They might turn to a local moneylender who charges daily or weekly interest, quickly spiraling into an unmanageable debt burden. These informal loans often lack transparency, and repayment terms can be predatory.

Furthermore, many rural residents might have multiple small debts from different sources. One loan for a new fishing net, another for school fees, and yet another for a broken motorbike. Each debt has its own due date, interest rate, and terms, making it incredibly difficult to keep track and manage. This fragmentation of debt leads to missed payments, penalties, and a constant state of financial anxiety. The lack of financial literacy also plays a role, as many individuals might not fully understand the implications of high-interest loans or the benefits of consolidating their debts. This is where microfinance steps in as a structured, more ethical alternative.

How Microfinance Facilitates Debt Consolidation Practical Approaches

Microfinance institutions offer several ways to help rural communities consolidate their debts. One common approach is through a specific debt consolidation loan product. Instead of taking out a new loan for a new purpose, borrowers can apply for a loan specifically designed to pay off their existing, high-interest debts. The MFI then disburses the funds directly to the original creditors, simplifying the process for the borrower.

Another method involves integrating debt consolidation into broader financial literacy programs. MFIs often provide training on budgeting, saving, and responsible borrowing. During these sessions, they can educate clients about the benefits of debt consolidation and guide them through the process. This holistic approach not only helps with immediate debt relief but also equips individuals with the knowledge to avoid future debt traps.

Some MFIs also act as intermediaries, negotiating with informal lenders on behalf of their clients to secure better terms or even partial debt forgiveness. While this is less common, it highlights the community-centric approach of microfinance. The goal is always to reduce the financial burden, lower interest payments, and create a single, manageable repayment schedule that aligns with the borrower's income stream, which is often seasonal in rural areas.

Key Microfinance Institutions and Their Debt Consolidation Offerings

Let's look at some specific examples of MFIs making a difference in rural Southeast Asia. While their specific debt consolidation products might vary, their core mission remains the same: financial inclusion and empowerment.

Grameen Bank Bangladesh A Pioneering Model

While not strictly in Southeast Asia, Grameen Bank in Bangladesh is the original pioneer of microfinance and its model has been widely replicated across the region. Their approach focuses on small loans to groups of women, often for income-generating activities. While they don't explicitly market 'debt consolidation loans' in the traditional sense, their flexible loan products and group lending methodology inherently allow borrowers to manage and effectively consolidate their existing informal debts by providing a more affordable and structured alternative. For example, a borrower might take a Grameen loan to buy livestock, and the profits from that venture allow them to pay off a high-interest loan from a local moneylender. The average loan size is small, often around $100-$300 USD, with repayment periods typically ranging from 6 months to a year. Interest rates are significantly lower than informal lenders, usually around 20% per annum, which is still higher than commercial banks but far more manageable than the 100%+ often seen in informal markets. Their focus is on empowering individuals to generate income, which then indirectly helps them consolidate and manage their existing financial obligations.

ASA Philippines Foundation A Leading MFI in the Philippines

ASA Philippines Foundation is one of the largest and most successful MFIs in the Philippines, serving millions of clients, predominantly women in rural and semi-urban areas. They offer various loan products, including enterprise loans, agricultural loans, and even housing loans. While they don't have a standalone 'debt consolidation loan' product, their general purpose loans are often used by clients to pay off more expensive debts from informal sources. For instance, a small vendor might take an ASA enterprise loan of around 5,000 to 20,000 PHP (approximately $100-$400 USD) at an effective annual interest rate of about 20-25%. This loan, with its structured weekly or bi-weekly repayment schedule, allows them to clear multiple smaller, higher-interest debts from local lenders or family members. The key here is the accessibility and the more favorable terms compared to the informal market. They also provide financial literacy training, which helps clients understand how to manage their finances better and avoid future debt traps. Their repayment terms are typically 4-6 months, designed to align with the short-term income cycles of their clients.

Kiva Partner MFIs Across Southeast Asia

Kiva, a non-profit organization, partners with numerous MFIs globally, including many in Southeast Asia, to crowdfund loans for underserved communities. Through Kiva's platform, you can see various loan purposes, and often, these loans are implicitly used for debt consolidation. For example, a Kiva loan might be for 'working capital' for a small business, but the underlying need is to free up cash flow by paying off an existing high-interest loan. Kiva's partner MFIs in countries like Cambodia, Vietnam, and Indonesia offer loans ranging from $100 to $1,000 USD, with interest rates set by the local MFI (typically between 15-35% APR, depending on the country and risk profile). The repayment terms are usually flexible, from 6 months to 2 years. The benefit here is the transparency and the ability for individuals to access capital that might otherwise be unavailable, allowing them to restructure their financial obligations. For instance, a farmer in Cambodia might get a Kiva-funded loan through a local MFI partner to buy fertilizer, and the increased yield from their crops allows them to pay off a previous loan taken at a much higher rate from a village lender. The Kiva platform itself doesn't charge interest to the borrower, but the local MFI partners do to cover their operational costs and manage risk.

AMK Microfinance Cambodia A Focus on Rural Development

AMK Microfinance in Cambodia is another prominent MFI with a strong presence in rural areas. They offer a range of financial products, including micro-loans, savings accounts, and even money transfer services. For debt consolidation, AMK's general purpose loans or agricultural loans can be instrumental. A rural family might take an AMK loan of 500,000 KHR to 5,000,000 KHR (approximately $125-$1,250 USD) at an annual interest rate of around 18-25%. This loan can be used to pay off multiple smaller debts from informal sources, such as loans from relatives or local shopkeepers, which might carry implicit or explicit higher interest rates. AMK's loans typically have flexible repayment schedules, often monthly or quarterly, to align with agricultural cycles or other irregular income streams common in rural Cambodia. They also emphasize financial education, helping clients understand the benefits of consolidating and managing their debt more effectively. The focus is on sustainable financial solutions that empower rural households.

Bank Rakyat Indonesia BRI A Hybrid Approach

Bank Rakyat Indonesia (BRI) is unique because it's a state-owned commercial bank that also operates a massive microfinance division, particularly through its 'Unit Desa' (village units) network. This allows BRI to reach deep into rural areas across Indonesia. While BRI offers traditional banking services, its micro-loan products, like 'Kredit Usaha Rakyat' (KUR), are often used by small entrepreneurs and farmers. These loans, which can range from 1 million IDR to 50 million IDR (approximately $65-$3,200 USD), come with subsidized interest rates, often as low as 6-7% per annum, thanks to government support. This makes them incredibly attractive for debt consolidation. A small business owner in a rural Indonesian village might use a KUR loan to pay off several higher-interest loans from informal lenders or even other commercial banks, significantly reducing their monthly payments and overall interest burden. The repayment terms can be quite flexible, from 1 to 5 years, depending on the loan amount and purpose. BRI's extensive network and government backing make it a powerful force in providing accessible and affordable financial services, including effective debt consolidation, to rural populations.

Benefits of Microfinance for Rural Debt Consolidation

The advantages of using microfinance for debt consolidation in rural Southeast Asia are numerous and far-reaching:

Lower Interest Rates and Reduced Financial Burden

This is perhaps the most immediate and significant benefit. Informal lenders often charge exorbitant interest rates, sometimes reaching hundreds of percent annually. Microfinance loans, while still higher than commercial bank rates, are substantially lower, typically ranging from 15% to 35% APR. This reduction in interest payments can free up a significant portion of a household's income, allowing them to invest in their businesses, improve their living conditions, or save for the future. It transforms a crushing debt burden into a manageable financial obligation.

Simplified Repayment Schedules and Reduced Stress

Juggling multiple debts with different due dates and terms is incredibly stressful. Debt consolidation through microfinance streamlines this process into a single, predictable payment. This simplification reduces the mental burden on borrowers, allowing them to focus on their income-generating activities rather than constantly worrying about upcoming payments. MFIs often tailor repayment schedules to match the borrower's income cycle, such as monthly payments for salaried workers or seasonal payments for farmers, further easing the burden.

Improved Financial Literacy and Empowerment

Many MFIs integrate financial literacy training into their programs. This education covers topics like budgeting, saving, and responsible borrowing. By understanding these concepts, rural individuals are better equipped to manage their finances, make informed decisions, and avoid falling back into debt. This empowerment goes beyond just debt relief; it builds long-term financial resilience and self-sufficiency within communities.

Access to Formal Financial Services and Credit History Building

For many rural residents, microfinance is their first interaction with a formal financial institution. Successfully repaying a microfinance loan can help them build a credit history, which can open doors to larger loans or other financial products in the future. This integration into the formal financial system is a crucial step towards greater financial inclusion and economic mobility.

Community Development and Economic Stability

When individuals and households are free from crippling debt, they are more likely to invest in their businesses, educate their children, and improve their health. This ripple effect contributes to broader community development and economic stability. Microfinance, by facilitating debt consolidation, plays a vital role in fostering sustainable growth in rural areas.

Challenges and Considerations for Microfinance Debt Consolidation

While microfinance offers immense potential, it's not without its challenges, especially when it comes to debt consolidation:

Over-Indebtedness and Multiple Borrowing

One of the biggest risks in microfinance is over-indebtedness. Sometimes, individuals might take loans from multiple MFIs or combine microfinance loans with informal loans, leading to a new form of fragmented debt. This can happen if MFIs don't adequately assess a borrower's existing debt burden or if borrowers are not transparent about their financial situation. Effective debt consolidation requires a clear picture of all existing debts.

Interest Rates Still Higher Than Commercial Banks

While microfinance interest rates are lower than informal lenders, they are generally higher than those offered by commercial banks. This is due to the higher operational costs associated with serving remote areas and managing small loans. For some, even microfinance rates might still be a struggle, especially if their income streams are highly volatile.

Limited Product Offerings and Flexibility

Some MFIs might have limited product offerings, meaning they might not have a specific, tailored debt consolidation loan. Borrowers might have to use a general-purpose loan, which might not always be the perfect fit for their consolidation needs. Greater product innovation and flexibility are needed to address the diverse debt situations in rural areas.

Geographical Reach and Infrastructure

Despite their efforts, reaching the most remote areas can still be a challenge for MFIs due to poor infrastructure, lack of transportation, and security concerns. This limits access for some of the most vulnerable populations who could benefit most from debt consolidation services.

Regulatory Environment and Consumer Protection

The regulatory environment for microfinance varies across Southeast Asian countries. In some regions, regulations might be weak, leading to potential exploitation or lack of consumer protection. Stronger regulatory frameworks are needed to ensure ethical lending practices and protect borrowers during the debt consolidation process.

The Future of Debt Consolidation in Rural Southeast Asia Through Microfinance

Looking ahead, the role of microfinance in debt consolidation in rural Southeast Asia is only set to grow. Several trends are shaping this future:

Digitalization and Mobile Banking

The increasing penetration of mobile phones and internet access, even in rural areas, is revolutionizing microfinance. Digital platforms and mobile banking can significantly reduce operational costs for MFIs, allowing them to offer more competitive interest rates and reach a wider audience. Mobile apps can simplify loan applications, repayments, and even provide financial literacy content, making debt consolidation more accessible and efficient.

Partnerships with Fintech Companies

Collaborations between traditional MFIs and fintech companies are emerging. Fintech can bring innovative solutions for credit scoring, risk assessment, and personalized financial advice, which can be particularly beneficial for debt consolidation. These partnerships can lead to more tailored and effective debt relief solutions for rural populations.

Focus on Financial Health Beyond Just Credit

There's a growing recognition that microfinance should go beyond just providing credit. A holistic approach that emphasizes savings, insurance, and financial education is crucial for long-term financial health. This broader focus will naturally include more robust debt management and consolidation strategies, helping individuals build resilience against future financial shocks.

Government Support and Policy Frameworks

Governments in Southeast Asia are increasingly recognizing the importance of microfinance for rural development. Supportive policies, regulatory frameworks, and even direct subsidies can further enhance the capacity of MFIs to offer effective debt consolidation services. This includes initiatives to improve financial literacy and protect consumers from predatory lending practices.

Impact Investing and Socially Responsible Capital

The rise of impact investing means more capital is flowing into organizations that aim for both financial returns and social good. This can provide MFIs with the necessary funding to expand their reach, innovate their products, and offer more affordable debt consolidation options to rural communities. Investors are increasingly looking for ways to support sustainable development, and microfinance in rural Southeast Asia fits this bill perfectly.

So, there you have it. Microfinance isn't just about small loans; it's a powerful tool for financial empowerment and stability, especially when it comes to helping rural communities in Southeast Asia consolidate their debts. It's about giving people a fair chance to manage their finances, reduce stress, and build a better future for themselves and their families. It's a journey, and microfinance is helping light the way.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)