When to Consider Bankruptcy Instead of Debt Consolidation

Understand the circumstances under which bankruptcy might be a more suitable option than debt consolidation for severe debt.

When to Consider Bankruptcy Instead of Debt Consolidation

Debt Consolidation vs Bankruptcy Understanding Your Options

Hey there! If you're reading this, chances are you're feeling the heavy weight of debt, and you're trying to figure out the best way to get out from under it. It's a tough spot to be in, and it can feel overwhelming. You've probably heard a lot about debt consolidation, which is a fantastic tool for many people. It can simplify your payments, potentially lower your interest rates, and give you a clear path to becoming debt-free. But here's the thing: debt consolidation isn't a magic bullet for everyone. For some folks, especially when the debt has become truly unmanageable, another option might be on the table: bankruptcy. Now, I know that word can sound scary, and it often comes with a lot of negative connotations. But sometimes, it's not just a last resort; it can be a necessary and even beneficial step towards a fresh financial start. This article is all about helping you understand when bankruptcy might actually be a more suitable option for you than debt consolidation, especially when your debt is severe. We'll break down the scenarios, the pros and cons, and what to consider so you can make an informed decision for your financial future.

The Debt Consolidation Approach When It Works Best

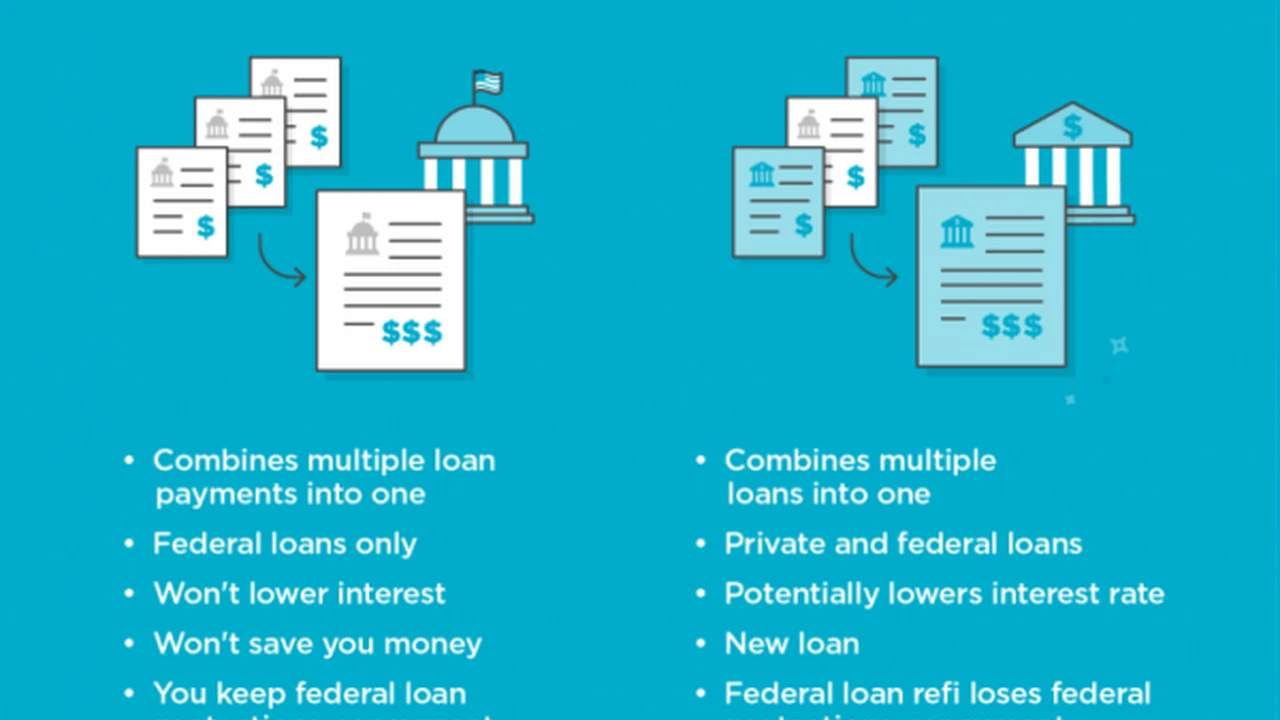

Let's start by quickly revisiting debt consolidation. It's essentially taking multiple debts – like credit card balances, personal loans, or medical bills – and rolling them into one single, new loan, often with a lower interest rate and a more manageable monthly payment. The goal is to simplify your finances, reduce the total interest you pay, and give you a fixed timeline for becoming debt-free. This strategy works wonderfully for people who:

- Have a decent credit score: A good score helps you qualify for those lower interest rates.

- Have a manageable amount of debt: While it can be significant, it's not so overwhelming that you can't realistically pay it off within a few years.

- Are disciplined with their spending: You need to be able to stick to a budget and avoid racking up new debt.

- Have a stable income: You need to be able to consistently make those consolidated payments.

Common products for debt consolidation include personal loans, balance transfer credit cards, and home equity loans or lines of credit (HELOCs). For example, a personal loan from a lender like LightStream (known for competitive rates for good credit, often 5-15% APR depending on credit and term, with no fees) or SoFi (offers loans up to $100,000, APRs from 8-25%, also no fees) can be a great way to consolidate. Balance transfer cards, like the Chase Slate Edge or Citi Simplicity Card, offer 0% APR for an introductory period (often 18-21 months), but usually come with a balance transfer fee (typically 3-5% of the transferred amount). HELOCs, offered by banks like Bank of America or Wells Fargo, can have lower interest rates (often prime rate plus a margin, currently around 8-10% APR) because they're secured by your home, but they put your home at risk if you default. The choice depends on your credit, the amount of debt, and your comfort with securing the loan.

Signs That Debt Consolidation Might Not Be Enough Severe Debt Indicators

So, when does debt consolidation start to look less like a solution and more like a temporary patch? It's when your debt has reached a level that makes repayment, even with a consolidated loan, incredibly difficult or impossible. Here are some key indicators that your debt might be too severe for consolidation:

- Your Debt-to-Income Ratio is Sky-High: This is a big one. If your monthly debt payments (excluding your mortgage) consume a huge chunk of your income – say, 40% or more – even a lower interest rate might not make the payments affordable. Lenders also look at this, and a high DTI can make it hard to even qualify for a good consolidation loan.

- You're Only Making Minimum Payments: If you're consistently only able to make the minimum payments on your credit cards and other debts, and those balances barely budge, you're likely in a debt trap. Interest is eating up most of your payment, and you're not making real progress.

- You're Using Credit to Pay for Necessities: This is a red flag. If you're relying on credit cards to cover basic living expenses like groceries, utilities, or rent, it means your income isn't sufficient to cover your costs, and you're just digging a deeper hole.

- You Have No Emergency Savings: A lack of an emergency fund means any unexpected expense – a car repair, a medical bill, a job loss – will immediately push you further into debt.

- You've Been Denied for Debt Consolidation Loans: If you've applied for consolidation loans and been turned down, it's a strong signal that lenders view your financial situation as too risky for them to take on. This often happens due to a low credit score or a high DTI.

- Your Assets Are at Risk: If creditors are threatening to repossess your car, garnish your wages, or foreclose on your home, your situation is critical, and you need a more drastic solution than consolidation.

- You're Experiencing Significant Stress and Health Issues: While not a financial metric, the emotional and physical toll of severe debt can be immense. If your debt is causing severe anxiety, depression, or impacting your health, it's a sign that your current approach isn't working.

Understanding Bankruptcy The Two Main Types for Individuals

If those signs resonate with you, it's time to seriously consider bankruptcy. There are two main types of bankruptcy for individuals in the U.S.: Chapter 7 and Chapter 13. Each has different eligibility requirements and outcomes.

Chapter 7 Bankruptcy Liquidation for a Fresh Start

Chapter 7 is often called 'liquidation bankruptcy.' It's designed for people with limited income and significant unsecured debt (like credit cards, medical bills, and personal loans) who can't realistically pay back what they owe. Here's how it generally works:

- Means Test: To qualify for Chapter 7, your income must be below the median income for your state, or you must pass a 'means test' which evaluates your disposable income. If your income is too high, you might be directed towards Chapter 13.

- Asset Liquidation: A bankruptcy trustee is appointed to sell off your 'non-exempt' assets to pay your creditors. However, most states have generous exemption laws that protect common assets like your primary residence (up to a certain value), a car, household goods, and retirement accounts. This means many Chapter 7 filers don't actually lose any property.

- Debt Discharge: The biggest benefit of Chapter 7 is that most of your unsecured debts are discharged, meaning you are no longer legally obligated to pay them. This provides a true fresh start.

- Speed: Chapter 7 is generally a quicker process, often completed within 3-6 months.

Who it's best for: Individuals with overwhelming unsecured debt, low income, and few non-exempt assets. It's a clean slate, but it does stay on your credit report for 10 years.

Chapter 13 Bankruptcy Reorganization for Repayment

Chapter 13 is often called 'reorganization bankruptcy.' It's for individuals with a regular income who can afford to repay some of their debts, but need a structured plan and legal protection from creditors. It's also an option if your income is too high for Chapter 7, or if you want to keep assets that would be non-exempt in Chapter 7 (like a second home or valuable collectibles).

- Repayment Plan: You propose a repayment plan to the court, typically lasting 3 to 5 years. This plan outlines how you'll repay a portion of your debts (secured debts like mortgages and car loans are usually paid in full, while unsecured debts might be paid partially or not at all, depending on your income and assets).

- Protection from Creditors: Once you file, an 'automatic stay' goes into effect, stopping foreclosures, repossessions, wage garnishments, and collection calls.

- Keeping Assets: You get to keep all your property, as long as you make your plan payments.

- Debt Discharge: At the end of the repayment plan, any remaining dischargeable unsecured debts are wiped out.

Who it's best for: Individuals with regular income, who want to save their home from foreclosure or catch up on secured debt payments, or who have too much income/assets for Chapter 7. It stays on your credit report for 7 years.

The Impact on Your Credit Score and Future Finances

Let's be honest: both debt consolidation and bankruptcy will affect your credit score. Debt consolidation, if managed well, can actually improve your score over time by reducing your credit utilization and demonstrating consistent payments. However, if you take out a new loan, there might be a temporary dip. Bankruptcy, on the other hand, has a more immediate and significant negative impact. A Chapter 7 bankruptcy stays on your credit report for 10 years, and a Chapter 13 for 7 years. This means:

- Difficulty Getting New Credit: For a while, it will be harder to get approved for new loans, credit cards, or even rental agreements. When you do get approved, the interest rates will likely be much higher.

- Higher Insurance Premiums: Some insurance companies check credit scores, so your car or home insurance premiums might increase.

- Employment Challenges: Some employers check credit as part of their background checks, especially for positions involving financial responsibility.

However, it's crucial to put this into perspective. If your credit score is already in the dumps because of missed payments, high utilization, and collections, bankruptcy might not make it much worse in the short term. In fact, by eliminating debt, it can set you up for a faster credit recovery in the long run than if you continued to struggle with unmanageable debt. Many people are able to start rebuilding their credit within a year or two after bankruptcy by getting a secured credit card or a small loan and making all payments on time.

When Bankruptcy is the More Strategic Move Real-World Scenarios

Let's look at some specific situations where bankruptcy might be the more strategic choice:

Scenario 1 Overwhelming Unsecured Debt with Limited Income

Imagine Sarah, a single mother working a minimum wage job. She has $40,000 in credit card debt from medical emergencies and trying to keep up with rising living costs. Her monthly minimum payments alone are $1,200, but her take-home pay is only $2,000. She can't even afford the minimums, let alone a consolidated loan payment. She's constantly getting collection calls, and her credit score is already in the low 500s. For Sarah, debt consolidation isn't a viable option because no lender would approve her for a loan with an affordable payment, and even if they did, she couldn't make it work. Chapter 7 bankruptcy would allow her to discharge most of that $40,000 debt, giving her a clean slate and the ability to focus her limited income on essential living expenses. She likely wouldn't lose any assets due to state exemptions.

Scenario 2 Facing Foreclosure or Repossession

Consider Mark and Lisa, who fell behind on their mortgage and car payments after a job loss. They're now facing foreclosure on their home and repossession of their car. They have some equity in their home and want to keep it. While debt consolidation might help with unsecured debt, it won't stop a foreclosure or repossession once those processes have started. Chapter 13 bankruptcy, however, would immediately halt these actions through the automatic stay. It would allow them to propose a repayment plan to catch up on their missed mortgage and car payments over 3-5 years, while also dealing with their other debts. This gives them a chance to save their most important assets.

Scenario 3 High Income but Unmanageable Debt Due to Specific Circumstances

Sometimes, even people with decent incomes can find themselves in a debt spiral. Take David, a small business owner whose business took a severe downturn, leaving him with $150,000 in personal guarantees on business loans and credit card debt. His income is now recovering, but the sheer volume of debt is too much to consolidate into a manageable payment, even with a good interest rate. He might qualify for Chapter 13, which would allow him to reorganize his debts, potentially pay back a percentage of his unsecured debt over time, and get a discharge of the remainder. This allows him to keep his business and rebuild his personal finances without the crushing burden of the full $150,000.

The Role of Credit Counseling and Legal Advice

Before making any big decisions, it's absolutely crucial to seek professional advice. This isn't a DIY project. Here's who you should talk to:

- Non-Profit Credit Counseling Agencies: Organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) offer free or low-cost counseling. They can help you assess your financial situation, explore all your options (including debt management plans, which are different from consolidation), and help you understand the pros and cons of each. They can also help you create a budget.

- Bankruptcy Attorney: If bankruptcy seems like a possibility, you absolutely need to consult with a qualified bankruptcy attorney. They can explain the specific laws in your state, determine which chapter you qualify for, explain what assets you can protect, and guide you through the entire legal process. Many attorneys offer free initial consultations, so take advantage of that.

These professionals can provide an objective perspective and help you navigate the complexities of debt relief. They'll look at your income, expenses, assets, and the types of debt you have to give you tailored advice.

Rebuilding Your Financial Life After Bankruptcy

If you do decide that bankruptcy is the right path for you, remember that it's not the end of your financial life; it's a new beginning. Rebuilding your credit and financial health after bankruptcy is entirely possible, and often faster than people expect. Here are some steps:

- Get a Secured Credit Card: This is one of the quickest ways to start rebuilding. You put down a deposit (e.g., $200), and that becomes your credit limit. Use it responsibly for small purchases and pay it off in full every month. Lenders like Discover it Secured Card or Capital One Platinum Secured Credit Card are popular choices, often requiring a deposit of $49-$200 for a $200 credit line.

- Consider a Credit Builder Loan: Some credit unions offer these. You make payments into a savings account, and once the loan is paid off, you get access to the money. This builds payment history.

- Monitor Your Credit Report: Regularly check your credit reports from all three bureaus (Equifax, Experian, TransUnion) to ensure accuracy and track your progress. You can get free reports annually at AnnualCreditReport.com.

- Live Within Your Means: This is fundamental. Create and stick to a strict budget. Avoid taking on new debt.

- Build an Emergency Fund: Start saving, even small amounts, to create a financial cushion. This prevents you from relying on credit when unexpected expenses arise.

- Be Patient: Rebuilding takes time and consistent effort, but it's definitely achievable.

Final Thoughts on Your Debt Relief Journey

Deciding between debt consolidation and bankruptcy is a deeply personal and significant financial decision. There's no one-size-fits-all answer. Debt consolidation is an excellent tool for many, offering a structured path to debt freedom without the severe credit impact of bankruptcy. However, when debt becomes truly overwhelming, when you're facing legal actions from creditors, or when your income simply isn't enough to make a dent, bankruptcy can be a necessary and even liberating step. It offers a fresh start that consolidation simply cannot provide in those extreme circumstances. The most important thing is to be honest with yourself about your financial situation, understand all your options, and seek professional guidance from credit counselors and bankruptcy attorneys. They can help you weigh the pros and cons specific to your unique circumstances and guide you toward the best path for your financial recovery and future well-being. Remember, your goal is financial freedom, and sometimes, the path to that freedom involves making tough but ultimately beneficial choices.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)